| Hi - here are your latest deals, freebies, tricks and messages to help you save.  THE TOP TIPS IN THIS EMAIL

| | Petrol prices now average a whopping £1.30/litre - so here are 18 ways to drive down motoring costs

Petrol prices have been on the rise for a miserable 16 weeks and while there was a slight respite last week, many still pay a staggering £70-£80 to fill up. The average price of unleaded is £1.30/L, 10p up from Feb and only a smidgeon below the four-year high we saw last Oct. Petrol prices have been on the rise for a miserable 16 weeks and while there was a slight respite last week, many still pay a staggering £70-£80 to fill up. The average price of unleaded is £1.30/L, 10p up from Feb and only a smidgeon below the four-year high we saw last Oct.

Of course, best for the environment (and sometimes you) is to reduce your car use or give it up altogether. Why not walk or cycle to your local shops rather than drive - less waste and maybe less waist? But that's not possible for all, so today we're focusing on tips to put the brakes on accelerating driving and fuel costs. We've 53 motoring tips to help - here are 18 to get you into gear: - Stop using your brake... to save up to 30% on fuel. Don't worry, this isn't about reckless driving - it's the opposite. By thinking about road positioning, rather than slamming on the brakes and burning all the energy you've pumped into the car, you'll be able to slow down gradually, making your driving more efficient - thus using less fuel.

This is just one of our tips to drive more efficiently (which isn't necessarily the same as just going slower) and to make your car more efficient. See our 13 tips to use 30% less fuel.

- Do your car insurance price comparison 21 days before renewal to cut the price in half. It sounds crackers, but if you leave it too late to get a quote you're seen as high risk so will pay more, while fewer insurers will return quotes if you're too early. We analysed more than 18 million quotes from 3 big comparison sites and found the optimum time to get a quote is 3 weeks ahead, and if you've less time, then hurry, as prices tend to rise the closer you get. Since we first told you about this we've been swamped with successes.

Maxine emailed: "I normally always do my car insurance one month in advance but after watching Martin I did it exactly 21 days ahead and saved £237. Thanks for the tip." For full help, see our Cheap Car Insurance guide. You'll find more tips for car insurance below - keep reading...

- Check your driving licence or risk a £1,000 fine. More than 2 million photocards have expired - see how to check (and how to renew if it's invalid).

- Find the cheapest petrol or diesel near you in seconds. A handy free tool finds your cheapest local forecourt, and the gap between best and worst can be BIG. Eg, in one Durham postcode, it's 126.9p/L to 141.9p/L, with the difference equiv to £8 for an average tank. Find cheap fuel

- Combine comparison sites to cut the cost of car insurance. They don't cover the same insurers or give the same price for the same insurer, so always check more than one. Our current order's: 1) MoneySupermarket* 2) Confused.com* 3) Gocompare* 4) CTM*. (Why? See comparison order.)

Then check for hot deals that comparison sites miss. Right now you can get a £60 M&S voucher with an Age Co policy, or a £55 Mastercard voucher via Admiral. See deals comparisons miss .

- Driving in Europe? Watch for emissions stickers... and Brexit. If you're taking your car to the Continent, check if you need to order an emissions sticker to avoid a fine, plus see more help incl equipment needed, insurance requirements and speed limits in our Driving in Europe guide. And if you're going after we're due to leave the EU, see the latest info on driving permits, 'green cards' and more in our Brexit need-to-knows.

- Trick to get basic AA/RAC breakdown cover from £23/yr. If you don't need full cover then don't buy direct - do it the right way via cashback sites and you can slash the cost. Cheap AA/RAC cover

- Use hidden council 'fewer fails' MOT centres (if your car's in decent nick). These generally only do tests, not repairs, so there's no incentive for them to 'discover' faults - and people tell us this works. (Though if your car's likely to need major repairs you'll need to find a garage that can do them too as you may not be able to drive away if it fails.) Find cheap MOTs.

- Full breakdown cover incl home start and onward travel for you and a spouse for £60/yr. AutoAid* charges £59.99 for 1yr. In contrast, an equivalent AA policy is £100+. More help and tips in Cheap Breakdown Cover.

-

Is there a carpool club near you? Whether commuting or going on a big journey it makes sense to share with others, assuming you can stand their company. You only pay for one lot of fuel and rack up miles in one car - better for the environment as well as your pocket. Is there a carpool club near you? Whether commuting or going on a big journey it makes sense to share with others, assuming you can stand their company. You only pay for one lot of fuel and rack up miles in one car - better for the environment as well as your pocket.

