| Plus... KFC/Costa etc VAT cut, £16/mth Virgin b'band, 2.8% loan  THE TOP TIPS IN THIS EMAIL

| | URGENT WARNING

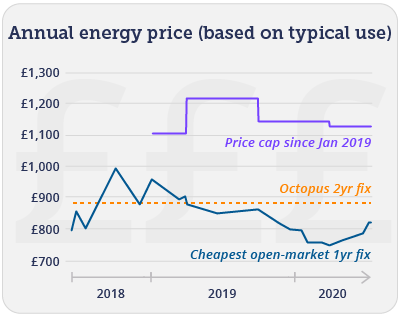

Save £340/yr now as energy prices are shooting up Two weeks ago we launched MSE's Big Switch 15. Then, it undercut the market's cheapest fix by £1/yr. Since, price hikes mean it's now £30/yr cheaper. But it's ending, so LOCK IN the cheap rate ASAP  Martin: "It may be hot outside, but this is an urgent warning to sort your energy bill via our Big Switch 15 now. Miss it and you will likely miss the boat, and probably pay far more than needed for the next year. Martin: "It may be hot outside, but this is an urgent warning to sort your energy bill via our Big Switch 15 now. Miss it and you will likely miss the boat, and probably pay far more than needed for the next year. "While the energy price cap that most people pay has remained horribly high, switchers' prices had been rock bottom due to the pandemic. Yet since April they've crept up, and in the last fortnight, driven by oil price rises and firms sorting out their supply for winter, they've rocketed. The open market's cheapest fix today is £30 more than a fortnight ago. "Luckily though, that's when we launched our cheaper-than-the-cheapest special deals - where we bagged tariffs that undercut the market's very cheapest, and for the next few days they're still on. And as the graph shows, that matters... "Most UK homes already overpay by £100s. So by switching now to a cheap fixed deal, you LOCK IN current cheap prices so they can't rise. "And for those who find switching a hassle, take a look at the 2yr fix, which means you need to switch less often, and if energy prices continue to ramp up substantially, it may well be the clever choice. "What's more, savings can be huge, as Sue emailed: "Just had to let you know I've just changed my energy supplier. I used your site and the saving is amazing - £453/yr. Thank you so much. Stay safe." Now over to the team to run you through the deals in more detail..." The MSE Big Energy Switch 15 deals

As your winner, saving and price depends on your usage and location, the links take you via our Cheap Energy Club comparison to give a bespoke result. Plus if new tariffs launch, you'll see them there. As your winner, saving and price depends on your usage and location, the links take you via our Cheap Energy Club comparison to give a bespoke result. Plus if new tariffs launch, you'll see them there. PS: Play with the filters, such as '3 star+ service only' or 'big name suppliers only', to home in on your best. Most people's tariffs in Eng, Scot & Wales charge close to regulator Ofgem's PRICE CAP. It's currently an avg £1,127/yr for someone with typical dual-fuel use. Prices / savings below are based on that.

-

BY FAR THE CHEAPEST TARIFF (& FIXED FOR 1YR): Pure Planet - £787/yr on typical use. Green: 100% elec & gas. Service rating: 3.9/5 (good). Save: £340/yr. Only 4,000 left.

There are 4,000 MSE Pure Planet 100% Green 12m Fixed Jul20 v1 online switches left - likely to be gone by Thu. So go quick. Pure Planet has a good customer service feedback rating, and has agreed to 'MSE enhanced service' for this deal, meaning we can escalate issues. It's a mid-sized firm with 130,000 customers - and when we've done deals with it before, they've gone well.

The tariff offers 100% renewable elec and 100% carbon-offset gas. It's a version of its standard fix, which is already cheap, but here you get an extra £30 bill credit and the usual £25 MSE cashback, so it's £55 less.

Factor this in and on average it beats the market's next cheapest fix by £30+/yr on typical use. In fact, it's the cheapest tariff of any type, undercutting even the cheapest variable deal. And as it's a fix, the price is LOCKED IN - though what you pay depends on use.

