|

| - | - | - | - | - |

| |

|

|

|---|

| DON'T believe the fake ads on Facebook |

| New. Get FREE £37.50 of Nectar points and (if you need it) the joint-LONGEST 0% spending credit card Sainsbury's Bank has boosted the offer on one of its credit cards, which includes freebies to entice you in. You can play the game and just use it to grab them if you want, yet if you will need a credit card to borrow on, it's also the joint-longest 0% for spending card, making it a double boost...

|

| £4.75 for unsold M&S, Next, River Island shoes, clothes & more. MSE Blagged. Discount retailer sells de-tagged high street + non-branded clothing. Everything is normally £5 plus delivery from £3.95. Our code gets it for £4.75 all-in until Sun (sometimes for even less, as it can be used on sale items). Everything5pounds New. Top 1yr 2.1% fixed savings - the best we've seen since Aug. If you're happy to lock away cash for the year, Aldermore* now pays a fixed 2.1% AER (min £1k). Full info and more deals in Top Savings. Will your mobile network still offer 'free' EU roaming after Brexit? See Roaming alert. Valentine's Day deals, incl £20 for 12 couriered roses, £3.50 mug, £1.49 personalised card. The week before (ie, now) is the big one for offers, but don't overspend. See all Valentine's Day deals. Free £100+. Now SIX banks pay you to switch. This fine harvest won't last long (it was seven deals and one ended last week). Top picks include NatWest/RBS free £150 + 2% cashback | First Direct £125 + top service | HSBC free £150. For a full breakdown, see our Best Bank Accounts guide. Is peer-to-peer lending riskier with Brexit? It looks like savings but smells like investing. If you are considering putting money in, or have done, it's worth knowing the risks, especially with Brexit looming. See Peer-to-peer help. |

| |

|---|

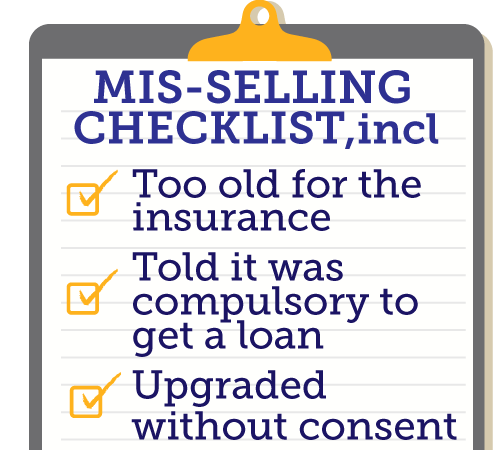

| 'I reclaimed packaged bank fees via MSE's tool - in just a week I had £2k' 100,000s were mis-sold over many years - reclaim for free and never use a claim firm

Let Linda's story be your inspiration: "I sat in bed and read your Mis-sold Packaged Bank Accounts guide. I thought 'nothing to lose' so I used your tool. In a week, I had £2,015 put in my account. I'm in shock, thanks. Here's to being debt-free, you guys are fantastic." Our Free Packaged Bank Account Reclaim guide and tool has full info, here are the key points...

|

| Should you equity-release? Martin's 5-min guide. If you own your home, you could borrow some of the cash locked in it. There was a 30% rise in this type of lending last year. Is it for you? See Martin's Equity Release guide. TV licence fee to rise in April - who needs one? Rules have changed, so more do now. Do you need a TV licence? Bargain weekend break finder, eg, Nice for £69pp. New weekend-specific comparison tool finds cheap flight and hotels combos. Is it any good? See weekend break finder. Ends Sun. Get 5p/litre off Tesco petrol & diesel. Useful with prices almost 20% up on 2016. Cheap fuel Earn £15 Amazon/M&S vouchers doing quick online surveys. MSE Blagged. Popular MSEers' site where you're paid to fill in surveys and do online searches. Swagbucks FREE Halfords winter car check. Battery, bulbs, wipers, oil check and screenwash top-up. Free car check |

| AT A GLANCE BEST BUYS

|

| Flog your unwanted clobber for cash, eg, £145 for Hunter wellies We're in the midst of a decluttering frenzy, which many put down to Netflix's declutter-encouraging show Tidying Up With Marie Kondo. As we reported last week, it's meant charity shops are overflowing with donations, though of course another option is to sell stuff for cash. So why not go through your home and ask: "Have I used this in a year?" If not, consider flogging old Walkmans, books, DVDs, clothes etc. Here are some tricks to help you get max cash from your cast-offs...

