| Plus... £103 No7 £35, Barclaycard warning  THE TOP TIPS IN THIS EMAIL

| | Ends 5pm Fri. MSE Big Energy Switch 16

Our super-cheap 14mth fixed gas & electricity deals may have sparked a price war. Save typically £300 over that time Lock in for longer - and for less  The story so far... a fortnight ago we launched our 16th Big Energy Switch event, where we lever our huge user base to get super-cheap deals, with fixes from Shell and British Gas (newbies only) lasting until the end of January 2022. The story so far... a fortnight ago we launched our 16th Big Energy Switch event, where we lever our huge user base to get super-cheap deals, with fixes from Shell and British Gas (newbies only) lasting until the end of January 2022.

Yet as sometimes happens (coincidentally?), other suppliers started cutting their prices, to bring in more switchers. In the last week Utility Point, Scottish Power and E.on came in with new best-in-category deals, so Shell and British Gas reacted by shaving their prices down a smidge (the links above go to these).

And savings from switching are often huge, as John emailed: "We finally took the plunge and followed your excellent tips. Within 10mins we'd switched gas & elec, saving about £360/yr. Thanks so much, MSE." With little time left, at least for two of our deals, if you haven't sorted it yet, it's time now. Find choosing confusing? We can pick your winner

If you want help, rather than the links to tariffs further below, which take you via our standard comparison, you can access these deals via our new whole-of-market tools. - Recommended: Pick Me A Tariff every year (MSE Autoswitch). For those unsure or nervous about switching, this is the best option. Tell us your energy preferences (fixed, name you know, top service, green etc) or just select Martin's default choice.

We then do it all for you - finding your top-pick tariff from the whole of the market, including the deals below, based on those priorities. Then each year, when your deal ends, we'll autoswitch you to your new winner based on your preferences (providing you agree, with one click).

- Pick Me A Tariff for now. Tell us your preferences the same way, but with no autoswitch after a year, just a reminder.

Tariff prices vary by your use and location, so links go via our Cheap Energy Club full market comparison to ensure they're personalised for you, and up to date if the market changes. Use our Pick Me A Tariff or MSE Autoswitch comparisons if you need help choosing your winner.

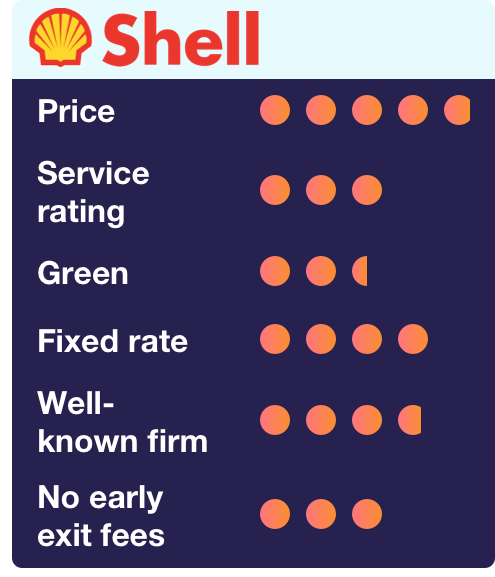

These deals are not available in N. Ireland (more help below). - Ends 5pm Fri. BIG SWITCH WINNER: SHELL ENERGY. Cheap 14mth fix + MSE enhanced service + 100% renewable elec. Price: £831/yr on typical use. Green: 100% elec, not gas. Service rating: 3.3/5 (OK). Save: £253/yr (see note below).

The Shell Energy Jan 22 v4 is a version of its already cheap standard fix, now with £35 bill credit and the usual £25 MSE cashback (£17.50 bill credit and £12.50 cashback for single elec). We include these in the price above. The Shell Energy Jan 22 v4 is a version of its already cheap standard fix, now with £35 bill credit and the usual £25 MSE cashback (£17.50 bill credit and £12.50 cashback for single elec). We include these in the price above.