If you can't share with friends, family or colleagues, special carpooling clubs help find people who'll take you in their car or vice versa. Craig on Facebook is a carpool commuter: "If I drove myself I'd spend £1,800 a year in fuel plus extra wear and tear - sharing with 2 co-workers, I'm saving £1,200 a year."

- Hit with an unfair COUNCIL parking ticket? 50%+ beat them even after being rejected by the council. If you lose an appeal, the odds are in your favour if you take it all the way to an independent adjudicator. See how to fight unfair COUNCIL parking tickets.

- Don't believe private parking firm porkies - their 'fines' are just invoices. Many tickets from supermarkets, retail parks and private car park firms do better impressions than Alistair McGowan. Some even call them Parking Charge Notices to mimic official Penalty Charge Notices. If you get an unfair private ticket, you can fight it - see how to fight unfair PRIVATE parking tickets.

- Should you ditch your car for a car club? You could pocket £1,000s selling your motor and instead join a specialist club - you typically pay an annual or monthly membership fee, then, when driving, per hour, per mile, or both. These urban-based schemes tend to be better for short hops rather than long journeys - see our car club analysis. Peter tweeted: "It's a revolution. Right outside my house to the airport in under an hour - £15."

- Car (or bike) pranged by a pothole? You could be due £100s. Forumite JRosh used our guide: "My car hit a deep pothole. I submitted a claim and received a cheque for £482." See if you're owed with our Pothole Claims guide.

- Cut down parking costs by renting a driveway. You can slash what you pay by renting a private space, eg, we found one for £20/week in London's King's Cross compared with £67 at a local NCP car park.

- Never renew AA or RAC policies without haggling. In our poll, the AA came top with 88% of hagglers having success, RAC came second with 85%. Eg, "Followed all your haggling hints and managed to get AA to reduce our breakdown renewal (for 2 people) from £306 to £154. Well worth the few minutes taken to study your website and call the AA." See our Breakdown Haggling Tips .

- Check for counter-logical car insurance savings. Sometimes common sense goes out the window and things that don't make sense can save you cash. Our Car Insurance guide has 'em all, incl:

- Comprehensive cover can beat 3rd party.

- Insuring more people on your policy can slash costs.

- Legitimately tweaking your job description can cut the price.

- Get 5% cashback when you fill up. Not fuel-specific, but the Amex Platinum Everyday card gives a massive 5% introductory cashback for 3mths (max £100), then up to 1%.

| | DON'T believe the fake ads on Facebook

Lots of scam ads that litter social media lie that we or Martin promote Bitcoin, binary trading etc. See Fake ads warning. | Martin: 'After 10yrs, finally BANK CHARGES for busting overdraft limits are ending. You may be able to reclaim them, and get a 0% overdraft'

In 2005, early in my & MSE's career, I launched template letters to reclaim unfair bank charges. By 2009 a staggering 6m+ had been downloaded with c. £1 BILLION repaid as 'goodwill' by banks scared to go to court. Eventually the banks agreed to a test case against the Office of Fair Trading. They lost in the High Court, lost at the Court of Appeal (we even had a bank charges protest song in the charts) but the Supreme Court overturned those on a technicality, saying charges didn't need to be fair. In 2005, early in my & MSE's career, I launched template letters to reclaim unfair bank charges. By 2009 a staggering 6m+ had been downloaded with c. £1 BILLION repaid as 'goodwill' by banks scared to go to court. Eventually the banks agreed to a test case against the Office of Fair Trading. They lost in the High Court, lost at the Court of Appeal (we even had a bank charges protest song in the charts) but the Supreme Court overturned those on a technicality, saying charges didn't need to be fair. It may have been a court loss, but overall the campaign was a success, putting pressure on the banks to stop their hideous £35ish per transaction penalties and move to daily charges. And they've kept dropping since, and now... - New. From 6 Apr 2020, banks can no longer charge more if you bust your overdraft limit. Regulator the Financial Conduct Authority has announced big changes for overdrafts. All daily charges must be replaced with an overdraft interest rate (which will cut costs for many). Crucially too, they won't be able to charge more for unarranged overdrafts than arranged ones - meaning an end to bank charges that take billions each year from some of the most desperate (though your bank can still refuse to make payments if you bust your limit). Full info in our Overdraft & bank charges shake-up MSE News story.

- How to cut your overdraft to 0%. There's detailed help in my Overdraft prisoner? How to escape blog, yet briefly...

