| | | Martin's Weekly Briefing: For more tips, alerts & puns, follow Martin on Twitter PRICE WAR: It's the best time ever to cut debt costs. Many can save £1,000s. Shift your debts to 41mths 0% for a fee or 2yrs totally free

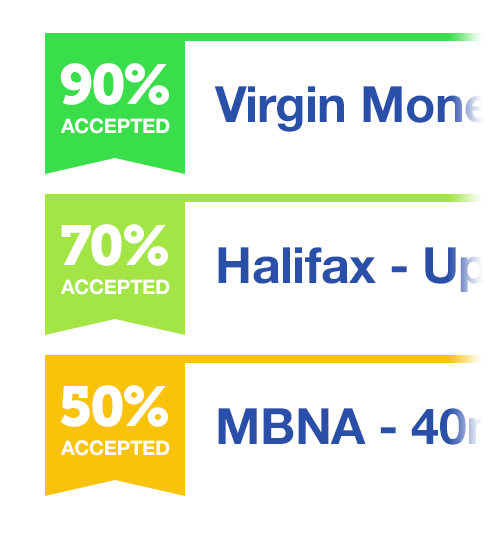

There's a credit card punch-up going on. In the last eight weeks, 10 new table-topping balance transfers have launched. We've covered the key blows in this email, but now I want to calmly take you through step-by-step how to use this price war to save large, like Jill: "@MartinSLewis Just saved over £4,000 over the next 3 years following your email on 0% balance transfer credit cards. Thank you :)" A balance transfer is simply a new card that repays existing credit and/or store cards for you, shifting the debt, so you owe it instead at a cheaper rate. That means more of your cash clears the actual debt. Here are the need-to-knows... | 1. | Today's deals are the best EVER. Almost every deal is improved from a few weeks ago. We've the longest 0% ever at 41mths, and the longest-ever fee-free 0% cards. Yet, as I'll explain, far better than just clicking is using our free Balance Transfer Eligibility Calc to see which cards you've the best odds of being accepted for...

| | | | 2. | Go for the lowest fee in the time you're sure you can repay. Most cards charge a one-off fee of the amount of debt transferred (so 4% is £40 per £1,000). So calculate how long you think you'll take to clear the debt, add a bit for safety, then pick the lowest fee within that. If you can repay in under two years it'll be totally free as there's no fee.

If you're unsure, play safe and go long; the fee's usually trivial compared with needing to pay interest afterwards. Having said that, the 40mth cards have much lower fees than the 41mth card, so it's often worth using these rather than pushing for the extra month. | | | | 3. | The best-buy table above is IRRELEVANT for most: get a personal best-buy table. Few people can get every best-buy deal. Each lender credit-scores you, and they all do it differently; so where one accepts, others reject. The only way to know is to apply, but that leaves a hard search on your credit file; too many, especially in a short time, hurt your score.

So use our free Balance Transfer Eligibility Calc which shows your acceptance odds for most top cards. This way you can home in on the top deal that you're most likely to get. Plus as the eligibility calc only does a soft search on your file, it doesn't affect your credit-getting ability (you'll see it on your credit file, but lenders usually can't - and where they can, they can't use it). So use our free Balance Transfer Eligibility Calc which shows your acceptance odds for most top cards. This way you can home in on the top deal that you're most likely to get. Plus as the eligibility calc only does a soft search on your file, it doesn't affect your credit-getting ability (you'll see it on your credit file, but lenders usually can't - and where they can, they can't use it).

As Kelly told us: "Legend. Used the eligibility calc, got 35mths 0% and shifted £11,000 from 29.9%. Shocked by the savings." That's a saving of £4,900 if it's cleared within the 35mths. | | | | 4. | Should I apply with just a 60% chance? I'm often asked something like this. Actually 60% is pretty decent odds. It means over half the people in your position get accepted. Cutting debt costs is important, the aim is to minimise applications, not stop them. A story may help.

I sat with a MoneySaver who had large costly credit card debts & a poor credit history. The eligibility calc showed zero chance of all balance transfers, except Halifax at 20%. She asked: "Is there any point?"