It increased the bill credit to £35 (from an initial £25) to compete with Utility Point, which had come in and undercut it. Though Utility Point is only fixed for a year, whereas Shell is for 14mths, until the end of Jan 2022, so you're price-protected this winter and some of next. Both will likely show in your comparison, as may a cheaper 1yr fix from a small firm we've no feedback on.

As Shell's service rating is middling, we've arranged 'MSE enhanced service' for this deal, which means if it isn't helping you, contact us so our energy team can escalate issues (pls talk to it first though).

Who can get it? New and existing custs on dual fuel (ie, gas & elec) and elec-only. Though you need to have signed up to this email (ensure you log in using the same email address) or have been a Cheap Energy Club member by 11.59pm on Mon 2 Nov.

Smart meters? Not required - though it'll contact you about them.

Renewable? 100% renewable elec, but gas isn't green.

Early exit fees? £30/fuel (unless within 49 days of the fix ending).

Payment? Monthly direct debit only.

Comparison link above: Filtered to show fixed rates with decent (or better) service (you can undo the filters).

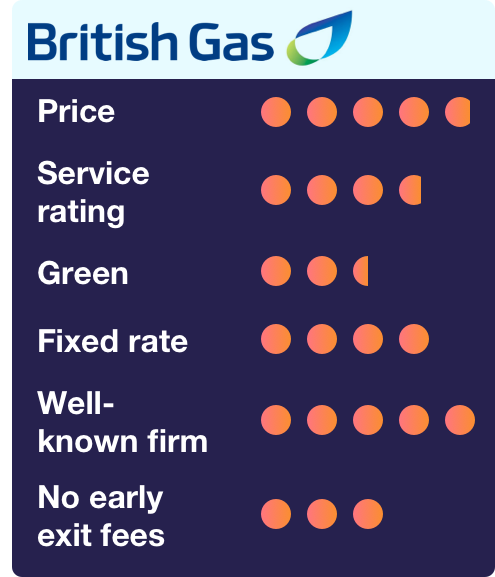

- BRITISH GAS (newbies). Cheap Big 6 fix, lasts 14mths, 100% renewable elec + 1yr's free heating insurance. Price: £852/yr on typical use. Green: 100% elec, not gas. Service rating: 3.9/5 (decent). Save: £232/yr (see note below). No end date specified.

Many of you tell us you want the safety of a big name. Originally we had a Big Switch British Gas winner to cover that, but it was undercut by E.on, and in response this British Gas Energy Plus Protection Jan 2022v4 tariff was launched (available on other comparison sites, not just us, but not direct). Many of you tell us you want the safety of a big name. Originally we had a Big Switch British Gas winner to cover that, but it was undercut by E.on, and in response this British Gas Energy Plus Protection Jan 2022v4 tariff was launched (available on other comparison sites, not just us, but not direct).

It's a soupcon cheaper than our original deal in most but not all regions (but both show in your comparison so you can see), plus you get the normal £25 MSE cashback. It's a dual-fuel only deal, available to those who aren't currently British Gas customers.

Again, the fixed rate (not the price, that varies by use) lasts until the end of Jan 2022, and you also get a year's 'free' heating, plumbing and electrical insurance if you don't already have its cover, which will auto-renew at £12/mth after a year.

You MUST agree to get free smart meters (one for gas, one for elec) installed if you don't have 'em already (unless it's impossible to fit them) within 3mths of switching.

Who can get it? New dual-fuel custs.

Smart meters? Required if possible, but they're free.

Renewable? 100% renewable elec, but gas isn't green.

Early exit fees? £40 (unless within 49 days of the fix ending).

Payment? Monthly direct debit.

Comparison link above: Filtered to exclude all but big name deals (you can undo the filters).

- Want a big name other than British Gas (eg, already a British Gas customer)? E.on and Scottish Power have launched fixes within a quid per year on average of British Gas on typical use. We've led on British Gas, as it's fixed for slightly longer. Use our big name comparison to find which wins where you are.

