| |

Many are skint after Xmas so use Jan to sort their finances. If you've not started, the clock's ticking. You may have seen these tips before but we make no apologies for repeating them as they're the key savers. So stop putting it off, pause the TV, delay your trip to the pub/salon/shops and read on... Many are skint after Xmas so use Jan to sort their finances. If you've not started, the clock's ticking. You may have seen these tips before but we make no apologies for repeating them as they're the key savers. So stop putting it off, pause the TV, delay your trip to the pub/salon/shops and read on...

| 1. | An easy big win for millions of you, if married or in a civil partnership. The marriage tax allowance is worth up to £432, takes 5 mins to sort, yet a huge 2.7m eligible couples haven't claimed. Our Marriage Tax Allowance guide explains all. Nancy said: "Easy procedure - we'll be £220 better off this year + got £212 from last year back. Thanks." | | | | 2. | STOP paying interest on your credit card, LOOK & LISTEN (to us) and shift debt to 0% - and even get paid to do it. A balance transfer card pays off existing credit & store cards, so you owe it instead, but at 0% interest. Repayments clear the debt rather than interest, so you're debt-free quicker.

Here's a selection of the top cards, some with cashback. Go for the lowest fee within the max 0% period you need to pay it off. If unsure, play safe and go long.

Balance Transfer Golden Rules

- Our eligibility calc shows which top cards you've best odds of getting.

- Some cards are 'up-to', so you may get a shorter 0% deal, even if accepted.

- Repay by the end of the 0% period or you pay the rep APR.

- Never miss the min payment or you could lose the 0%.

- Avoid spending or cash withdrawals, which are unlikely to be at 0%. | | | | 3. | If you pay £300+/yr for phone & broadband, give yourself a slap on the wrist. BT, Sky, TalkTalk, Virgin etc plunder existing customers' wallets, charging £275-£540/yr outside promos. Yet hot, short-lived deals can slash bills. The following 1yr unlimited b'band options are our top picks...

- Standard speed & line: Plusnet, '£13/mth'.

- Faster fibre & line: Virgin (50Mb), £24/mth-ish.

- A rare fibre-ONLY (no landline) deal : Virgin (50Mb), £23/mth-ish.

Full info & options in Cheap Broadband. Also see haggling in pt 10. | | | | 4. | Don't let the taxman take too large a bite out of your pay packet. A huge 3.5m overpaid in the 2014/15 tax year, many due to an incorrect tax code (the info that tells your employer how much to deduct from your pay packet). Our free Tax Code Checker works out if you could get a refund. Chris told us: "I got the MSE email, checked my tax code, rang HMRC and it told me I'd get between £5,000 and £7,000 back. Incredible." | | | | 5. | S*x up your savings by showing them more interest. Rates are, on the whole, dire historically, yet we've dug out the gems for you that still pay juicy loss-leading interest of up to 5% - mainly via current accounts. Full info and eligibility criteria in Top Savings Accounts. | | | | 6. | Save £100s on your energy bill before the tea's brewed. Depressingly, 66% of you are still on a standard energy tariff. These cost an average £1,065/yr on typical use. Yet the cheapest deals are sub-£900/yr for the same usage. We've timed it (yes, we really did, see our Facebook page), and it can take less than 5 mins to switch to a better deal via our Cheap Energy Club. Sophie told us: "I switched using your energy club and my direct debit dropped from £140/mth to £99/mth [saving about £500/yr]. How good is that?"

Oh, and if you've switched in the last six years... call your OLD firm, you may be owed £100s. See Reclaim Old Energy Bill Credit. | | | | 7. | Look at the ceiling and ask yourself, 'Am I paying too much for the roof over my head?' If your mortgage is due to renew in 2017, there's never been a better time to search for a new one. But act fast or you could miss out - because many think the record-low mortgage rates are coming to an end. We've full help in our updated free 66-page MSE Remortgaging 2017 booklet. Plus if you're looking to make your first move onto the property ladder, our free 56-page MSE First-Time Buyers' 2017 booklet explains the basics. | | | | 8. | Stop, yes we mean STOP, paying for things you don't want or use. Millions wrongly let cash drip away via direct debits from their bank accounts for things they don't really want, such as unused gym membership. So do a direct debit check-up, like Becky, who said: "I moved two years ago, but still paid my old gym £330/yr. Cancelling this and two other direct debits meant a £500+ saving." | | | | 9. | Drive down your car insurance cost - even if not at renewal. The AA says prices are 12% higher than a year ago, and are expected to keep rising. So check now if you're overpaying via our full car insurance cost-cutting system. It explains how to save - even if not at renewal - and shows hot deals including £60 Amazon & Debenhams vouchers. | | | | 10. | Don't be so bloomin' British. If you meekly renew, the AA, BT, Sky, Virgin etc will take advantage. So many of you hate asking for a price reduction, yet haggling's often your best weapon. Companies want you to stay but will only offer incentives if you ask. Success rates for those who try are huge: 87% at AA, 87% Sky, 79% Virgin, 78% BT. As Carole emailed: "Threatened to leave Sky, as MSE suggested, and it matched my promo - result. Saved almost £30/mth [£350+/yr] - you guys rock." For full help see our Haggle with Sky, AA & more guide. | | | |  The Martin Lewis Money Show The Martin Lewis Money Show