|

| FREE £16 Wedding Show tickets. 500 pairs of tix for The National Wedding Show in London (15 Feb) and 500 pairs for Birmingham (1 Mar). National Wedding Show £500 STUDENT LOAN RECLAIM IN 5 MINS - SUCCESS OF THE WEEK: "Thanks to you I just called the Student Loans Company and have been told I'm due a refund of over £500 - not bad for a five minute call." (Send us yours on this or any topic.) |

| THIS WEEK'S POLL Which stores' gift cards do you value most? Imagine a friend offered to sell you a perfectly valid £100 gift card which doesn't expire for two years - what's THE MOST you would be willing to pay for it? Which stores' gift cards do you value most? Remainers and Leavers are split over how Brexit will affect their personal finances. Last week, we asked how you think Brexit will affect your finances - over 8,800 responded. Perhaps unsurprisingly, MoneySavers who voted remain were more pessimistic, with 74% believing they'll be worse off, compared with just 21% of those who voted leave. Few of any persuasion expect a Brexit boost to their wallet though - only 17% who voted leave and 3% who voted remain think they'll be better off. See full Brexit poll results. |

| MONEY MORAL DILEMMA What should I do with forgotten change? Sometimes when I use a supermarket self-service checkout, I discover a previous customer (no longer on the premises) has omitted to collect their change. Should I leave the money where it is, alert a shop supervisor, pocket it or give it to charity? Enter the Money Moral Maze: What should I do with forgotten change? | Suggest an MMD | View past MMDs THE QUICKIES - Debt-Free Wannabe chat of the week: Birthday and Christmas Planning Club |

|

| MARTIN'S APPEARANCES (WED 6 FEB ONWARDS) Thu 7 Feb - Good Morning Britain, ITV, Deals of the Week, 7.40am MSE TEAM APPEARANCES (MOST SUBJECTS TBC) Wed 6 Feb - BBC Radio Cumbria, Money Talks with Ben Maeder, from 6pm, mobile money-saving |

| QUESTION OF THE WEEK Q: My car insurance is about to expire, but I was recently involved in a car accident. Do I need to renew with the same insurer if I make a claim? Jackie, via email

Whether you claim or not, you must still declare the incident to your new and existing insurer. Be warned that it could put the price of the renewal up compared to what it would have been had you not had the incident. This makes it even more important to do a full comparison before getting a new policy, to ensure you get it as cheaply as possible. See our Cheap Car Insurance guide for how to bag the best deal. Please suggest a question of the week (we can't reply to individual emails). |

| POP THE QUESTION FOR JUST A QUID? That's it for this week, but before we go... "I'll go £200", "It's looking like a 20p machine ring to me", "Let's meet in the middle... £500". That's just some of the reaction MSE Jordon got when he asked the public how much they thought Poundland's £1 engagement ring costs. But do you agree with them? Check out the video and let us know. We hope you save some money, |

Important. Please read how MoneySavingExpert.com worksWe think it's important you understand the strengths and limitations of this email and the site. We're a journalistic website, and aim to provide the best MoneySaving guides, tips, tools and techniques - but can't promise to be perfect, so do note you use the information at your own risk and we can't accept liability if things go wrong. What you need to know This info does not constitute financial advice, always do your own research on top to ensure it's right for your specific circumstances - and remember we focus on rates not service. We don't as a general policy investigate the solvency of companies mentioned, how likely they are to go bust, but there is a risk any company can struggle and it's rarely made public until it's too late (see the Section 75 guide for protection tips). We often link to other websites, but can't be responsible for their content. Always remember anyone can post on the MSE forums, so it can be very different from our opinion. Please read the Full Terms & Conditions, Privacy Policy, How This Site is Financed and Editorial Code. Martin Lewis is a registered trade mark belonging to Martin S Lewis. More about MoneySavingExpert and Martin LewisWhat is MoneySavingExpert.com? Who is Martin Lewis? What do the links with an * mean?Any links with an * by them are affiliated, which means get a product via this link and a contribution may be made to MoneySavingExpert.com, which helps it stay free to use. You shouldn't notice any difference; the links don't impact the products at all and the editorial line (the things we write) isn't changed due to them. If it isn't possible to get an affiliate link for the best product, it's still included in the same way. More info: See How This Site is Financed. As we believe transparency is important, we're including the following 'un-affiliated' web-addresses for content too: Unaffiliated web-addresses for links in this email admiral.com, aldermore.co.uk, aviva.co.uk, comparethemarket.com, confused.com, directline.com, gocompare.com, hsbc.co.uk, moneysupermarket.com, sainsburysbank.co.uk, santander.co.uk Financial Conduct Authority (FCA) Note MoneySupermarket.com Financial Group Limited is authorised and regulated by the Financial Conduct Authority (FRN: 303190). MoneySavingExpert.com Ltd is a company registered in England and Wales. Company Registration Number: 8021764. Registered office: One Dean Street, London, W1D 3RB. MoneySavingExpert.com Limited is an appointed representative of MoneySupermarket.com Financial Group Limited. To change your email or stop receiving the weekly tips (unsubscribe): Go to: www.moneysavingexpert.com/tips. |

No comments:

Post a Comment