| THE TOP TIPS IN THIS EMAIL | | Menu links don't work in some email readers. If a problem, view online | | Been Plevined? Now just having had PPI means you could be due £1,000s | | Ending. 'Free' £55 M&S vouchers | | Beat home ins hikes, eg, '£640 renewal, but I paid £133' | | Book 2018 summer holiday now? | | New. Get 1.95% on savings for 1yr | | 4GB data, unltd mins & texts Sim £9/mth | | £5 London to Paris rtn coach trick | | Ends Sun. 'Free' 500 Clubcard pts | | 'I got £79 Amazon Prime fee back' | | Let firefighters wash your car | | 26 perennial plants £5 all-in | | Apple student deals, eg, 10% off Macbook | | Cheapest 2-winter energy fix - many could save £250/yr+ | | £50 Nutribullet, £39 Amzn Echo Dot | | £64 of BareMinerals beauty for £28 | | Urgent. Kids had GCSE results? If you get child benefits, tell the taxman | | | | | | | | - New game-changing way to reclaim has opened this week

- 2yr reclaim countdown has begun - go NOW to beat the backlog

- £27bn+ claimed, but majority haven't - grab YOUR share of £bns

It's official - the clock is now ticking to beat a two-year deadline to claim for mis-sold Payment Protection Insurance (PPI). We know, we know, we've been hectoring you for YEARS, but it's time to act. The City regulator is spending millions on advertising the 29 Aug 2019 deadline (have you seen the Arnie ad?), so go quick using our free PPI reclaiming tool to beat the rush. It's official - the clock is now ticking to beat a two-year deadline to claim for mis-sold Payment Protection Insurance (PPI). We know, we know, we've been hectoring you for YEARS, but it's time to act. The City regulator is spending millions on advertising the 29 Aug 2019 deadline (have you seen the Arnie ad?), so go quick using our free PPI reclaiming tool to beat the rush.

PPI is insurance sold alongside loans, cards, overdrafts, mortgages and catalogue accounts. It's designed to cover repayments for a year if you can't, eg, if you become unemployed - and in itself, there's nothing wrong with it.

Yet banks and building societies massively overcharged and systemically mis-sold it, lying that it was compulsory, adding it without asking and failing to ensure it was suitable. Just 12m have claimed, despite 64m policies being sold - so millions more are likely to be due cash. And there's now a new way to claim just for simply having had a policy. It's been ruled most were overpriced as lenders creamed off too much commission from the cost for themselves. It's a rule called Plevin, named after Susan Plevin who took on her bank in 2014 and won on this basis. For full info see our free Plevin reclaim tool, but here are the key details... | Simply having had PPI now means you were likely mis-sold | | | | • | The Plevin rule is all about excessive commission taken by banks and building societies. The new rule means if over 50% of your PPI's cost went as commission to the lender, and that wasn't disclosed to you (most won't have been told), you're due back the extra above that (though we think it should've been a lower threshold given the huge sums).

With loan PPI, on average a STAGGERING 67% of what you paid was pocketed by banks as commission from insurers, so millions more people are owed possibly billions more between them. Watch Martin's Plevin video to see him explain how outrageous the commission was. On a £10,000 loan over 5 years, your Plevin compensation would typically be £500.

So even if you knowingly took out PPI, you were still likely mis-sold it, and if you've had a past claim rejected, you can claim again under this ruling (see below). Of course, as commission usually wasn't disclosed, you probably won't know the amount, but as most banks took 50%+ it's worth a go. If you bought it from a broker or direct from a retailer, they didn't tend to take as much commission but it's still worth checking.