Mon 30 Jan, 8pm, ITV - Even if you don't think you had PPI, watch this (plus I give marital advice...). Everyone who's had a loan, credit card, overdraft or mortgage in the last 20 years should watch. There's a deadline coming, and you may be owed £1,000s even if you don't think you ever had PPI. Plus there's the couple who'd been engaged for 22 years but wanted my help to get 'em over the threshold (it's all about their credit score). If you can't watch, at least set the timer on the DVD recorder...

How to get the perfect holiday money rates. If you missed this week's, watch it online for how to get perfect holiday money rates and how to stop spam calls, texts, junk mail and nasty knockers. For more help, see the 16 Travel Money Tips and Stop Spam guides. | | | | | | | | | | | | | | | | | | | This triple deal from TSB is likely the last of the New Year offers, and unusually interest is paid on the main account

If service is as bad as Fawlty Towers' or rewards are rancid, our message is simple: give your bank the boot. Even if happy, check if you can profit from the top deals bonanza. Switching is easy - yet it's just been revealed fewer than 2% did it in the last year. It takes just seven working days, and the new bank moves all payments for you - in fact, 76% of you tell us it's hassle-free. -

New. Triple bank bonus - free £125, 3% interest + £5/mth cashback. TSB's been back as a high street fixture since it demerged from Lloyds in 2013. Since then it's released many hot offers - and here's a cracker. As of this week, switchers to TSB's Classic Plus* (via this link only) get: New. Triple bank bonus - free £125, 3% interest + £5/mth cashback. TSB's been back as a high street fixture since it demerged from Lloyds in 2013. Since then it's released many hot offers - and here's a cracker. As of this week, switchers to TSB's Classic Plus* (via this link only) get:

- A free £125 if you use the link above before 27 Feb. You must complete the switch, using the current account switching service, before the end of March, and transfer 2+ active direct debits.

- If you're in credit you'll get 3% AER variable interest on balances up to £1,500, as long as you pay in £500+/mth, register for internet banking + paperless statements/correspondence. Above that you'll get nothing, so don't keep too much in the account.

- Spend up to £100/mth on contactless debit and you'll get 5% cashback up to a max of £5/mth until Sep.

-

And now for the alternatives - more free cash + top customer service. As with TSB, you'll be credit-checked when you apply and you'll need to be a new customer using official switching services to get all the perks.

- Free £125, No.1 for service, 5% regular saver. Apply via this First Direct* link and you get £125 (£100 if you apply direct). The bank's won every service poll we've done - 91% rate it 'great' - and it has a £250 0% overdraft plus access to its 5% fixed regular saver. The account's free as long as you pay in £1,000/mth, if not it's £10/mth.

- Free £200 (£150 upfront, £50 if you stay), 5% regular saver. Switch to the HSBC Advance* account and you get £150, and another £50 if you're still with it after a year. It also gives access to a 5% fixed regular saver. To get it all you need to pay in a min £1,750/mth, switch 2+ direct debits/standing orders and register for online or mobile banking within 60 days.

- Best of the rest. There are loads more, so in brief... Co-op Bank offers a free £110 and up to £5.50/mth, Halifax has a free £100 and a possible £3/mth, or switch to M&S Bank for a free £50 M&S gift card + an extra £5/mth. Full help and eligibility for all above in Best Bank Accounts. | | | | | Topshop, River Island, Zara etc clothes & shoes ALL £4.75 per item via code. MSE Blagged. Discount retailer Everything5pounds.com sells surplus stock from high street giants for, er, £5. We've a code making it £4.75 incl delivery till Fri. Sub-£5 clothes

Beat BT price hikes. Third increase in just over 18 months, including broadband, TV and calls. How to beat BT rises

How to get 500 free Tesco Clubcard points. Worth up to £20. Full info in free Tesco points.