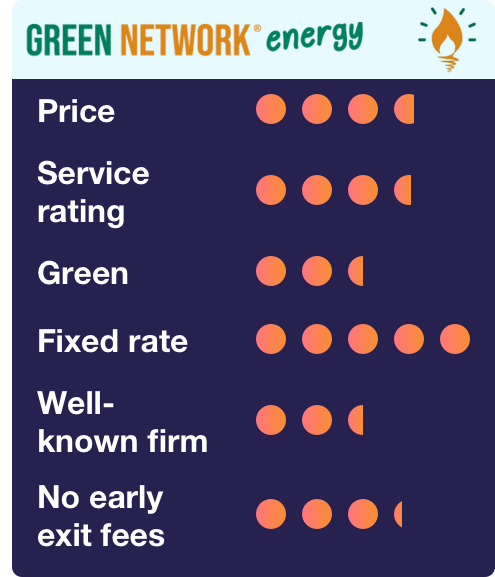

- Ends 5pm Fri. BIG SWITCH TARIFF: GREEN NETWORK ENERGY. Cheapest TWO WINTER fix - great for those who don't want to switch a lot, with 100% renewable elec. Price: £913/yr on typical use. Green: 100% elec, not gas. Service rating: 3.6/5 (decent) - not MSE-enhanced. Save: £342 over 2yrs (see note below).

This Green Network Energy 2 Year Green Fix dual-fuel and elec-only deal, available to new customers only, is the cheapest 2yr fix on the market, including the £25 MSE cashback (£12.50 elec-only). The fixed rate (not the price, that varies by use) lasts for 24mths from the day you switch. This Green Network Energy 2 Year Green Fix dual-fuel and elec-only deal, available to new customers only, is the cheapest 2yr fix on the market, including the £25 MSE cashback (£12.50 elec-only). The fixed rate (not the price, that varies by use) lasts for 24mths from the day you switch.

This is the best deal for those who don't like switching often or are worried about future prices and want certainty now. It's about £85/yr more expensive on typical use than the market's cheapest, but you get this price locked in for two winters.

Who can get it? New dual-fuel and elec-only custs, though you need to have signed up to this email (ensure you log in using the same email address) or have been a Cheap Energy Club member by 11.59pm on Mon 2 Nov.

Smart meters? Not required.

Renewable? 100% renewable elec, but gas isn't green.

Early exit fees? £25/fuel (unless within 49 days of the fix ending).

Payment? Monthly direct debit.

Comparison link above: Filtered to exclude all but longer fixed deals (you can undo the filters). Not on direct debit or live in Northern Ireland?

We try to get non-direct-debit deals but providers aren't usually keen to offer them. However, that doesn't mean you shouldn't act. - Not on direct debit? If you're not on a prepay meter, the best thing to do is to switch to monthly direct debit, as the top deals are only via this payment method. If you're not happy to do that, you can still do a comparison based on your payment method.

- Prepay customers: Try our prepay comparison - savings are smaller, typically £85/yr, but it could still be worth doing. For bigger savings, see if you can switch to a credit meter. See Cut prepay energy costs.

- Northern Ireland: Our Cheap Energy Club, like all UK comparisons, doesn't include NI, but you can do a comparison via Cheap NI Electricity or the Consumer Council for Northern Ireland's tool.

When we show your annual savings, we do it for someone who uses a typical amount of energy, according to regulator Ofgem, and who is currently paying the energy price cap rate, which millions do. Yet right now, in some ways that's misleading, as the current energy price cap, which started in Oct and lasts 6mths, is low because of the lockdown. While that's good news, it artificially reduces annual savings, as next March's cap is likely to jump. As we're already in the period where data is collected to set the price cap, energy analysts at Cornwall Insight say it's currently predicted to rise by about 6% - £63/yr higher.

So when we note savings above, we've factored that in and compared the price you get with the estimated typical price cap over the next year (ie, 4mths at current cap, 8mths at future). However, when you do a comparison via Cheap Energy Club, it's based on the current, lower price cap - so your real savings are likely to be bigger than it tells you. Here's a quick Q&A - for more, see the full Cheap Energy Club FAQs.

Q. Is switching risky? Could I be cut off? No, as no one visits your home (unless you want a smart meter) and it's the same gas, same electricity and same safety. The only things that change are price and service. See our 'Switching is no biggie' FAQs.