I explained that as it was the only thing she needed credit for, 20% chance is better than nowt and the worst that can happen is she doesn't get it. She applied and got a 26mth 0% card - £1,500 limit.

Equally it's worth understanding that even a 95% score means one in 20 gets rejected. | | | | 5. | Some cards' 0% lengths are 'up to', so you may get a shorter deal. This is done based on your credit score (we always list alternative non-'up to' deals as well). The only way to know is by applying; however, as a loose indication, a higher eligibility calc score gives more chance of getting the longest deal.

What if the eligibility calc only shows 'up to' cards? I saw this recently while helping someone at my TV roadshow. It shows no fixed-length 0% cards want you, so it's likely you've a weak credit score, and you'll likely get a shorter length than advertised. Sadly there's no way to know who'll give the longest in these circumstances; it's a case of suck it and see. | | | | 6. | 100% pre-approval is possible on two top 0% cards. Within the eligibility calculator, we currently have two top cards some can be pre-approved on. They're the Virgin Money (eligibility calc / apply*) 41mth 0% card with a 4% fee and the MBNA (eligibility calc / apply*) up to 40mths 0% for a 2.47% fee (both are 20.9% rep APR after).

If you get 100% pre-approval it means (subject to an ID & fraud check) you know if you'll get that card, and even though the MBNA's an 'up to' card, it means you will get the full 40mths. There's no impact on your credit score, though of course if you then apply, that will mark your file. | | | | 7. | Even 41mths 0% isn't long enough for me, what can I do? One option, if you've a decent credit score, is before the 0% ends, simply shift the debt again to a new balance transfer deal. But safer is to go for a much longer term cheap deal.

- 5 years at 4.9% (0.5% fee). The MBNA 5 (eligibility calc / apply*) is 5yrs 4.9% with a 0.5% fee for debt shifted within 60 days (8.9% rep APR after).

- 6.4% (no fee) until the debt is repaid. The AA (eligibility calc / apply*) and Lloyds Platinum (eligibility calc / apply*) offer 6.4% rep APRs. While technically 'variable rate', the rate-jacking rules mean if you shift debt to it early, and they try and increase rates later, you can reject those as long as you don't borrow more (and meet at least the min repayments).

All these cards are 'representative' APRs, meaning sadly only 51% of accepted customers need get that rate; the rest can be charged more. | | | | 8. | Are 0% loans possible too? The answer's yes-ish. And they're useful for clearing overdrafts too. This is a feature of just a few balance transfer cards called 'money transfers'. They mean, usually within 60 days of getting one, you can pay cash into your bank account to use at will, so you then owe the card instead.

To do it, ask for a money transfer. Here are the top picks...

- Virgin Money (eligibility calc / apply*) is 32mths 0% on balance and money transfers, for a 1.69% fee, min £3 (19.9% rep APR after).

- MBNA (eligibility calc / apply*) is up to 32mths 0% with a 1.14% balance transfer fee and up to 24mths 0% with a 1.99% money transfers fee (20.9%/22.9% rep APR after). | | | | 9. | The balance & money transfer GOLDEN RULES. Getting the right card's only half the job...

a) Repay at least the set monthly min, or you can lose special rates.

b) Always clear the card/shift again before the 0% ends, or rates jump.

c) Don't spend/withdraw cash on them, it's rarely at the cheap rate.

d) Unsure what to pick? Use our Which Card Is Cheapest? tool.

e) Check if you can use existing credit first. See Credit Card Shuffle. | | | | 10. | Balance transfer common questions (& the answers too, obvs)...

- Can it clear multiple cards? Yes, if the new credit limit's big enough.

- How big will the credit limit be? That's a toughy; so far we've no way to know what the limit will be for each card and it can vary.

- My credit limit is not big enough. What should I do? Balance transfer what you can across to the 0% card. When done, apply for another card for the rest, and fingers crossed you're accepted. However, each subsequent application can get more difficult.

- Can I transfer the whole credit limit? Usually not. Most let you do 90%-95% of it, as they want to leave room for you to spend (avoid that).