It's back - Ikea 'free prize with any purchase'. From hot dogs to Sweden trips, EVERYONE gets something. Maureen won big previously: "I won a Sweden holiday for four with £500 spending cash. Can't stop smiling." Ikea freebies

£1 kids' book sale, incl Peppa Pig, Star Wars, Gruffalo & Minions. Also £2 teachers' resources. Min spend £10, del £3. Till Fri. See what's available in the Scholastic sale. Related: The Works 10 books for £10.

Are you doing a new Big Energy Switch?

We're swamped with questions on this (especially from those whose current collective deal's up soon). We're trying really hard but with energy prices rising rapidly, it's tough to get providers to play ball. By next week's email we'll either have a deal, or if not, tell you the best thing to do. | | | | | | | | | | | EVERYONE with a loan should check out her story - and see if you can do the same

MoneySaver Amy emailed after she read our cheap loans tip, with this inspiration gold: "Had a 23.9% £12k loan. Used your guide & eligibility calc & got a new 3.1% £11,500 loan. Went from a whopping £7,700 interest to £750. So happy, thanks." It made us realise many more could make massive savings thanks to the current crop of record-low loan rates. Full info in Cut Existing Loan Costs, but in brief... MoneySaver Amy emailed after she read our cheap loans tip, with this inspiration gold: "Had a 23.9% £12k loan. Used your guide & eligibility calc & got a new 3.1% £11,500 loan. Went from a whopping £7,700 interest to £750. So happy, thanks." It made us realise many more could make massive savings thanks to the current crop of record-low loan rates. Full info in Cut Existing Loan Costs, but in brief...

-

The lowest rates from £1,000-£25,000. All are for 1-5yr repayments, unless stated. If you're doing new borrowing, as opposed to switching, be careful. Only do it for the minimum amount that's planned, budgeted and needed. See Cheap Personal Loans (APR Examples). - £20k-£25k: Ratesetter* is 3.1% rep APR, Hitachi* 3.2% rep APR (2-5yrs).

- £15,001-£19,999: Sainsbury's* is 2.8% rep APR over 2-3yrs, if you've a free Nectar card. If not, Sainsbury's* (2-7yrs, without Nectar) is 2.9% rep APR and Cahoot* is 3% rep APR.

- £7.5k-£15k: Sainsbury's* is 2.8% rep APR over 1-3yrs, if you've a free Nectar card. If not, Sainsbury's* (without Nectar) and TSB* are 2.9% rep APR.

- £5k-£7,499: Hitachi* is 3.7% rep APR (2-5yrs). If for £7k-£7,499, Admiral is 3.6% rep APR.

- £3k-£4,999: Zopa* is 5%-6.9% rep APR, Ikano* 5.2% rep APR.

- £2k-£2,999: Zopa* is 6.9%-7.9% rep APR, Ikano* 7.9% rep APR (credit card loans are often cheaper).

- £1k-£1,999: Zopa* is 9.9% rep APR (2-5 yrs), Ikano* 11.9% rep APR (credit card loans are often cheaper). All rates are 'representative APR' so, sadly, ONLY 51% of those accepted will get that rate. Anecdotally, the higher your eligibility chance, the more likely you'll get the advertised rate. -

See if you should switch and save. Now you know the top rates, check if you'll save money.

- Step 1: Call your current lender for a settlement figure. This is what you need to borrow on your new loan. It's the full debt plus early settlement charge (if any) - max fee is 2mths' interest.

- Step 2: Find YOUR new top rate for the amount needed to clear your loan. Now you know what's available, use our free Loans Quick Eligibility Calc to show your chances of getting most top loans without hitting your credit score. Or our FULL Credit Club Loans Eligibility Calc, where you also get a free Credit & Affordability Score.

- Step 3: The BIG reveal: check if you can save. Plug the old and new loan details into our nifty loan switching calculator. If you can save, apply. If accepted, use the new loan to pay off the old one. | | | | | Ends Tue. Which? Power of Attorney £70 code (norm £139). MSE Blagged. Martin says these are often more important than a will, as if you lose capacity from dementia, an accident or a stroke without one, your loved ones may be cut out of your finances, even to pay for your care. This Which? offer gets a paralegal's help (there's also the standard £110 to file it). See full Power of Attorney help.

West End show tix £10-£40, eg, Half a Sixpence, Wicked, School of Rock. 25,000 tickets for shows up to Fri 10 Feb. Norm £18.50-£72.50. Some exclusions. Get Into London Theatre

Hot Diamonds extra 30% off 'up to 50%' sale code, eg, £50 bangle for £18. MSE Blagged. Big discounts on already-reduced women's jewellery. Ltd stock. Free delivery. Hot Diamonds

Thinking of joining a Christmas savings club? Are you sure you're protected? See Savings Club Warning.