Q. Do you compare the whole of the market? Yes, we show every available open tariff. We can't always include other comparison sites' exclusives, and very rarely small firms don't provide their rates (or have them on beta test tariffs such as Agile Octopus), so until they do, we can't include them.

Q. Does MSE make money from Big Switches? Yes, as like all energy comparison sites, we're paid each time you switch through us, yet we give you roughly half as cashback (that's £25 dual fuel, £12.50 single fuel). This is money you wouldn't get if you went direct (not that the deals above are available directly anyway). So it's a win-win. The rest helps cover our costs and hopefully makes us some profit. More switching and energy help in the links below... Switching with smart meters | Why's my price risen when I'm fixed? | Reclaim credit | Switching-in-debt help | Switching if I've solar panels | How direct debits are set | Can I pick a switch date? | How do you compare my rates? -------------------------------------------------- Council tax crackdown & Xmas/Black Friday special

8.30pm Thu, ITV - Martin's Money Show Live

8pm Tue 24 Nov, ITV - Martin's Money Show Live Xmas Special

Busy weeks for Martin. This Thu, his lead topic of the regular weekly show is a council tax cost-cutting masterclass - many are due £1,000s back. Then next Tue, a 75min Christmas/Black Friday live (virtual) audience special - including the much-anticipated festive forecaster.

And of course, as they're live you can tweet suggested questions to @MartinSLewis, but you must use the show's hashtag #MartinLewis. Do tune in to both or set the Betamax. | | DON'T believe the fake 'Martin Lewis' or 'MSE' ads

Lots of scam ads litter social media and even newspaper websites - some of these lie that we or Martin promote Bitcoin, binary trading etc. See Fake ads warning. | Martin's savings crisis update

Easy-access rates drop to new lows as NS&I cuts rates to near zero. Is it time to lock in at 1.05%? All savers should read this...

I've been the Money Saving Expert for 20yrs (I know, thanks, I look younger) and can't think of a worse time for savers. The market's top easy-access rate's just 0.7%. I'd once have shrieked 'ditch & switch' at such paltry fare. One catalyst for this is that, next Tue (24 Nov), NS&I slashes most of its main savings rates, eg, Income Bonds drop from a best-buy 1.16% to just 0.01%. So here's how to fight for every scrap of interest (all savings accounts listed have up to £85k per person savings safety protection)... can't think of a worse time for savers. The market's top easy-access rate's just 0.7%. I'd once have shrieked 'ditch & switch' at such paltry fare. One catalyst for this is that, next Tue (24 Nov), NS&I slashes most of its main savings rates, eg, Income Bonds drop from a best-buy 1.16% to just 0.01%. So here's how to fight for every scrap of interest (all savings accounts listed have up to £85k per person savings safety protection)... - Got debts or a mortgage? Overpaying often beats saving. If the interest you're charged for debt is higher than what you earn on savings, clearing the debt pays. With such low interest rates, that means right now it can pay a lot. See Repay cards/loans vs saving and Overpay mortgages vs saving - the links have full info and calculators.

- As a bare minimum, move savings to top easy-access accounts. Easy access means you can move money in and out when you want - so its top rate should be your lowest rate. Saga's 0.7% AER* (min £1, min age 18) online account is the top payer, and its rate includes a fixed 0.15% bonus for 12mths. While the interest is low, it's still 70 times what many other accounts pay. Yet easy-access rates are variable, so can, and currently do, often change rapidly.

As noted below, Virgin Money pays 2% - but on its current account, not savings, and you only get that rate on up to £1,000. You don't need to switch to it to get the interest, but if you do, it also gives you 15 bottles of wine worth a stated '£180'. For more easy-access options, see Top Savings.

- Want certainty? Lock in to a top fixed savings rate. The risk-averse bet, especially with the unlikely but not impossible spectre of negative interest rates looming, is fixed-rate savings. Here, the rate and your money is locked in (ie, you can't access it - so only put away what you definitely won't need). That gives you surety, but if rates start to rise within the fixed term, you've lost the freedom to ditch 'em. Tandem's 1.05% AER fix (min £1,000) is the highest rate for 1yr. For more options and longer deals, see Top Fixed Savings.