For this to count, your PPI and any connected loan had to still be active at some point since 6 April 2008, though there can be exceptions. | | | | • | Can I claim under Plevin if I've already had a mis-selling payout? No. If you've already made a successful claim, even if you didn't get the full amount back, you can't get any more. | | | | • | I think I had PPI but I'm not sure I was wrongly flogged it - should I just do a Plevin claim? NO - STOP. It's VITAL to check first if you were originally mis-sold PPI, because if you discover you were, you'll be entitled to the full amount back, plus interest charged on those payments, plus an additional 8% interest. The bank must also now automatically consider you for Plevin as well, so if you're rejected you could then get a Plevin payout. | | | | If you've previously been rejected for mis-selling you CAN claim under Plevin | | | | • | If that's you, the reclaiming door has been opened. If you had a claim rejected by a bank, building society or other big financial institution (and even if the ombudsman agreed with the rejection), you should make a Plevin complaint.

You'd likely be part of the 1.2m about to be written to by providers to explain the Plevin reclaim process - but there's no need to wait to get a letter (which must arrive by the end of November at the latest). Plus, we don't know what the banks will say in their letters.

You can complain now and say you're doing so on the basis that you may have paid undisclosed high commission. If you've still got details from your previous claim, use those to help your claim.

However, don't worry if you don't. Resolver, which operates our reclaim tool, says banks have been preparing in accordance with Financial Conduct Authority (FCA) rules to be able to find former PPI customers. Go to our free Plevin reclaim tool which will ask for a few straightforward details. | | | | • | I put in a mis-selling claim months ago but have heard nothing. What happens now? The regulator says a firm must still assess your mis-selling claim as normal and if it rejects you it must assess you under the Plevin rule - though you can still fight any mis-selling claim rejection and take it to the independent Financial Ombudsman Service. | | | | So how do I actually reclaim PPI? | | | | • | First check if you were mis-sold in the traditional sense so you know under which basis to claim. You'll get more back if you were mis-sold, as explained above.

Classic examples are when you were told it was compulsory to get a loan, you were self-employed but wrongly told you qualified for unemployment cover, or it was simply added without your knowledge. So if you've had a debt product of any type, check. See our full Mis-selling Checklist.

Just look at MoneySaver K.H, who emailed: "We believed we'd never had PPI and ignored all your suggestions to check - until we saw you say that even if we didn't think we had, check. Turns out we had three policies over the past 20 years and have recently had almost £5,000 back. Thank you, thank you." | | | | | • | How do I know I had it? Help. I can't find any paperwork. Check all old loans, credit cards, mortgages, store cards and overdrafts to see if there was PPI. It will have been called something like 'payment insurance' or 'accident or sickness cover'.

- Can't remember who your lender was? All debts active in the last 6 years are on your credit report(s). Get your Experian report (from the UK's largest credit reference agency) for free via the MSE Credit Club, plus see how to check other reports. It won't tell you if you had PPI, just which lenders to check with.

- Don't have the paperwork? Request it from your lender going back 6 years.

- No paperwork for very old loans? Ask your lender, but be prepared you may've missed the boat. Go to our free PPI reclaim tool and if you're struggling to find paperwork, we've guidance to help you dig out what you can. | | | | • | Claim YOURSELF for free. You DON'T need to pay a claims handler. They do very little you can't do yourself, and take up to a whopping third of your payout - which can be £1,000s. You can do it easily with our free PPI reclaiming tool.

If you've used a claims company in the past we're concerned it'll now try to take a percentage of any Plevin payout you're due.

We've asked the FCA for guidance on this and much will depend on what's in your original contract with the firm. We're compiling claims handler guidelines (see the last dropdown in our link) including how to tell us your story if approached… | | | | • | If rejected, go to the free Financial Ombudsman. Sometimes banks and building societies say 'fair cop' and pay out £1,000s in just a few days.

But if they wrongly reject you (as many scandalously do), you have six months to take your case to the Financial Ombudsman Service, an independent body which can adjudicate and force banks to pay you back. In 2016, in over half of all cases where banks rejected a reclaim, the ombudsman overturned it and ordered them to pay out.