- Can I use it to clear store cards too? Yes, it works the same way.

- Should I use savings to clear the debt instead? If it's costly debt this is usually the best plan. See my repay debt with savings guide.

- I also want to do new borrowing cheaply, can I? If you've already got debt, you should be very careful about getting more. However if you must, you want a top 0% spending card. If you need to shift debts too, see top 0% balance transfer & spending all-rounder cards.

- My credit score is poor, what can I do? There are lots of things that can help over the long term; read my 36 credit score boosting tips. | | |

Can't sleep because of your debts? This isn't for you. I've three tests for debt crisis: a) If you can't meet your minimum repayments b) If your non-mortgage debts are more than a year's after-tax salary c) If you aren't sleeping due to worries about debt.

If any affect you, the above is the wrong solution. Instead, get free debt-counselling help from Citizens Advice, StepChange or National Debtline. Or, if struggling emotionally too, CAPUK. Full info: Debt Crisis Help.

They're there to help, not judge. Many people's first comment to me after is "I finally slept last night". Read some inspiring stories in Debt-Free Wannabe and also my Mental Health & Debt guide. | | | | | | | | | | | | | | | | | | Pay £412 for 1yr up-to-52Mb fibre broadband & line but CLAIM £200 back - cheaper than many bog standard deals

Fibre broadband is fast, great for gamers, downloaders and multiple users. Yet it can be very costly, the key is to wait for cheap promo deals. And unusually right now the big broadband beast, BT, has one on.

-

BT fibre broadband & line rent. Until 11.59pm on Thu (28 July), get a 1yr contract for phone, line rent & up-to-52Mb speed unlimited broadband (3x faster than standard). 83% of the UK can get it, but sadly existing BT broadband customers are ruled out... BT fibre broadband & line rent. Until 11.59pm on Thu (28 July), get a 1yr contract for phone, line rent & up-to-52Mb speed unlimited broadband (3x faster than standard). 83% of the UK can get it, but sadly existing BT broadband customers are ruled out...

1. Sign up. You must use this specific link via the Cable.co.uk* comparison site.

2. Pay line rent upfront. If you can afford it, during the application opt to pay £205.08 for the year (equiv £17.09/mth). If not, you pay £18.99 per month.

3. The broadband's discounted to £12.50/mth (+ one-off £49). The broadband's usually £26/mth but it's discounted for the year to £12.50/mth, plus there's a £49 activation fee. You also get 100GB of free online storage.

4. You get a 'free' BT Infinity Hub router, but must pay £7.95 p&p. This isn't optional, sadly.

5. To get £200 back you need to CLAIM. BT doesn't make it easy. It won't remind you, so ensure you diarise AFTER installation to use this £150 prepaid Mastercard claim form, you can then spend the cash on it. You can use this £50 cheque-back claim form too. Turn off ad- or cookie-blocking software or the deal mightn't track.

- What about calls? Weekend calls to UK landlines included. See BT costs for other calls.

- No line/switching from cable? Not a problem, as installation's free.

- Want BT Sport? It's £5/mth or free with BT TV.

- Will cashback sites pay more? Regular users of cashback sites will see deals there with bigger cashback, but sometimes on more expensive deals. They can change daily though, so you may want to check.

Just how good is this? Pay the line upfront and it's £412 (£435 line paid monthly) all-in for the year (except calls). Provided you claim and use the £50 cheque and £150 Mastercard, it's £212/yr (£235 paid monthly) equivalent to £17.70/mth (£19.60/mth paid monthly). Compare that with the £300-£400/yr most standard broadband users pay. Already got BT fibre? You can find far more help and options in our Cheap Fibre Broadband info. -

Don't need fibre? If you don't need fast fibre broadband then the market's cheapest deals are TalkTalk £198 for a year, get £90 vch and BT £303 for a year, get £150 back. Full options in the Cheap Broadband & Line guide. | | | | | Vax up to 67% off cordless vacuum cleaners codes. MSE Blagged. On four items till Mon. This includes a £130 handheld cordless cleaner for £50 and a £200 2in1 handheld/upright for £85. Great feedback after past codes. Vax sale

NHS worker since 1999? Are you due £1,000s of tax back? We believe possibly 10,000s of NHS workers were mis-taxed. Already we've reports of over £5,000 back. Our new NHS tax reclaim guide explains how. Pls share.

