| Plus... 50 coupons, Google Nest trick, beware energy hikes  THE TOP TIPS IN THIS EMAIL

| | 10 motoring MoneySavers to drive down costs at a key time - Cut petrol costs after biggest rise in 9yrs

- Beat car insurance rip-offs in peak period

- Plus 11m MOTs due, bag £60 full breakdown cover & lots more Millions are back on the road after the easing of lockdown, but this month in particular there are plenty of metaphorical roadblocks that could send your wallet into a spin. Right now drivers have to combat rising fuel costs, many need to sort their insurance at a busy renewal time, and millions of MOTs are due. So to help slow accelerating costs, we've 53 Motoring Tips. Here are 10 to start with... -

After the biggest petrol price rise in more than 9yrs, find the cheapest fuel near you in secs. Pump prices dropped in the early part of the pandemic due to falling worldwide fuel demand, but they're back up again as lockdown eases. July's inflation figures showed the largest monthly rise in petrol prices since Jan 2011, and RAC data shows they continued to edge up in Aug. Diesel has also risen sharply in recent months. After the biggest petrol price rise in more than 9yrs, find the cheapest fuel near you in secs. Pump prices dropped in the early part of the pandemic due to falling worldwide fuel demand, but they're back up again as lockdown eases. July's inflation figures showed the largest monthly rise in petrol prices since Jan 2011, and RAC data shows they continued to edge up in Aug. Diesel has also risen sharply in recent months.

While not quite at pre-coronavirus levels, the avg cost of unleaded is 114.66p/L compared with 106.48p/L in May. To help you keep prices in check, a nifty tool finds your cheapest local forecourt - and the difference between best and worst can be huge, eg, in Leicester on Tue we found it ranged from 106.7p/L to 118.9p/L. See petrol comparison.

- Whatever you pay for fuel, we've 7 ways to cut your use, eg, keep tyres pumped. Drive clever to drive cheap - cut fuel use.

- We're in peak car insurance-buying season - and to avoid getting stung, NEVER auto-renew. Sep is one of the two main car insurance-buying months of the year - along with Mar - as they're when new number plates are released, which prompts more car purchases, and therefore insurance-buying too.

We've found the best time to buy is three weeks before renewal. If you've less time, hurry, as prices tend to rise the closer you get. Even if you're months away, note this key time in your diary so you can pounce. Follow these steps to find YOUR cheapest quote (for full info, see our Cheap Car Insurance guide):

- DON'T auto-renew or you'll likely overpay, instead combine comparison sites to speedily find your cheapest cover. They don't cover the same insurers, nor give the same price for the same insurer, so always check more than one. Our current order is: 1) MoneySupermarket*, 2) Confused.com*, 3) Compare The Market*, 4) Gocompare*. (Why? See comparison order.)

- Also check insurers not on comparisons. You won't usually find biggies Direct Line* or Aviva* on all sites - they're worth a check.

- Also see if counter-logical savings work. Eg, if comprehensive's cheaper than third party, whether adding extra drivers slashes costs or if legitimately tweaking your job description cuts costs.

-

11.3m MOTs are due in the next 3mths - sort yours NOW to beat the rush and avoid a £1,000 fine. During the early part of the pandemic, deadlines were extended by 6mths for MOTs due between 30 Mar and 31 Jul. But that means in the next few weeks those originally requiring their annual check-up in spring must be sorted on top of the autumn crop. Repairer Kwik Fit estimates a huge 11.3m are therefore needed in the next 3mths. 11.3m MOTs are due in the next 3mths - sort yours NOW to beat the rush and avoid a £1,000 fine. During the early part of the pandemic, deadlines were extended by 6mths for MOTs due between 30 Mar and 31 Jul. But that means in the next few weeks those originally requiring their annual check-up in spring must be sorted on top of the autumn crop. Repairer Kwik Fit estimates a huge 11.3m are therefore needed in the next 3mths.

That's prompted the Govt to urge motorists to sort their check-up ASAP if it's upcoming in case test centres are fully booked. Our Cheap MOTs guide can help you find tests from £27 and explains how to find 'hidden' centres to avoid paying out needlessly for repairs.

- Unsure when your MOT is due? Use a quick tool to help avoid a fine of up to £1,000 for driving without one. See MOT checker.

- Free parking, breakdown recovery & car checks for NHS staff. See our full round-up of NHS motoring deals.