Key Pure Planet tariff facts:

Who can get it? New customers for dual fuel (ie, gas & elec)

Smart meters? Not required - available if you want them

Renewable? 100% renewable elec, gas is 100% carbon-offset

Fixed? Yes, for 12mths from supply start date

Early exit fees? £60 (unless you're within 49 days of the fix ending)

Payment? Monthly direct debit

Comparison link above: Filtered to exclude all but good-service, fixed-rate results (you can undo the filters) -

CHEAPEST 'TOP SERVICE' 1YR FIX: So Energy - £814/yr on typical use. Green: 100% elec, not gas. Service rating: 5/5 (great). Save: £313/yr. 2,500 left.

There are 2,500 MSE So Ash Essential - Green - Seasonal Payments switches left - likely to be gone by Wed pm. So Energy is the joint-top firm for customer service feedback.

This tariff is 100% renewable electricity (not gas). It's a version of its standard fix, which is already competitive, yet you get an exclusive £25 bill credit and the usual £25 MSE cashback, so it's £50 cheaper.

Factor this in and on average it's the cheapest top-service fixed tariff on typical use. So Energy is a mid-sized firm with about 200,000 customers.

PS: As part of our Big Switch 15 launch, we had 5,000 super-cheap deals from So Energy. They went quickly. Then it launched this £19/yr pricier deal, but we sorted out the extra bill credit too, and because other prices have risen, even at slightly more than the original, this is still comfortably the cheapest top service fix.

Key So Energy tariff facts:

Who can get it? New customers for dual fuel (ie, gas & elec)

Smart meters? Not available

Renewable? 100% renewable elec - gas isn't green

Fixed? Yes, for 12mths from supply start date

Early exit fees? £10 (unless you're within 49 days of the fix ending)

Payment? Monthly direct debit

Comparison link above: Filtered to exclude all but good-service, fixed-rate results (you can undo the filters) -

CHEAPEST BIG 6 FIX: British Gas - £830/yr o n typical use. Green: 100% elec, not gas. Service rating: 3.9/5 (good). Save: £297/yr. Extras: 1yr's free heating insurance.

This isn't part of our Big Switch event, but we know some of you feel nervous switching unless it's a name you know. So we've put it in as an option. This British Gas Energy and Home Services Jul 2021v3 dual-fuel deal is only available to new British Gas customers (defined as those not currently its energy customer), and you can only get it via comparison sites, not direct from BG. Go via our link, and you get an extra £25 MSE cashback.

You also get a year's 'free' heating insurance if you don't already have its cover, but it auto-renews after a year, so cancel then if you don't want it. You MUST agree to get free smart meters (one for gas, one for elec) installed within 3mths if you don't have 'em already.

Key British Gas tariff facts:

Who can get it? New customers for dual fuel (ie, gas & elec)

Smart meters? You must get them within 3mths of switching

Renewable? 100% renewable elec - gas isn't green

Fixed? Yes, until 31 July 2021

Early exit fees? £60 (unless you're within 49 days of the fix ending)

Payment? Monthly direct debit

Comparison link above: Filtered to exclude all but big name deals (you can undo the filters) -

CHEAPEST 2YR FIX: Octopus Energy - £883/yr on typical use. Green: 100% elec, not gas. Service rating: 4.2/5 (great). Save: £488 over 2yrs. Unlimited - but ends 4pm Fri.

The MSE Exclusive Octopus 24M Fixed July 2020 v1 deal is available until 4pm on Fri. Octopus has a great customer service feedback rating, and the tariff comes with 100% renewable electricity (not gas).

It's only about £60/yr more expensive than the current cheapest open-market fix on typical use (ie, not including our other deals). And with prices on the rise, the fact the rate is locked in until July 2022 is a boon - it gives price certainty over two winters, and means you can forget about switching again for a while. Though if you want to, you can, as there are no early exit penalties.