- Overdraft up to £500? First Direct gives accepted newbies £100 and most get a £250 0% overdraft too. So if your overdraft's up to £350, it pays some off and the rest is interest-free. Even with slightly bigger overdrafts, it's cheapest.

- Bigger 1 year 0% overdrafts: Nationwide FlexDirect offers a year's 0% overdraft. It depends on your credit score, but some report getting up to £1,500.

- Shift it to a 0% card. A few specialist cards allow money transfers, where the card pays cash into your bank account (for a fee), clearing your overdraft, so you owe it instead, at up to 28mths 0%.

- Can you reclaim past bank charges? While mainstream 'had-a-charge, get-it-back' reclaiming ended a decade ago, if the charges were a major contributing factor to financial hardship, you may be able to reclaim them. Like Holly: "@MartinSLewis thanks to your advice I have received £923 from NatWest for unfair overdraft charges. Very happy." For full help and free template letters, see Reclaim Bank Charges.

- Reclaim packaged bank account fees. These are the monthly fees some pay for packaged bank accounts, which include insurance. Some get 'em confused with bank charges, yet actually you can reclaim unfair packaged account fees too.

| FREE PG Tips 80 tea bags (norm £2ish)... plus 70+ more supermarket coupons. We've collated all the best coupons this month, and if you use them all, there's over £70 worth. June's coupons Warning. Topshop, Miss Selfridge, Dorothy Perkins, Burton shopper/gift card holder. The parent company is reported to be struggling. We've help on how to play it safe with gift cards and online orders. See Arcadia safe shopping. As Ikea launches 'up to 40% off' sale, we've 23 Ikea MoneySaving hacks to slash costs. Incl FREE tea/coffee, store shortcuts, how to legitimately dodge queues and more. Ikea hacks New. Post Office easy-access savings now 1.45%, just shy of the top payers. Many like to save with a name they know, and there are few bigger than the Post Office*. Luckily, it's now near the top of the easy-access table with 1.45% (incl a 1.2% fixed 1yr bonus). That's only just behind the leaders, incl Marcus paying 1.5% (incl a 0.15% fixed 1yr bonus) and Cynergy also paying 1.5% (incl a fixed 0.5% 1yr fixed bonus) - and they have the same £85k savings safety protection, so there's nowt wrong with 'em. All rates are AER variable. Full info in Top Savings Accounts. 60 FREE UK festivals this summer - see Liberty X, The Coral or Wet Wet Wet's Marti Pellow. We've put together a list so you can find those near you. Plus how to get into paid ones for nowt. Freebies all around me New. EDF joins Brit Gas in offering no-brainer existing customer deal - save £340/yr. Last week, we reported a big firm price war to draw in energy switchers. Now EDF's joined it, at just £910/yr for someone with typical use incl MSE cashback. As it's £340/yr less than its standard tariff that most customers are on, and existing customers can get it as well as newbies, for them it's a no-brainer. Brit Gas has a similar deal via comparison links like this one, and while it's put the price up in the last week, most can still typically save £280/yr. For cheap smaller providers, do a whole of market comparison. These tariffs aren't for those on prepay or in N. Ireland, full details via the links. | Now FIVE personal loans are at the rock-bottom rate of 2.9% Many lenders are fighting for your business, likely meaning MORE chance of acceptance if you need to borrow  Loan rates are currently close to all-time lows. Yet crucially while we normally see just a couple of lenders pushing hard to be top of best-buy tables, right now for larger amounts there are five. While it's impossible to validate, intuitively with more choice you've more chance of being accepted, so long as you've a decent credit score and income. Use our Loans Eligibility Calc to home in on the ones you're most likely to be accepted for without damaging your credit score. Loan rates are currently close to all-time lows. Yet crucially while we normally see just a couple of lenders pushing hard to be top of best-buy tables, right now for larger amounts there are five. While it's impossible to validate, intuitively with more choice you've more chance of being accepted, so long as you've a decent credit score and income. Use our Loans Eligibility Calc to home in on the ones you're most likely to be accepted for without damaging your credit score. - Should I get a loan? We're not suggesting you rush in. Only apply if you NEED one (eg, your car for commuting has packed in), and it's budgeted for and affordable. If in doubt, don't risk it. If struggling with debt, ignore all of this and read our Debt Help guide.