- STOP PRESS: Photo licence renewal amnesty extended - but check now if you've one of 2m which are invalid. As part of its coronavirus help measures, the DVLA announced just before we sent this email that drivers whose licences expire between 1 Feb and 31 Dec have an auto 11mth extension from the date of expiry to renew them (previously the amnesty was due to end on 31 Aug, with only a 7mth extension).

Some may want to do nothing, but if your licence has recently expired, it's best to sort it now to be safe as there may eventually be backlogs. If your licence expired before 1 Feb and you want to drive, you MUST renew it or you could be fined up to £1,000. See how to check your driving licence (and what to do if it's invalid).

- Get full breakdown cover for £60/yr, or basic cover from £23/yr. For full cover, incl home start and onward travel if broken down elsewhere, AutoAid* has been our top pick for years and still is due to its price and good feedback. It covers you, plus your spouse or civil partner, in any car you or they drive, for £59.99/yr. For comparison, an equiv AA policy is £140/yr bought direct.

If basic cover will do (ie, no cover at home and no onward travel), see how to get RAC/AA cover from £23/yr via cashback sites. More help, deals and tips in Cheap Breakdown Cover.

- Car (or bike) damaged by a pothole? You could be due £100s. Use our Pothole Claims guide to see if you can claim.

-

Buying a new or used car? How to get it cheaper, incl loans from 2.8%. With new number plates out every Sep (this time it's 70 plates), it's one of the peak car-buying months, though buying brand new is THE most expensive way to do it. For example, the AA estimates a car loses up to 40% of its value in the first year. Buying a new or used car? How to get it cheaper, incl loans from 2.8%. With new number plates out every Sep (this time it's 70 plates), it's one of the peak car-buying months, though buying brand new is THE most expensive way to do it. For example, the AA estimates a car loses up to 40% of its value in the first year. Whatever car you buy, the cheapest way to get it is to buy it outright, if you have the cash (though we know that's impossible for many). If you don't, the next cheapest route is usually via a standard bank loan, as rates tend to be lower than specialised car finance packages. Loan rates are currently near all-time lows, yet due to the financial fallout from the pandemic, lenders are being more cautious about who they accept. So to help, use our Loans Eligibility Calc , where you fill in some details and it lists firms most likely to accept you, thus helping to protect your credit score. For an idea of the best buys, here's the cream of the crop: - £5,000-£7,499, Tesco Bank (eligibility calc / apply*) is 3.4% rep APR, MBNA ( eligibility calc / apply*) is 3.5% rep APR.

- £7,500-£15,000, Cahoot (eligibility calc / apply*) and TSB ( eligibility calc / apply*) are both 2.8% rep APR.

All are over 1-5yrs, except Tesco which is 1-3yrs. We've full info & more loan options in Cheap Car Loans. However, many people like to use specialist car finance packages such as personal contract purchase or other dealer finance. While they're usually pricier than a loan, they can provide flexibility, eg, with one it can be easier to trade in your car for a newer model, though you don't always end up owning the vehicle outright. -

Smash parking costs by renting a driveway. See if you can rent a private space for less. We found £7/day in London compared with NCP's £14/day. PS: If you're getting on two wheels instead, we've 14 cycling MoneySaving tips. There's been a surge in bicycle ownership during the pandemic, so we've 14 MoneySaving cycling tips to help, incl work-based discounts, free repairs & try before you buy. | | DON'T believe the fake 'Martin Lewis' or 'MSE' ads

Lots of scam ads litter social media and even newspaper websites - some of these lie that we or Martin promote Bitcoin, binary trading etc. See Fake ads warning. | Credit card freebies - do NORMAL spending to bag up to £120 (and you can even get it in time for Christmas) But remember cards such as these are like fire - a great tool if used well, but you'll get burnt if used badly It's been a lean year for new credit card bonuses, but there are still some good long-standing deals, and now is the perfect time to get them if you want a cash boost for (dare we mention it) Christmas. Like most card freebies, you must spend a minimum sum in a set time - often three months - to trigger the bonus. But only do it if you're debt-free and have a good credit history, and for normal spending you've budgeted for, as they're not an excuse to overspend. Then pay IN FULL each month to avoid interest. -

Earn £120 in Nectar pts - spendable at Argos, eBay, Sainsbury's etc. The Amex Nectar (eligibility calc / apply* ) gives a bonus 20,000 Nectar pts if you spend £2k on it within 3mths, on top of the usual 2 pts per £1. So once you hit the trigger you'll have 24,000 pts, which should come within a month of spending £2k. These are worth £120 if spent at Sainsbury's, Argos, eBay etc. Earn £120 in Nectar pts - spendable at Argos, eBay, Sainsbury's etc. The Amex Nectar (eligibility calc / apply* ) gives a bonus 20,000 Nectar pts if you spend £2k on it within 3mths, on top of the usual 2 pts per £1. So once you hit the trigger you'll have 24,000 pts, which should come within a month of spending £2k. These are worth £120 if spent at Sainsbury's, Argos, eBay etc.