To make it easier, our free reclaim tool does this for you. If you're struggling or unsure, call the ombudsman helpline - 0300 123 9123. |

| | | | | | | | | | | | | | | | | | Or £50 in Nectar pts on £350 Sainsbury's spend. Both by grabbing a 0% spending credit card

Getting a top credit card is never an excuse to spend willy-nilly - ensure it's planned and budgeted, and clear before the 0% ends. But used right, you can get 'free' vouchers just for doing everyday spending up to the trigger limit, clear the debt at no cost, then cancel if you want (though if you need to borrow there's no cheaper way than interest-free). Full info and options in Top 0% Cards - but in brief... -

Ends Thu. Get £55 M&S vchs + 25mths' 0% spending. Accepted new M&S Bank (eligibility calc / apply*) cardholders who apply via this link by 11.59pm on Thu 31 Aug and spend £100+ anywhere on it by 30 Sep get emailed a £50 M&S vch to use by 30 Nov. Ends Thu. Get £55 M&S vchs + 25mths' 0% spending. Accepted new M&S Bank (eligibility calc / apply*) cardholders who apply via this link by 11.59pm on Thu 31 Aug and spend £100+ anywhere on it by 30 Sep get emailed a £50 M&S vch to use by 30 Nov.

You can earn another £5 to spend at M&S, as you're sent a separate voucher with the card - swipe it at the till or use the code online to buy most things at M&S and you'll get 500 M&S points, worth £5. Plus you earn one point (worth 1p) for every £1 spent at M&S and every £5 elsewhere.

-

It's back. Up to £50 in Nectar pts + 32mths' 0% spending. While the M&S card has the biggest freebie of all 0% spending cards, the relaunched Sainsbury's Bank card (eligibility calc / apply*) has the longest 0% length at 32mths. Plus it may win for regular Sainsbury's shoppers as it gives 1,000 Nectar pts (worth £5) each time you spend £35+ in Sainsbury's in the first 2mths, up to 10,000 pts (worth £50). You also get an ongoing 2pts for every £1 spent in Sainsbury's and 1pt for every £5 spent elsewhere. -

Will it affect my credit score? An application leaves a footprint on your credit report, which is trivial unless you do many in a short time or are about to make an important credit application, eg, a mortgage. It's best to check your chances first using our free eligibility calc, which shows which cards you've best chances of getting and doesn't affect your score. -

0% Card Golden Rules.

a) Always pay at least the set monthly minimum or you can lose the 0% (and stick within the credit limit).

b) Plan to clear the card (or balance-transfer) before the 0% ends or both rates jump to 18.9% rep APR.

c) These cards are usually ONLY cheap for spending, so avoid cash withdrawals or balance transfers on them. | | | | | | | | | | | | | | | Our cost-cutting system helps you smash the rises and includes top deals comparison sites miss

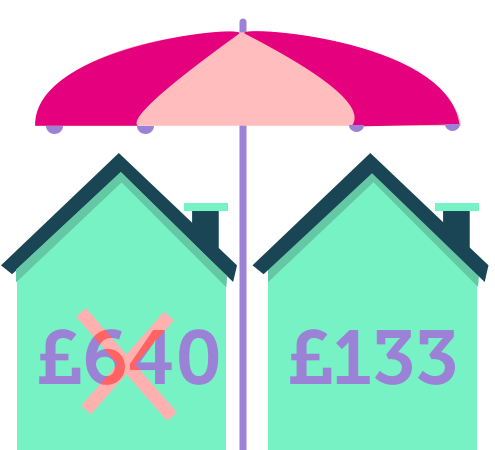

Like many other bills, home insurance costs are rising. Buildings insurance is up 5.6%, while our new Bills Tracker index shows contents insurance is up 3.3%. So use our Cheap Home Insurance system to fight back, as Anthony did: "Renewal up from £460 last year to £640, but I found a quote for £133. Thank you." Here's how to do it... -

Step 1. NEVER simply auto-renew. Combine comparison sites to get 100s of quotes in mins. They zip your details off to dozens of insurers but don't search 'em all and don't give identical prices - so use a mix. Our current search order's MoneySup*, CTM*, Gocompare*, Confused.com* (see full order and why). Step 1. NEVER simply auto-renew. Combine comparison sites to get 100s of quotes in mins. They zip your details off to dozens of insurers but don't search 'em all and don't give identical prices - so use a mix. Our current search order's MoneySup*, CTM*, Gocompare*, Confused.com* (see full order and why).