- Lowest loan rates - from 2.9%. Here are all the top picks (ALL are 'representative APR' - see below for explanation):

- £7,500-£15,000: 2.9% at M&S Bank*, Admiral*, John Lewis*, Sainsbury's Bank (with Nectar card) & Zopa* (new)

- £5,000-£7,499: 3.3% at Yorkshire Bank* / Clydesdale Bank* (new) & Zopa* (new)

- £3,000-£4,999: 6.4% at Admiral* , 8.5% at Hitachi*

- £2,000-£2,999: 13.2% at Admiral*, 13.4% at Ikano Bank*

- £1,000-£1,999: 13.2% at Admiral*, 13.5% at Santander

- Borrowing less than £5,000? A 0% money transfer credit card may be cheaper. A few specialist cards allow money transfers. You can use one to pay cash into your bank, so you owe it instead. And if you can get a card with a big enough credit limit, you can in effect use it to get a loan at 0% for up to 28mths (for a 3-4% fee) - a lot cheaper than if you were paying loan interest. Just make sure you repay before the end of the 0% period. Full info and top picks in 0% Money Transfers.

- Beware - 'representative rates' mean you may NOT get the advertised rate. Sadly, ONLY 51% of those accepted need to get the advertised rate - others can pay more, and there's no limit. So a '2.9% loan' could cost you 20%. Unfortunately there's no way to know this without applying (but we're working on it), as even if you're using our eligibility calc , high chances of acceptance don't automatically mean you'll get the cheap rate. So ALWAYS check the rate you've been given once you apply.

- Loan Golden Rules. Full info and options in Cheap Personal Loans (APR Examples).

a) Minimise the amount and repay as quickly as possible.

b) Pay on time (preferably by direct debit) or you may get a charge and credit black mark.

c) If you're applying to pay off credit cards, a balance transfer may be cheaper. | Tell your friends about us They can get this email free every week | | AT A GLANCE BEST BUYS | | Free £175 to switch and stay + 2% bills cashback: RBS

Free £175 to switch: HSBC | | MoneySaver Claire: 'Phoned my energy supplier, they reduced my direct debit and I got a £570 REFUND' Martin's clarion call - 'Check THIS WEEK if your energy bill's in credit. As if it is at this time of year, you're likely due cash back'

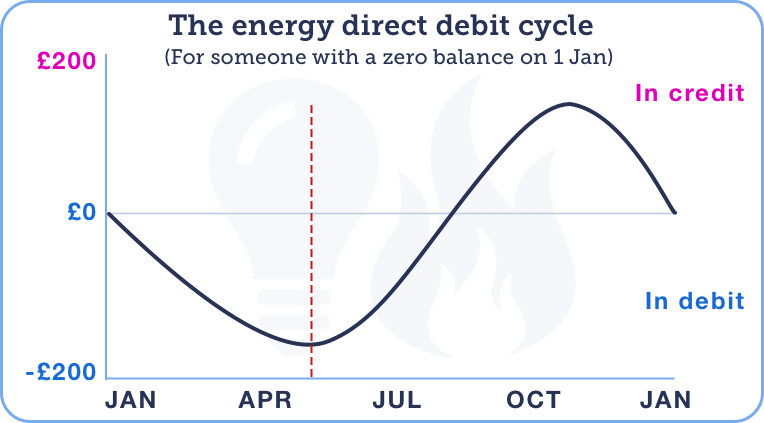

I wanted to write a second note this week, as the timing is crucial. If you're one of about 70% who pay for electricity or gas bills by direct debit, check NOW if you're due credit back. I've written before how to reclaim £100s in energy credit, but I wanted to do it again right now, as this is the perfect time... I wanted to write a second note this week, as the timing is crucial. If you're one of about 70% who pay for electricity or gas bills by direct debit, check NOW if you're due credit back. I've written before how to reclaim £100s in energy credit, but I wanted to do it again right now, as this is the perfect time... - It's the PERFECT moment to check. With most direct debit energy bills, you pay the same each month, to smooth out the cash flow. In other words, you overpay in the low-use summer months, to prevent bill shock in the costly winter months. Yet direct debits are usually an estimate of your usage, which means they can be, and often are, wrong - though as it's cyclical it's often tough to tell, UNTIL THIS POINT OF THE YEAR.

To show you, here's a plot of how the cycle pans out (with data kindly provided by Octopus Energy). It's done for someone with a £100/mth gas & elec direct debit.

As you can see, the graph bottoms out in May, and as it can take a bit of time to filter into your bill, this is a spot-on moment to check. It means everyone, regardless of when you switched (see graphs for if you switched at different times of year), should usually be at the lowest point, and not in credit. So check if you are...