Important: It's fee-free in year one, but there's a £25 annual fee after, so diarise to cancel if you don't want it. Pay off IN FULL each month or it's 22.2% interest (27.3% rep APR, incl fee). Note: You won't get the bonus if you've had a personal Amex in the past 2yrs. -

Earn £50 Amazon, Ikea, M&S etc gift card. The Amex Preferred Rewards Gold credit card (eligibility calc / apply* ) gives 10,000 bonus Membership Rewards pts if you spend £3k+ within 3mths, on top of the usual 1 pt per £1. You can swap every 5,000 pts into £25 Amazon, Ikea, M&S etc gift cards, so by hitting the trigger you'd get a £50 vch, which comes within a month (and you'd have pts left over).

Important: The card is fee-free in the first year, but there's a £140 annual fee after, so diarise to cancel if you don't want it. Pay off IN FULL each month or it's 22.2% interest (56.6% rep APR, incl fee). Note: You won't get the bonus if you've had a personal Amex in the past 2yrs. - Or earn £37.50 Sainsbury's or £25 M&S vchs. Here, rewards are lower than the cards above, but so too is the min spend required. Plus as they're Mastercards, they're more widely accepted than the Amex cards above. Below are the basic details, but click on the links for full info and how to apply.

- Free bonus £37.50-worth of Nectar pts + ongoing pts. Via this Sainsbury's Bank Mastercard.

- Free £25 M&S bonus vchs + ongoing pts. Via this M&S Bank Mastercard.

Get more help and find lots more deals in Credit Card Rewards (APR Examples).

- The Credit Card Rewards Golden Rules.

a) Don't apply in hope. Use our eligibility calc to find cards you've best odds of getting - protecting your credit score.

b) Do all normal spending on the card to max the gain - but it's not an excuse to overspend.

c) Always repay IN FULL each month, preferably by direct debit, to avoid interest that would dwarf the gain.

d) Never withdraw cash. You pay interest on it even if repaying in full, and it hits your credit score.

e) Never go over your credit limit, or you'll pay a fee. | New. Green Homes Grant eligibility tool. The Govt scheme in Eng launches in late Sep, offering up to £5k vchs - now it's launched a tool to check what you may be eligible for, eg, insulation. See Green Homes Grant latest. Working from home? How to claim for additional expenses. It's been more than 5mths since millions were required to work from home, though some have since gone back. I f it's created increased costs (eg, bigger energy bills), you can ask your employer to pay you £6/wk tax-free (but with many firms struggling, that may be tricky). Or, there's a tax break you can claim yourself, which for 20% taxpayers is worth £1.20/wk, and for 40% payers it's £2.40/wk. Full details, incl how and when to claim, in Martin's home working blog . New. Top 1yr fixed savings - 1.2%. If you're happy to lock cash away, you can get 1.2% AER fixed for 1yr from Paragon* (min £1k). It's hardly a rate to bring out the bunting for, but given six weeks ago the top standard 1yr fix was a paltry 0.95%, it shows fresh signs of life in the market. Full info and more options, incl 1.16% easy-access rates, in Top Savings. 'Eat Out to Help Out' extended at Toby Carvery, Harvester, Slug & Lettuce etc. The official Govt 50% off discount is over, but some eateries are offering similar schemes at their own expense. See where 'Eat Out to Help Out' is extended Ends Fri. Cheapest 64GB iPhone 11 with 5GB data. MSE Blagged. A new smartphone isn't MoneySaving, but if you'll get one anyway, at least get it for less. Until 11.59pm Fri, via this link for the iPhone 11 with 64GB storage*, new customers of iD Mobile (uses Three's network) get 5GB/mth of data + unlimited mins & texts for £39.99 upfront when using code IDM10OFF. It's then £32.99/mth, making it £831.75 over the 2yr contract. It's the cheapest way we've seen to get this combo and is £200 less than similar 4GB deals. For more, see Cheap iPhones & Samsungs. Trick to get a £49 Google Nest Mini for £10 (or 'free' if you've Spotify Premium). This is about manipulating a deal from the music streaming service for the Google Nest Mini (formerly the Google Home Mini), but stock could be limited. | Double energy warning - act NOW to save £250+/yr