- Can you BOOST INTEREST to 50%? I've now told you about the best mainstream savings. Yet there are specialist routes where some can earn more. There is the option of investing too, where unlike saving you take a risk in the hope of earning more. Nowt wrong with that, it's just not my expertise, so below I stick to savings.

- Low income? Get a 50% savings bonus. Check the Help to Save scheme to see if you qualify.

- First-time buyer? Get a 25% boost on savings via a Lifetime ISA.

- Get up to 3% interest by saving £100s monthly. See Regular Savings.

- Pay tax on savings? See if a cash ISA is more suitable.

- Premium Bonds' 1% prize rate can win for some. For those nearer the £50,000 max, especially if you pay tax on savings, they can be a winner. See Are Premium Bonds for me?

- Not sure how much to put away? An array of autosaving apps can decide for you. | New. Shift debt to 18mths 0% for NO FEE, plus £20 Amazon voucher. Last week we warned that longer 0% balance transfer deals could disappear. This week, a hot new short deal arrived. Those accepted for this Santander 18mth no-fee 0%* will be sent a £20 Amzn voucher within 90 days. So if you've existing credit card debt, check NOW if you'll be accepted via our eligibility calc. This is the longest NO FEE card, so clear what you owe within 18mths and it's totally free, and you get the voucher. Full options in Top Balance Transfers. Golden rules: 1) Pay at least the min monthly repayment. 2) Clear the debt before the 0% ends or you're charged 18.9% rep APR interest. 3) Don't spend or withdraw cash on it. Trick gets two boxes of £2 Shreddies cereal for 60p. MSE Rhiannon shows you how to get a cereaously good deals stack. New. Free ('£180') 15-bottle wine case for switching to Virgin's 2% interest account. New Virgin Money* current account switchers get a case of wine it values at £180. The account pays 2.02% AER variable interest on up to £1,000 (also accessible without switching). To get the wine, within 31 days of opening you need to: switch incl 2+ direct debits (via its official switch service), register for its app and put £1,000 in its linked 0.5% savings account (you can shift this after the wine voucher arrives). Will it come by Christmas? There's a chance if you apply quickly, but it's not certain - and do pls be Drinkaware. PS: Prefer £100-ish free cash for switching? The only deals left are about to end - see Best Bank Accounts (also including more help on the Virgin deal). Martin: 'Glimmer of hope for excluded new-starter self-employed?' Martin's new self-employment blog.

New. Boots 'Star Gifts': £103 of No7 for £35 | £81 of MAC make-up for £35. From Wed. See Boots deals. Mortgage payment holidays extension confirmed - NOW UNTIL 31 Mar (was 31 Jan), but ONLY do it if needed. The last-min extension of the mortgage holiday regime was confirmed yesterday (Tue), meaning you can apply till 31 Mar. Check what you can get and what your lender is doing.

Barclaycard customer alert. It's hiking minimum payments in Jan. See Barclaycard news and help. | NEW. The MSE Christmas 2020 Deals Predictor We predict deals, discounts & vouchers to let you plan perfect purchase times. Last year 89% accurate It's the eighth year we're doing this. And we're delighted (if a touch trepidatious) today to launch the Christmas Deals Predictor 2020. In it, we estimate when and where you'll get deals from the likes of Amazon, Asos, Boots, M&S and more. As well as analysing data from past years, we've taken a closer look at what retailers have or haven't done already this year , to help you bag your planned purchases when they're at their cheapest point. Last year our deals elves were 63% spot on, or 89% right within a day or two.  - When will Disney etc reduce prices this year? That's how it works. It's like a calendar of deals, with 80+ predictions. Biggies include: Half-price Soap & Glory | Cheapest Amazon devices | 20% off ShopDisney | £10 Baileys. Those on now, or coming this week include Selfridges 20% off code, AO.com and '£9' Ikea Christmas trees.