- Still in credit by over a month's direct debit? Assuming you give regular meter readings (if not, do one first) or have a smart meter, check your energy account online or on the phone. To be a month's worth in credit right now is a lot, so unless you're with one of the few firms that pay you interest on it, politely request your provider explains why, and if its reason isn't good enough, ask for the cash back. See help on how to ask for the credit back.

The impact can be huge, as Claire tweeted: "@MartinSLewis Phoned my energy supplier as I was paying £147/mth and was £960 in credit. They reduced my DD to £80 and I got a £570 refund." Do tell us how it goes. Also find out what to do if you are in too much energy debt. | CAMPAIGN OF THE WEEK Teachers - it's My Money Week. Charity Young Money (part of Young Enterprise) is running My Money Week until Sun. Offering interactive video resources, it includes lesson plans and activities for primary and secondary school teachers delivering cash classes for the first time, or those looking for new ideas. See My Money Week and our financial education info for more. | THIS WEEK'S POLL How much do you spend on wedding gifts? There are of course many variables - where the wedding is, what the couple have asked for, and whether you're going to the whole day or just the reception. But depending on your relationship with the couple, how much do you spend on wedding gifts? MoneySavers rate Monzo as the best banking app. Last week we asked you how you rate your bank's app. More than 5,000 responded and as you might expect, app-only banks Monzo and Starling came out top - 78% and 70% respectively said the apps had lots of features and great usability, while traditional banks' apps lagged behind. See full banking app results. | Coupons - Incl 80 FREE PG Tips tea bags (norm £2ish)

Ikea - 'Up to 40% off' sale + 23 MoneySaving hacks

Free festivals - Incl Liberty X, The Coral & Marti Pellow

The Gym - Free 6-week membership for 16 to 18-yr-olds

Ciaté - £20 nail polish set (norm £64ish individually) | | | MARTIN'S APPEARANCES (WED 12 JUN ONWARDS) Thu 13 Jun - Good Morning Britain, ITV, Deals of the Week, 7.40am

Thu 13 Jun - The Martin Lewis Money Show roadshow at St David's Centre, Cardiff, from 12.30pm

Fri 14 Jun - This Morning, ITV, Martin's Quick Deals, from 10.30am

Mon 17 Jun - This Morning, ITV, from 10.30am

Mon 17 Jun - BBC Radio 5 Live, Lunch Money Martin, noon MSE TEAM APPEARANCES (SUBJECTS TBC) Wed 12 Jun - BBC Radio Cumbria, Money Talks with Ben Maeder, from 6pm

Fri 14 Jun - BBC South West stations, Good Morning with Joe Lemer, from 5am

Mon 17 Jun - TalkRadio, Breakfast with Julia Hartley-Brewer, 9.45am

Mon 17 Jun - BBC Radio York, Beth McCarthy, from 7pm

Tue 18 Jun - BBC Radio Cambridgeshire, Lunchtime Live with Jeremy Sallis, 2.20pm | QUESTION OF THE WEEK Q: My energy supplier recently offered me a smart meter. I've heard mixed reviews - is it worth it or not? Melanie, via email.  MSE Steve B's A: S mart meters aren't mandatory, so ultimately you'll need to weigh up the pros and cons yourself, but there is no real reason not to. They provide automatic meter readings, which means no more estimated bills - so you should only pay for what you use. You can also monitor your energy use via an in-home display, which shows you the cost in near real time, so it could help you identify where to cut back to save. MSE Steve B's A: S mart meters aren't mandatory, so ultimately you'll need to weigh up the pros and cons yourself, but there is no real reason not to. They provide automatic meter readings, which means no more estimated bills - so you should only pay for what you use. You can also monitor your energy use via an in-home display, which shows you the cost in near real time, so it could help you identify where to cut back to save. Depending on what kind of meter you're given, there is still a risk it could go 'dumb' and lose some functionality, if you later switch supplier. But if so it'll still work as a basic meter, so don't let this put you off. See more in our Smart Meters guide. Please suggest a question of the week (we can't reply to individual emails). | 'I GOT STUNG BY A BEE THE OTHER DAY... £15 FOR A JAR OF HONEY' That's it for this week, but before we go... as Sunday is Father's Day, we thought we'd share with you some of our favourite 'dad jokes', including Martin's above, plus: - What's orange and sounds like a parrot? A carrot...

- What do you call a man with a seagull on his head? Cliff...

- What cheese is made backwards? Edam... Now let us know your best (or worst) dad jokes in our Facebook post. We hope you save some money,

The MSE team | |

No comments:

Post a Comment