- Switchers' prices are rising, so today's cheap deals mightn't last long

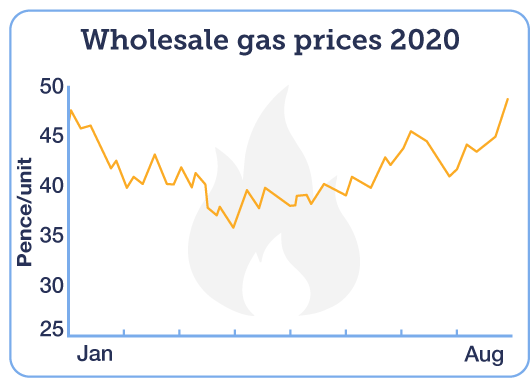

- The Big 6 will tell you they're cutting expensive standard prices, but you can still save by switching  If you're one of 11m on a standard tariff, we make no excuses for reminding you to check now if you can save £100s via a new deal - as switchers' prices look likely to keep rising, due to sharp rises in the wholesale costs that firms pay for the energy they sell to us. We warned that July's cheap deals could jump for this reason , and we were right - the cheapest 1yr fix 6wks ago was an avg £787/yr, now it's £823/yr. Wholesale costs are still rising, fuelled by more worldwide energy demand as lockdown eases - as the graph for wholesale gas shows (it's similar for elec as it often comes from gas sources). So today's deals might not be around for long. If you're one of 11m on a standard tariff, we make no excuses for reminding you to check now if you can save £100s via a new deal - as switchers' prices look likely to keep rising, due to sharp rises in the wholesale costs that firms pay for the energy they sell to us. We warned that July's cheap deals could jump for this reason , and we were right - the cheapest 1yr fix 6wks ago was an avg £787/yr, now it's £823/yr. Wholesale costs are still rising, fuelled by more worldwide energy demand as lockdown eases - as the graph for wholesale gas shows (it's similar for elec as it often comes from gas sources). So today's deals might not be around for long. Meanwhile, standard tariff prices will fall by an avg £84/yr in Oct as the regulator has cut the cap for 'em, but don't jump for joy. If you're on one, you may get a letter from your firm shouting about the cut - and BG, E.on & SSE letters are already going out. But it only makes these rates a little less pricey and you can still save an avg £250+/yr by switching So here are today's top deals - all for newbies only and all except for Outfox are only avail via our Cheap Energy Club links. They incl £25 MSE dual-fuel cashback where avail. We've led on fixes as they offer security while prices are rising as the rate is, er, fixed. CheapeST energy deals - ALL FOR NEWBIES ONLY

Prices are avgs based on typical use. Your winner depends on region & use, so links go via our comparison | BENCHMARK: Energy price cap (applies to 50%+ of homes) over next year on typical dual-fuel use

| £1,046/yr (1) | | TOP PICK 1YR FIXES - excl tiddlers or firms with poor/no feedback | Utility Point 1yr fix. Cheapest 1yr fix in Eng & Wal (and some of Scot) | Dual-fuel only | A middling 3.1/5 service rating | £823/yr

(save £223/yr) | Ends Mon. MSE Blagged. E.on 1yr fix. Cheapest Big 6 tariff & cheapest GB-wide fix | 100% green elec | Dual-fuel & elec-only | Smart meters required where possible | A middling 3/5 service rating | £834/yr

(save £212/yr) | Pure Planet 1yr fix. Cheapest 100% green 1yr fix | 100% renewable elec + offset gas | Dual-fuel & elec-only | A good 3.9/5 service rating | £837/yr

(save £209/yr) | | MARKET'S CHEAPEST - but it's from a firm with a POOR service record | Outfox the Market variable. It's cheapest, but we've seen big problems with its service | 100% renewable elec | A poor 2.3/5 service rating. Note: As it's variable, prices can move up or down. | £788/yr

(save £258/yr) | | Deals not avail in NI, sadly. (1) Assumes 0.5mths at current price cap, 11.5mths at new level. Savings are versus that figure. | -