109 free or cheap things to do with the kids. We've compiled scores of deals to help you keep the lickle darlin's entertained this summer with free activity packs, swimming, football training and more. See 109 things to do with the kids.

LOWCOSTHOLIDAYS VICTIM? MUST-READ SUCCESS OF THE WEEK: (Send us yours on this or any topic)

"Just received £1,400 from my Lowcostholidays booking after sending off MSE's chargeback template letter. Our bank paid in just 5 days, now we're by the pool in Kefalonia. Can't thank you enough."

If you're affected or know someone who is, see full help in our Lowcostholidays money back guide.

M&S £2 top, £6 shirt in up to 70% off sale boost. Clothes, beauty & home. Ltd stock. M&S. Related: All sales

New. Off to Malaga, Marbella, Torremolinos, Fuengirola? 43 Costa-cutting tips. If you're off to the Costa del Sol (ie, flying into Malaga) take a look at our new 43 cheap Costa del Sol tips. Other travel guides: 31 New York Tips, 29 Paris Tips | | | | | | | | | | | The top savings bank account has launched a new lower-fee little sister that er, doesn't pay interest. Any good?

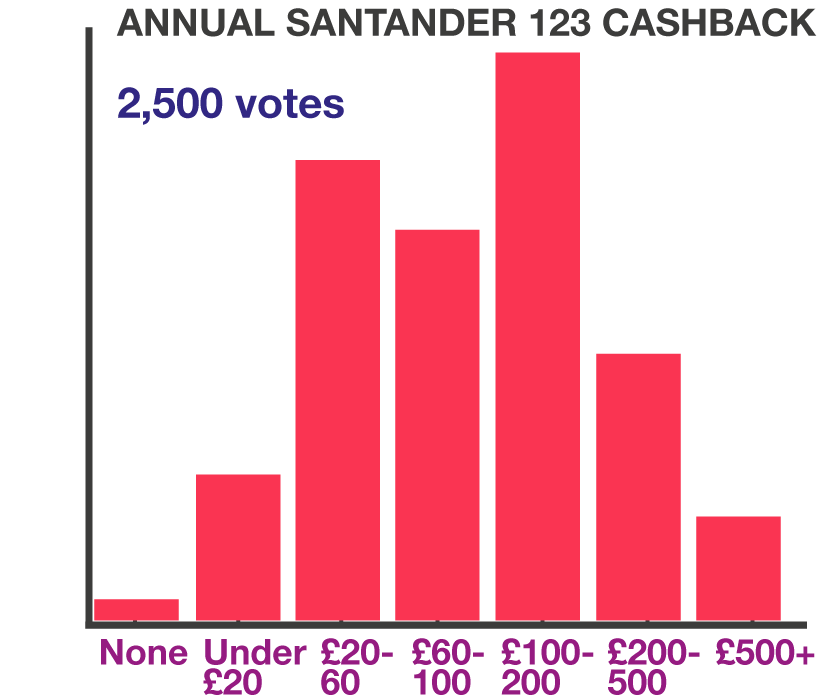

For over four years the Santander 123* bank account has been a top pick for savers, as it pays a huge 3% AER if you've £3,000 to £20,000 in it. But in January its fee increased to £5/mth. For most that's easily covered by the up to 3% cashback it gives if you pay bills by direct debit and even without cashback, on c. £8,000+ it beats owt else. Some ditched it due to that fee hike though, and now, we suspect in response, it's launched a new lower-fee Lite option. -

What is the new Lite account? Santander 123 Lite is a bank account you pay £1/mth for and which gives you cashback on bills paid by direct debit. There's no interest paid if you're in credit. You get 3% cashback on mobile, phone, broadband & TV; 2% on energy & Santander home insurance; 1% on water and council tax and also 1% on Santander mortgage payments, but with a £10/mth max. Its overdraft isn't cheap, so if you dip into that, avoid. What is the new Lite account? Santander 123 Lite is a bank account you pay £1/mth for and which gives you cashback on bills paid by direct debit. There's no interest paid if you're in credit. You get 3% cashback on mobile, phone, broadband & TV; 2% on energy & Santander home insurance; 1% on water and council tax and also 1% on Santander mortgage payments, but with a £10/mth max. Its overdraft isn't cheap, so if you dip into that, avoid.