-

Step 2. Check insurers NOT on comparison sites. Two biggies - Direct Line* and Aviva* - won't appear on them. They're worth checking as they can be competitive for some. -

Step 3. See if HOT deals beat the above, eg, £70 Amazon vch. We've blagged extra promos via the links below for combined buildings and contents cover. Vouchers can take about 100 days to arrive. - £70 Amazon vch. Via Insure4Retirement*.

- £30 Amazon vch (rising to £40 on Thu). Via Leisure Guard*. Do I need buildings or contents insurance? It's a question we're often asked. Here's the answer...

- Buildings cover is usually only needed by freeholders (not usually required for leaseholders or renters, but check). Those who get it sometimes wrongly insure their home's market value rather than the often lower rebuild cost - use a rebuild calc to see how much you should insure for.

- Contents is for everyone but don't under-insure, eg, if you cover £10k, have £20k of stuff and your £1,000 TV is smashed, you may only get £500. Use a contents calc to check you're fully covered. | | | | | 26 perennial plants & garden snips £5 all-in (norm £28ish). MSE Blagged. Lucky dip, eg, lavender, carnations, echinacea etc. Ends Sun. Thompson & Morgan

Apple student deals, eg, up to 10% off AND 'free' £116-£224 Beats headphones when buying a Mac/iPad Pro. Teachers and parents can get 'em too. See Apple discounts.

Cheapest 2-winter energy fix - many could save £250/yr+. Lock in a cheap rate until Mar 2019 with this Green Network Energy tariff. It costs a typical £866/yr - the cheapest 2-winter fix, though we've little feedback on the supplier. Switch through Cheap Energy Club and you'll get £30 dual-fuel cashback till Friday (£25 after). Plus registration's now open for our Big Switch Event 8. Next week, we're hoping to bring you a 1yr fixed deal. If you get this email, you're automatically registered, but suggest friends, family and colleagues check if they're registered (and register if not).

£50 Nutribullet, £39 Amazon Echo Dot, via Tesco Direct codes. Get £5-£20 off, works on discounted items. Tesco codes

£64 of BareMinerals beauty products for £28, incl 'Mineral Veil' powder. MSE Blagged. Plus brush, mascara, serum & more. Via code, 1,000 avail. Lookfantastic

Urgent. Kids had GCSE results? If you get child benefits, tell the taxman to avoid missing out. See GCSE tax help. | | | | | They can get this email free every week | | | | | | | | | Sometimes the cheapest time to book your next fun in the sun can be as soon as you return

Many returning holidaymakers immediately plan their next dose of sun, sea and sightseeing to beat the back-to-work blues. And although it's not cut and dried, booking before the sand in your toes has washed away can be MoneySaving. For instance, we found flights and car hire for Croatia in August 2018 at 25% cheaper than the same trip this year, when booked in Jan. So if you plan to book now, see our 60 Overseas Travel Tips - here are the key points: -

Booking packages early can net special deals. Tour operators can offer discounts for booking way ahead, eg, right now Thomson, First Choice and Jet2holidays are offering free child places for summer 2018. However, waiting till the last minute can also pay off as prices often plummet, though you've MUCH less choice. See Cheap Package Holidays for when they beat DIY trips and how to compare 'em. Booking packages early can net special deals. Tour operators can offer discounts for booking way ahead, eg, right now Thomson, First Choice and Jet2holidays are offering free child places for summer 2018. However, waiting till the last minute can also pay off as prices often plummet, though you've MUCH less choice. See Cheap Package Holidays for when they beat DIY trips and how to compare 'em.