As the graph below shows, the Octopus price would've been the market's cheapest for good chunks of the last few years. So if prices do rise substantially in a year, as is possible, this may look very cheap with hindsight.  Octopus is catching up with the Big 6 in size (it even powers M&S's energy), with well over 1m customers and counting. Key Octopus Energy tariff facts:

Who can get it? New dual-fuel (gas & elec) or elec-only customers

Smart meters? Not required - available if you want them

Renewable? 100% renewable elec - gas isn't green

Fixed? Yes, for 24mths from supply start date

Early exit fees? None, you can leave any time penalty-free

Payment? Monthly direct debit

Comparison link above: Filtered to exclude all but longer fixed-deal results (you can undo the filters) - CHEAPEST PREPAYMENT TARIFF: Bulb - £963/yr on typical use. Green: 100% elec & gas. Service rating: 4.1/5 (great). Save: £201/yr (compared with the £1,164/yr prepay price cap). Unlimited, but ends 4pm Fri.

The MSE Bulb Vari-Fair Prepay tariff is available for a fixed time - until 4pm on Fri. Bulb has a great customer service feedback rating, and is one of the biggest firms outside the Big 6, with a strong following.

This tariff comes with 100% renewable electricity and 100% offset gas. It's a version of its standard variable tariff, which is already competitive. But we've arranged that new customers get an extra £10 dual-fuel cashback on top of the usual £25 MSE dual-fuel cashback, meaning it's £35 cheaper (£17.50 elec-only).

Factor this in and it's on average the cheapest prepay deal on the market, on typical use. Like the vast majority of prepay tariffs, this is variable, not fixed, so the price can move. But it's been consistently near the lower end of the prepay market since it was launched.

Key Bulb tariff facts:

Who can get it? New dual-fuel (gas & elec) or elec-only customers

Smart meters? Not required - available if you want them. If you have them already with another provider, you can't switch to this

Renewable? 100% renewable elec, gas is 100% carbon-offset

Fixed? No, it's variable so prices can change

Early exit fees? None, you can leave any time penalty-free

Comparison link above: Whole market prepay comparison Common energy-switching questions Here's a quick Q&A - for more, see the full Cheap Energy Club FAQs. Q. I live in Northern Ireland. Can I get these deals? Unfortunately not. No UK comparisons include NI, but see Cheap NI Electricity or the Consumer Council for Northern Ireland's tool. Q. Is switching risky? Could I be cut off? No. No one visits your home (unless you want a smart meter) and it's the same gas, same electricity and same safety. The only things that change are price and service. See our 'Switching is no biggie' FAQs. Q. Does MSE make money from this? Yes. Like all energy comparison sites, we're paid each time you switch through us, yet we give you roughly half (that's £25 dual-fuel, £12.50 single-fuel cashback). This is money you wouldn't get if you went direct (not that the deals above are available directly anyway). So it's a win-win. The rest helps cover our costs and hopefully makes us some profit. More switching and energy help in the links below... Switching with smart meters | Why's my price risen when I'm fixed? | Reclaim credit | Switching-in-debt help | Switching if I've solar panels | How direct debits are set | Can I pick a switch date? | How do you compare my rates? | | DON'T believe the fake 'Martin Lewis' or 'MSE' ads

Lots of scam ads litter social media and even newspaper websites - some of these lie that we or Martin promote Bitcoin, binary trading etc. See Fake ads warning. | Savers: THREE accounts that are totally safe, top the best-buy tables, where rates are now likely to stay high for the foreseeable...

Millions have money sitting in high street savings accounts earning diddly-squat, often at 0.1% or less, and are scared to move it as they want safety. If that's you, STOP IT. Currently, and unprecedentedly, the top-paying easy-access savings all come from by far the safest place, NS&I (used to be called National Savings), the Government-backed savings institution. So it's time to ditch and switch, and to help, here's our five-minute briefing (PS: We suspect we may overload NS&I with traffic, so it may be a little slow)... -

NS&I currently offers the top THREE easy-access accounts. Easy access means you can pay in or withdraw money whenever you want. All these accounts (and you can have more than one of them) are taxable, but as with all savings, in practice most people won't pay tax due to their personal savings allowance. NS&I currently offers the top THREE easy-access accounts. Easy access means you can pay in or withdraw money whenever you want. All these accounts (and you can have more than one of them) are taxable, but as with all savings, in practice most people won't pay tax due to their personal savings allowance.