The chart shows how much cashback main 123 users told us they get. Typically £120ish/yr; with that, after the Lite fee, you'd be £108/yr up.

-

You can earn £100s with the right account, but often that isn't Santander 123 Lite. So how does the Lite stack up? Let's assume you're in credit and likely to use it as your main bills account, and thus get cashback (if not it's pointless; see top bank accounts for alternatives). Even then, it's often beatable by another option.

- It wins if you've a Santander mortgage & little savings. The mortgage cashback means Lite is a big winner.

- Main Santander 123 beats Lite for savings over £3,000. The interest paid by Santander 123* overcomes its extra £48/yr fee over the Lite if you've £3,000+, even factoring in if you'd been saving most of it in a normal top savings account.

- NatWest usually beats it for cashback. For a £3/mth fee the no in-credit interest NatWest Reward* account pays 3% cashback on council tax, mobile, landline, TV package, energy, water & broadband bills. For typical bills, this extra cashback outweighs Lite's smaller fee. Eg, someone earning roughly £120/yr cashback after fees on Lite, earns around £180/yr here.

- Many with smaller bills are better off getting a free £150 and £4+/mth. If you've smaller bills, the Co-op Bank* pays you £150 for switching. Then sign up to its Everyday Rewards scheme to get £4/mth plus 5p per debit card use, up to £1.50/mth. So that's a max £216 in year one and £66/year afterwards. These accounts usually require you to pass a credit check to switch, plus set up 2+ direct debits, and pay your income in. Full info & options incl eligibility details in Top Bank Accounts. Related: Top Savings, Top Cashback Credit Cards | | | | | | | | | They can get this email free every week | | | | | | | | | 'It was amazingly easy and within a month I had £1,415 from British Airways in my bank account' - Clair via email

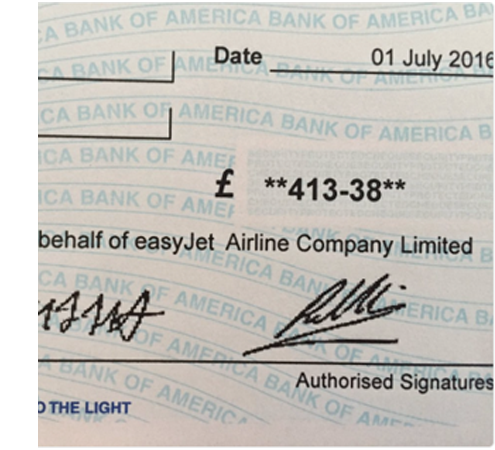

If you're one of millions jetting off right now, tool yourself up on your delay rights (and let fellow travellers know too). Yet even if your delay was in 2010, you may still be due up to £500/person. Daily we hear successes, such as from Andrew who tweeted a picture of an Easyjet cheque (below). Our Flight Delays Guide & Tool has full plane English help. In brief: -

Flight delay compensation - the basics... This is all about EU regulation 261/2004, and indeed there's a question once we leave the EU whether this will continue (but we've likely a couple of years until that). Flight delay compensation - the basics... This is all about EU regulation 261/2004, and indeed there's a question once we leave the EU whether this will continue (but we've likely a couple of years until that).

- You must've arrived 3hrs+ late (see how to check past delay lengths).

- All flights from EU airports count, or to EU airports if it's an EU airline.

- Compensation's fixed, based solely on delay & journey length. What am I due?

- It must be the airline's fault - eg, strikes don't count. See What counts?

- Airlines may offer vouchers, but go back to 'em - you're entitled to cash.