- Take a slightly bigger pinch of salt with it this year. This is a predictor. And if we've learned anything, we know predicting in 2020 is tough. Restrictions on store openings in certain regions plus stock shortages could limit some promotions, while overstocking could mean deeper discounts for others.

- Deals and discounts don't make it cheap if you weren't planning to buy anyway. By enabling you to organise yourself better, we hope you can avoid being sucked in by retailers' hype and just buy what you need and can afford. Use Martin's Money Mantras before you spend, and consider if you can ban unnecessary presents this year.

- Do think about local retailers too. By definition, we have to stick with predicting big chains' sales - we can't focus on small independent stores as there'd be 10,000s of them, and we don't have that resource. Yet that doesn't mean big chains are best. And in such a tough year for retailers, it's worth supporting local stores if you can - if not, there's a risk they won't be there in future.

| Tell your friends about us They can get this email free every week | THIS WEEK'S POLL Are you an app, web or branch banker? With more of us banking remotely during the pandemic, and bank branches continuing to shut, it seems the digital revolution is taking over for many. So this week, we want to know how you now access your bank. Tell us in this week's poll. Sky tops the list of firms it's easiest to haggle with. Last week, we asked which companies you've tried to haggle with in the past year, and if you got a better deal - over 5,000 people responded. A whopping 85% of those who'd tried haggling with Sky reported some sort of success - the highest among all firms. The RAC and AA took second and third place, with success rates of 83% and 82% respectively. See full haggling poll results. | Shreddies - Two boxes for 60p via deal-stacking trick

Glasses Direct - Two pairs of specs for £14

No7 - £35 for £103 worth of beauty/make-up

MAC - £35 for £81 make-up set

Radflek - Free radiator reflector pack, 1,000 avail Selfridges - Up to 20% off via code

AO - 100s of items discounted, many joint-cheapest around

La Redoute - Up to 40% off everything

Thorntons - 3for2 on Christmas gifts

Santa letters - Receive a 'free' letter, incl Braille, in the post | Joe & Seph's popcorn - 20% off Christmas range (ends Sun)

eBay - 20% off selected sellers, min spend £15 (ends Thu)

Asda - £7 meal deal (two pizzas, a side and four beers)

Lidl - 5kg of imperfect fruit & veg for £1.50

Kindle comics - Free comics & graphic novel downloads Quick recipe ideas for using beetroot. Beet it

Make the most of delivered veg boxes. Saving thyme

How to cook frozen veg and keep the flavour. Chill out | | MARTIN'S APPEARANCES (WED 18 NOV ONWARDS) Wed 18 Nov - Lorraine, ITV, 9.10am

Thu 19 Nov - This Morning, phone-in, ITV, 11.55am

Thu 19 Nov - The Martin Lewis Money Show Live, ITV, 8.30pm

Mon 23 Nov - Ask Martin Lewis, BBC Radio 5 Live, 12.20pm. Listen again

Tue 24 Nov - The Martin Lewis Money Show Live, ITV, 8pm MSE TEAM APPEARANCES (MOST SUBJECTS TBC) Wed 18 Nov - BBC Three Counties Radio, The JVS Show, Guy Anker on financial help in lockdown, from 11.30am

Mon 23 Nov - BBC Radio Manchester, Drive with Phil Trow, from 2.25pm

Mon 23 Nov - BBC One (Wales), X-Ray, Oli Townsend on Black Friday, from 7.35pm

Tue 24 Nov - BBC Radio Cambridgeshire, Mid-morning with Jeremy Sallis, from 12.20pm | WHAT IS YOUR PREMIER LEAGUE FOOTBALL TEAM'S MONEYSAVING PERSONA? That's all for this week, but before we go... with the men's Premier League back this weekend after the international break, we decided to have a little fun on our social channels and created a MoneySaving persona for each team in the league. Some make costly vanity purchases, others flog prized assets to boost their coffers, while some are obsessed with the MSE Deals page. So see each Premier League team's MoneySaving persona in our Facebook post. We hope you save some money, stay safe,

The MSE team | |

No comments:

Post a Comment