-

You can book BA, Virgin etc flights NOW for summer 2018. Many airlines release seats 11-12 months ahead, with cheaper seats often released early. While you can't be sure these will be the cheapest, as prices could drop later, you'll likely at least get a decent price if you book as soon as all airlines on that route make seats available. See Airline-by-airline seat release dates and our Cheap Flights guide to help. -

Easyjet and Ryanair are NOT yet available for summer 2018. If they fly your route, it can be worth waiting for 'em. They're only currently selling tickets till March 2018 and don't publish release dates, but we expect them to make summer 2018 seats available in autumn/winter. See our 21 Ryanair tips and 18 Easyjet tips for more. -

Manipulate hotel prices with our rebook tricks. Rates can fluctuate but if you find a good deal on a room with free cancellation then grab it, monitor prices and cancel and rebook if it drops. Some booking sites also match prices if they fall later. Both strategies can pay off but have their risks - see Hotel rebook tricks for full info. -

Get travel insurance as soon as you book. ALWAYS get it immediately. It doesn't cost any more to get a policy early, and you're then covered if you have to cancel any time BEFORE your holiday begins, eg, if you or a relative falls ill. See Cheap travel insurance from £5. | | | | | Baking round-up, incl 75p bowl, £6 Paul Hollywood cookbook. Bake Off is back, and we've risen to the occasion. Save dough

£91 of Nails Inc nail polish for £22 all-in. MSE Blagged. 8-polish set, incl glitter & leather effects. 600 avail

SUCCESS OF THE WEEK: (Send us yours on this or any topic)

"Cannot say a big enough thank you. I completed the Resolver form to reclaim packaged bank account fees - getting £4,197 back. Five minutes to complete and five minutes to chat to the bank so not a bad rate of earning - over £25,000/hour."

Know a charity that helps people through life-changing events? Does it want an MSE Charity grant? Our charity's current funding round is for organisations that support people going through life-changing events such as bereavement or homelessness. The round opens this Friday - find out more about the charity and how to apply online at MSE Charity. | | | | | | What puts you off reclaiming mis-sold PPI? The majority of people likely owed compensation for PPI haven't claimed it yet. There are only two years left to do so, and given many could be owed thousands, plus a new ruling means just having had PPI makes it likely you were mis-sold, we want to know what puts you off reclaiming mis-sold PPI. You're reluctant to switch to energy providers you haven't heard of... In last week's poll we asked what puts you off / frustrates you about switching energy. Of 5,192 responses from those who haven't switched, the biggest put-off was lesser-known providers. See what else puts people off switching energy. | | | | | | | | | | | | | | | | | | | | | | | | | | | Mon 4 Sep - This Morning, ITV, time TBC. View previous

Mon 4 Sep - BBC Radio 5 Live, Lunch Money Martin, noon. Subscribe to podcast | | | | Wed 30 Aug - BBC Radio Scotland, The Kaye Adams Programme, 10.30am

Thu 31 Aug - BBC South West stations, Good Morning with Joe Lemer, PPI

Tue 5 Sep - BBC Radio Cambridgeshire, 2.20pm | | | | | | | Q: If I switch banks, do I have to close my old current account? Janet, via email.  MSE Rosie's A: You have to close your old account if you switch via the seven working-day Current Account Switch Service (CASS). As part of the process, your new bank will automatically close it and also move all payments, eg, direct debits out or salary in, across. MSE Rosie's A: You have to close your old account if you switch via the seven working-day Current Account Switch Service (CASS). As part of the process, your new bank will automatically close it and also move all payments, eg, direct debits out or salary in, across.

If you'd rather keep your old account open, or your old or new bank is one of the few not signed up to CASS, you'll need to use the older, slower and more complicated system. Your payments will still be switched over, but there's less protection if anything goes wrong, and it's likely you won't get any of the switch incentives. For more info on bank switching, and our top-pick accounts, see Best Bank Accounts. Please suggest a question of the week (we can't reply to individual emails). | | | | | | | That's it for this week, but before we go... Santa and his elves may still be sunning themselves on the beach and you may be thinking more BBQs than tinsel, but we've seen tubs of Christmas chocolates already on sale in Tesco. Is it too early or are you happy to get into the festive spirit while still wearing shorts? Let us know what you think plus your early festive finds in our Early Christmas Facebook post. We hope you save some money,

The MSE team | | | | | | |