- Is it fair to airlines? Not always, eg, a £10 flight gets £500 compensation. See Martin's Legal vs moral concerns.

-

Free online reclaim tool. Our Flight Delay Reclaim Tool is a collaboration with complaints site Resolver, matching our template letters & experience with its tech. It auto-drafts your complaint, sends it, keeps track & escalates it if necessary. Lee emailed: "Raised the claim and £628 was actually in my bank 4 days later - just incredible. Thank you MSE and Resolver." See our Resolver guide for how we work with it. -

Tried before and claim failed? Try again. We're hearing from some who've tried again after rejection, following last year's landmark EU court ruling that you can claim for most technical faults. Jacqueline emailed: "My original claim was unsuccessful but you said 'don't give up - claim again', I did and they're giving us £774". | | | | | £8 for 6 lucky-dip potted plants bundle (norm £12). MSE Blagged. For 9cm plants. Or £11 for 12cm plants. Incl busy lizzies, geraniums, petunias, begonias. 1,400 avail. Jersey Plants Direct

£100ish Nails Inc polish set £25 all-in (ltd stock). MSE Blagged. 10 x 10ml incl floral, foil, glitter etc. Nails Inc

Last chance. The tax credit renewal deadline is SUNDAY. If you've been sent a tax credit renewal in a brown envelope, check it and tell HMRC of changes. White envelope? Contact 'em regardless. Full Help: Avoid tax credit overpayments

£5 prosecco, £10 champagne. See all corking summer bubbly deals. Please be Drinkaware.

Pay min £1 for £55 of PC games. Ends Tue. Incl The Darkness II & Duke Nukem Forever. Charitable firm Humble Bundle lets you 'pay what you want'. Pay more to unlock more, eg, £12ish for £200+ games incl Battleborn. Humble Bundle | | | | | | | | | | How much are you worth (or do you owe)? If you add up the value of all your assets (eg, home, savings, investments, car, possessions) and take off the value of your debts (eg, mortgage, loans, credit cards - but not student loan) you'll come to a rough figure as to what you're worth. Then whether you've "net worth" or "net debt", click here to pick your value. We're all going on a summer holiday... Or at least some of us are. In last week's poll, 63% of you told us you were going to be holidaying this summer, with 56% of those planning a holiday abroad. Just 5% of you have no holiday plans at all this year. See full summer-holiday poll results. | | | | | | | | | | | | | | | | | | | | | | | | | | | Thu 28 Jul - Good Morning Britain, ITV, Deals of the Week, 7.40am. View previous

Fri 29 Jul - This Morning, ITV, Martin's Quick Deals, from 10.30am. View previous | | | | Wed 27 Jul - Share Radio, 11.20am

Thu 28 Jul - BBC Radio Manchester, 4.50pm

Tue 2 Aug - BBC Radio Cambridgeshire, 2.20pm | | | | | | | Q: I often order goods online, but collect them from the store - what rights do I have if I wish to return them? Is it classed as a web order or an in-store purchase, given I'm collecting at the store? Graham, by email. MSE Megan's A: It all depends on WHEN you pay for the goods. If you pay online and simply pick the items up in-store (what some shops call 'Click and Collect'), then it counts as a web order, meaning that under the Consumer Contracts Regulations 2013 you generally have 14 days to cancel the order and a further 14 days to return what you've bought. It's worth bearing in mind though that your 14-day cancellation period starts from the date the item's delivered to the store, not when you decide to collect it. However if you just reserve an item online and then actually pay when you pick it up in-store, web return rights don't apply - the rules are the same as if you'd just walked into the shop to buy something. Unless an item's faulty, you don't have a legal right to return it just because you've changed your mind (though of course many shops let you exchange and return things even if you don't have a legal right to do so). See our Consumer Rights guide for more information. Please suggest a question of the week (we can't reply to individual emails). | | | | | | | That's it for this week, but before we go...

A MoneySaver said on the forum,

"I love poems - in fact, I adore 'em".

So he started a thread,

Where posts are rhyme-led

Why don't you go and explore 'em? We hope you save some money,

Martin & the MSE team | | | | | | |