Switching is easy - little changes apart from service and cost. Switch firm and it's the same gas, same elec and same safety. The only thing that changes is customer service and price. Your supply isn't cut off, while no one visits your home unless you're having smart meters installed. See our switching FAQs for more help. | Cinemas are back - so we've 10 tricks, incl a year's 2for1 films for £2, two Vue tix for £7 for some & can you take your own food? With the major chains now back open across the UK, we've big screen savings. 50+ supermarket coupons & cashback, incl £1.50 off Tetley & Nescafe + 'free' £2ish Lindt choc. See Sep's top coupons & cashback. 'I saved £36/yr on Netflix as I didn't realise I was paying its top price - thanks.' John used our 18 Netflix hacks to cut costs. You can too, incl how to save up to £72/yr, free alternatives and can you share accounts? EXTRA 30% off already-reduced Adidas, Timberland, Hunter wellies, Vans and more shoes. MSE Blagged. Via Shoeaholics outlet code. Also includes Kurt Geiger and other designer brands. Step this way First Child Trust Funds mature in Sep - what's yours worth? These tax-free savings accounts were available for ALL born from 1 Sep 2002 to 2 Jan 2011, where the Govt paid most people a free £250-£500, but it'll likely be worth much more now. They're accessible at 18, and with about 60,000 hitting that milestone this month, but many may have forgotten they even had one. See how to find a CTF & what to do with it. Ends Sun. Get a train season ticket refund for unused journeys in the past 8 weeks. That's on top of the usual refunds available for the portion that covers future travel you don't want to use. Claim backdated train refunds | Tell your friends about us They can get this email free every week | Student loan interest in Eng & Wal has risen to 5.6% - should I panic? That's the rate from Sep for those from Eng and Wal who started uni in 2012 or later, and is up from 5.4% (for those from Scot and NI, and all 1998-2011 starters, it's still 1.1%). Yet don't be misled by the headline figure, as for most, interest is actually IRRELEVANT. See more in Martin's 'Should I pay off my student loan?' guide . Extra 40% off Hot Diamonds outlet, eg, £40 earrings for £17. MSE Blagged. Plus free deliv. Hot Diamonds SUCCESS OF THE WEEK:

"My mum's mobile contract ended and she was paying £20/mth for just 500MB of data. I switched her to a cheap Sim for £6/mth for a much larger 3GB, saving her £168 a year. Success."

(Send us yours on this or any topic.) Want an MSE Charity grant of up to £7,500? Our charity's latest grant-giving round is now open. It's themed on 'building and developing resilience', so if you're interested in applying, your group's project should be focused on building financial life skills, to support people recovering from the impact of coronavirus, and to equip them to move forward. You can check if your project is eligible and apply via the MSE Charity website. The round closes once the charity accepts 40 applications, or on Fri 25 Sep, whichever comes first. | THIS WEEK'S POLL Will you be travelling abroad over the next year? International travel has been hit hard by the coronavirus pandemic. While some travel restrictions have now been lifted, others are still in place. As the current situation continues to shift, some are starting to look further ahead. Will you be travelling abroad over the next year? The vast majority of you are worth MORE than you owe. Last week, we asked you to calculate how much you are worth, or how much you owe (excluding mortgage and student loans). Over 13,000 of you responded, and encouragingly only 15% said they were in overall debt. Older age groups were better off than their younger counterparts, with 30% of over-65s sitting on a net worth of £500,000 or more. See the full net worth poll results. | Co-op - £5 'freezer filler' frozen meal deal

Asda - £7 pizza meal deal, incl 4-pack of Budweiser

Deliveroo - £5 off £20 code at small restaurants Mon-Wed

KFC - £5 Boneless Banquet (norm £6) and more app deals

Lidl - £5 prosecco | | | MARTIN'S APPEARANCES (WED 2 SEP ONWARDS) Mon 7 Sep - BBC Radio 5 Live, Ask Martin Lewis, 12.20pm MSE TEAM APPEARANCES (MOST SUBJECTS TBC) Wed 2 Sep - BBC Radio Manchester, Drive with Phil Trow, from 2.25pm, Gary Caffell on mobile MoneySaving

Mon 7 Sep - BBC Radio Manchester, Drive with Phil Trow, from 2.25pm

Tue 8 Sep - BBC Radio Cambridgeshire, Lunchtime Live with Jeremy Sallis, from 12.25pm | WHAT'S IN YOUR ULTIMATE MONEYSAVING BURGER? That's it for this week, but before we go... it was National Burger Day last week, so for a bit of fun we opened up the MSE Build-a-Burger Bar on our social channels, with loads of you creating your perfect burger - within a £5 limit (we had to keep it MoneySaving, of course). Everybody is given a bun and a patty to begin with and a list of toppings to choose from. You all relished the challenge with bacon, egg and cheese among the favourites, while we had to laugh at the cheeky MoneySaver who wanted to know if it was part of the Eat Out to Help Out discount scheme. Let us know what you'd choose in the MSE Build-a-Burger Bar Facebook post. We hope you save some money, stay safe,

The MSE team | |

No comments:

Post a Comment