- NS&I Income Bonds: 1.16% AER (min £500). It's the top payer. While the name's strange, Income Bonds are just easy-access savings, and can be operated online. Deposits and withdrawals must be in blocks of £500+, so it's better for bigger savers. As the name suggests, you get an income , as each month interest is paid into a separate account. This means you won't earn interest on the interest (ie, compound interest), but may be able to manually re-add it if you're making further £500+ deposits. Max savings: £1m/person.

- NS&I Direct Saver: 1% AER (min £1). The Direct Saver is simple. It can be operated online and you have full flexibility on withdrawals and deposits, while the interest is paid into the account annually and compounds. Max savings: £2m/person.

- NS&I Investment Account: 0.8% AER (min £20), post only. The Investment Account works like the Direct Saver, except you operate it by post - including withdrawals. Max savings: £1m/person.

And to prove this is an unprecedented time, NS&I doesn't just top the charts in easy-access savings - it's also got the top junior ISA and NS&I's direct cash ISA. Plus, see the Premium Bonds - are they worth it? guide.

- The Govt's told NS&I to raise billions, so its rates are likely to stay strong. Put money in NS&I and you're lending to the Govt. The fact it's table-topping shows the Govt wants to raise money, and l ast week the Treasury increased NS&I's financing target to £35bn, nearly six times the £6bn target set in Mar. That means it's now more likely to defend its position robustly at the top of the best-buy tables, providing savers with some certainty. What's more, its rules say it must tell you 2mths in advance of rate cuts which adds some comfort. We suspect it may also launch more products.

- Money in NS&I is as safe as savings get - even if you're lucky enough to have millions. All UK-regulated savings accounts are protected up to £85k per person per institution under the UK safe savings scheme, but for those with more, NS&I is an easy winner, as it's Government-backed so it's all protected.

- How NS&I compares with the best of the rest. Yorkshire BS pays the next-best easy-access rate, at 0.8% AER variable if you deposit £10k+ (0.9% if you deposit £50k+). For smaller amounts, Saga pays 0.75% AER variable and can be opened with £1.

While fixed rates normally smash easy-access, as you have to lock your money away, two of NS&I's easy-access deals even beat the top 1yr fix from Allica Bank at 0.95% AER (min £1k), though the top 2yr fix from Close Brothers gets, er, close at 1.15% AER (min £10k). More options and full info in Top Savings Accounts. | Martin: 'WARNING: The Student Loans Company's new 'quick repayment' tool is dangerous & irresponsible.' He's writing to the head of the SLC and the University Minister to ask for it to be withdrawn, and the whole of the new website to be redone as it's "demoralising, damaging and dangerous for university leavers, and may encourage people to needlessly overpay". For full info, see Martin's 'beware the new student loans website' warning. VAT cuts - who's giving 12.5% off? Costa, KFC, McDonald's, Nando's etc? The cut is now in place for restaurants, pubs and coffee shops - see our 21 VAT cut givers and takers list of the biggies. See price cut round-up. ... and 10 McDonald's hacks - incl £2.20 off a McChicken Sandwich & £1.10 off a DIY Big Mac. With 700+ restaurants reopening today, we've 10 McDonald's hacks to help you make a tasty saving. New. Cheapest loan 2.8% - nowt cheaper if you need to borrow. This new TSB loan is 2.8% for those borrowing £7,500-£15,000, matching Santander-owned Cahoot's 2.8%. For smaller amounts, use our loans eligibility calculator which will show you personalised best buys. IMPORTANT: Never borrow just because loans are cheap - only do it for something budgeted for, affordable, that you NEED (eg, your car is a wreck and you need it for work). Plus minimise the amount, never miss a payment and repay ASAP. Full info & deals in Cheap Loans (APR Examples). No7 trick: £55 of make-up for £12. Incl foundation, plus a lip & cheek palette. No7 trick Ends Sun. 54Mb fibre (ie, FAST) b'band AND line from Virgin for '£15.62/mth'. Anything sub-£20/mth for fibre b'band is great, but this smashes that - though you need to get your skates on. Till Sun, Virgin Media newbies can get this 54Mb-speed 18mth deal for £23.95/mth, and you're automatically given a £100 credit on the first bill (so you pay nothing for 4mths), and you can claim a £50 Amazon vch. If you'd have spent the vch anyway, the price is equiv to £15.62/mth. But only 51% of homes can get Virgin - the link takes you via our broadband comparison tool to check your eligibility, and from it you can check other deals too. New UK-wide stamp duty calculator. Next week, Wales joins the rest of the UK in cutting property purchase tax (ie, like stamp duty in Eng & NI). Our UK-wide stamp duty calc is now updated. | Martin's 10 new CORONAVIRUS financial need-to-knows, including... Auto 0% overdrafts ending | Govt-backed travel refunds | Travel insurance news | Self-assessment deferrals | Loveholidays hell & more...  The coronavirus news flow is thankfully slowing, as there's a push to return life to something closer to normal. Yet there are always twists and tweaks worth knowing. So let me zip you through this week's need-to-knows. Do remember, there's lots more help in our constantly updated coronavirus help guides:

Travel rights | Employees | Self-employed & ltd co | Finance & bills | Benefits | Lockdown life 1) Halifax, Lloyds, B of Scot, TSB, Nationwide and Santander automatic up to £500 0% ending - ask to keep it. The first four have already ended it, the other two are due to soon. Yet if you're struggling due to coronavirus you can still ask for the 0% overdraft, and ask to not be charged 40% on the rest. See the overdraft section in my payment holiday blog for more. 2) ATOL credit refund notes are now GOVERNMENT-BACKED. This is a key travel intervention I've been calling for. It's far from a cure-all, but ATOL is a statutory tour operator's scheme, and the Govt has just announced it's effectively underwriting its credit refund notes, giving a solid bedrock of security for those willing to take them. And the fact that it can be exchanged for cash if you don't use it gives peace of mind. Full info in ATOL credit refund notes. 3) Car finance, payday loan, pawnbroker, buy-now-pay-later PAYMENT HOLIDAYS extended. Regulator, the Financial Conduct Authority, has now confirmed these join mortgages, credit cards and loans in being extended until 31 Oct. Ie, you can apply for your first payment holiday until then and (other than payday loans) you can extend existing payment holidays. See my Should I take a payment holiday? blog for help on all types. 4) Finally TRAVEL INSURANCE that covers Covid-19 cancellations? Until now, the only travel insurance policies that would cover your holiday being cancelled if the Foreign Office were again to warn against travel are those taken out pre-pandemic for holidays booked pre-pandemic. Now Nationwide says its FlexPlus packaged bank account will do it too, even for new custs, provided the warning wasn't in place when you booked the holiday or got the insurance, whichever is later. 5) SELF-ASSESSMENT PAYMENTS due on 31 Jul can be deferred. Many self-employed workers pay their tax "on account" split into a Jan and Jul payment. HMRC is allowing 'on account' tax deferrals, so those due to pay now can defer it to 31 Jan 2021 without interest or penalties. More info and examples in our self-employed coronavirus guide. 6) Loveholidays cancellation refund nightmare help. We recently published our 70 best & worst travel firms for coronavirus refunds news story following a survey which had 77,000 responses. Of the big, bad names, all scoring worse than -80%, Ryanair, Virgin and Loveholidays were included. We've previously covered the first two, and now we've added step-by-step Loveholidays refund info. There's no perfect solution, but it may help. 7) MOT due after 31 Jul? Compulsory testing restarts next week in Eng, Scot & Wal. If your MOT is due on or after 1 Aug, it's business as usual. Yet for MOTs due between 30 Mar and 31 Jul, you automatically have 6mths added on top, eg, 24 Jul becomes 24 Jan 2021. See MOTs update. In Northern Ireland testing's still on hold, and MOTs have been extended by 12mths. 8) Which countries can you fly to HASSLE-FREE? Where can you go that the Foreign Office allows, lets Brits in without quarantine, and you won't need to quarantine on return? It's fast moving, so we've the top 15+ destinations travel rules. 9) Do pre-lockdown SHOP RETURNS ASAP. Many retailers extended refund policies so you wouldn't miss out while stores were closed - the final few are coming to an end soon. See retailer-by-retailer lockdown return policies. 10) Will my TRAVEL INSURANCE cover me if I move my holiday to next year? Ask them. Most single trip policies can be changed to cover the new holiday if it's within the next 12mths, though annual insurers may only give 3mth extensions - see our insurer-by-insurer list. Booked for next year? Mostly insurers let you buy for trips starting in the next 365 days, but we've seen a few travel insurers that let you book further ahead. PS: Those excluded from coronavirus support are revolting - and I'm revolting with them. Last week, I joined forces with a cross-party group of MPs, plus campaigners for freelance PAYE, new starters, forgotten ltds and more, to challenge the Chancellor to help the excluded. | Tell your friends about us They can get this email free every week | SUCCESS OF THE WEEK:

"Thank you for your info about council tax rebanding. We have had our refund back of nearly £3,000, which will be well spent on improvements to our house. Thanks again and keep up the hard work. "

(Send us yours on this or any topic.) | THIS WEEK'S POLL What sorts of places are you now comfortable going to? As the UK's lockdown eases, places such as pubs, museums and hairdressers are reopening. We want to know which places you feel comfortable returning to - and which ones you'd still rather avoid. Where are you comfortable going? Two-thirds of MoneySavers are spending more on groceries during lockdown. Last week, we asked how your monthly outgoings had changed during lockdown. More than 6,000 people responded, and while lockdown didn't have an impact on all bills, a whopping 67% reported spending more on groceries, and 32% said their electricity bill was up. On the other hand, 88% said they spent less on petrol, with 78% spending less on public transport. See full household outgoings poll results. | MONEY MORAL DILEMMA I was sent free beer by mistake - should I keep it? I ordered a case of beer online and, though the courier emailed to say it was delivered, it didn't actually arrive. I asked the beer firm to send another, but when that arrived, the original did as well. While it seems the beer firm wasn't at fault, if I explain and I'm asked to return one case, it's going to be a hassle to send back such a heavy item, and that seems unfair as I'm not at fault either. Enter the Money Moral Maze: Should I keep beer sent in error? | Suggest an MMD | View past MMDs | Topshop - 'Up to 70% off' sale

Habitat - 'Up to 50% off' sale

Lego - 'Free' £11 Lego City minifigure pack with £9ish+ spend

Matalan - 'Up to 50% off' summer sale

ShopDisney - 'Up to 50% off' sale plus extra 20% off code | Morrisons - £12 for two mains, two sides, dessert & wine

Caffè Nero - Free hot or cold drink via O2 Priority is back

Co-op - Five items for £5, incl Oreo ice cream (norm £12.70)

Readly - Two months' free access to 5,000+ digital magazines

Ciaté - £50 nail polish collection for £20 delivered | | MARTIN'S APPEARANCES (WED 22 JUL ONWARDS) Thu 23 Jul - Good Morning Britain, ITV, 8am

Thu 23 Jul - This Morning, ITV, 10.45am

Mon 27 Jul - This Morning, ITV, 10.55am

Mon 27 Jul - BBC Radio 5 Live, Ask Martin Lewis, 12.20pm MSE TEAM APPEARANCES (SUBJECTS TBC) Mon 27 Jul - BBC Radio Manchester, Drive with Phil Trow, from 2.25pm

Tue 28 Jul - BBC Radio Cambridgeshire, Lunchtime Live with Jeremy Sallis, from 12.25pm | CHOCOLATE, BEANS AND LOO ROLL: YOUR 'SHRINKFLATION' SPOTS That's it for this week, but before we go... after Cadbury announced it's reducing the size of its Wispa Gold and Double Decker bars but charging the same, you've been sharing the things you've spotted that have fallen victim to 'shrinkflation'. Mars, Kit Kat Chunky, Yorkie and Wagon Wheels all featured, but it's not just dwindling chocolate that's left a bitter taste. Users told us they've found the same with toilet rolls, toothpaste and even baked beans, while we had to smile at the suggestions the Double Decker should now be rebranded as 'Minibus'. Let us know your examples of 'shrinkflation' in our Facebook post. We hope you save some money, stay safe,

The MSE team | |

No comments:

Post a Comment