FitFlop extra 20% off sale code, eg £65 sandals for £23. MSE Blagged. £3.95 del. Plus code for £30 off full-price boots. Ends Fri. FitFlop

Designer sunnies 25% off code, eg, Ray-Bans £52 delivered. MSE Blagged. Ltd stock. Sunglasses Shop | | | | | They can get this email free every week | | | | | | | | | One commuter told us he got £2,400 back after his Southern Rail hell. Here's how to grab a refund

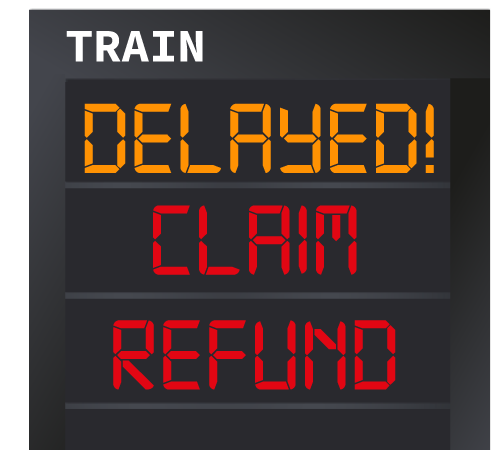

Tales of commuter misery are rife, with delays and cancellations at a 10-year high according to Network Rail. But don't take it lying down. Our Train Delays guide has full info on your rights - here are key announcements to keep your refund chances on track... -

Most can claim for 30min+ delays (some for 2min+). There are 24 UK train firms and, confusingly, each has its own rules. Here's what to check: Most can claim for 30min+ delays (some for 2min+). There are 24 UK train firms and, confusingly, each has its own rules. Here's what to check:

- See what you're entitled to. Mostly, if you arrive 30mins+ late you're due at least 50% of the fare in cash, whatever the reason for the delay. See firm-by-firm rules.

- Check the delay if unsure. A clever tool tracks train times (not for N Ire).

- Got a season ticket? You can sometimes claim per delay, for a cluster of delays or not at all. See season ticket refunds by firm.

- How to claim. All let you do it online, must be within 28 days of delay. See how to claim & what if they say no. -

Constant season ticket delays? Sean reclaimed £2,400. Can you? If you paid by card you could try to claim for delays via your card firm, as Sean did after months of Southern Rail hell. While untested on a larger scale, it may open the floodgates. See card firm train delay refunds. -

Awful onboard service, eg, dodgy loos, no seats? There's a new refund route. For tickets bought since October, you can complain to train firms quoting the Consumer Rights Act for delays or shocking onboard service. While it adds legal clout, it's a longer process and as it's new, we haven't seen any successes - but it's worth trying if stuck. See your train consumer rights. | | | | | Body Shop 40% off incl sale code, eg, £14 body butter £4ish. Online & in stores. Body Shop

SUCCESS OF THE WEEK: (Send us yours on this or any topic)

"We got £890 back via the chargeback scheme for money paid out on a debit card for two valuable clocks lost when the repair shop went into liquidation, thanks to your tips."

FREE £12 Build it Live tickets (Kent & Manc). MSE Blagged. 750 pairs of tix for Kent (4-5 Feb) & 750 pairs for Manc (18-19 Feb). Free tix | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | Thu 26 Jan - Good Morning Britain, ITV, Deals of the Week, 7.40am. View previous

Fri 27 Jan - This Morning, ITV, Martin's Quick Deals, from 10.30am. View previous

Fri 27 Jan - Any Questions, BBC Radio 4, 8pm

Mon 30 Jan - This Morning, ITV, from 10.30am

Mon 30 Jan - BBC Radio 5 Live, Lunch Money Martin, noon. Subscribe to podcast

Mon 30 Jan - The Martin Lewis Money Show, ITV, 8pm. View previous | | | | Wed 25 Jan - Share Radio, 11.20am

Wed 25 Jan - BBC Radio Cumbria, 'Money Talks', from 6pm

Thu 26 Jan - BBC Radio Tees, 10.35am

Fri 27 Jan - BBC South West stations, breakfast

Tue 31 Jan - BBC Radio Cambridgeshire, 2.20pm | | | | | | | Q: I'm hoping to build my own fly-drive holiday with the same travel site, but only need the car for part of my trip. Will I still get ATOL protection? Chloe, by email.  MSE Megan's A: You do, assuming you book a flight and car hire from the same UK travel agent within 24 hours of each other - even if you've only got the car for part of your trip. MSE Megan's A: You do, assuming you book a flight and car hire from the same UK travel agent within 24 hours of each other - even if you've only got the car for part of your trip.

ATOL protection means if the travel company goes bust, you get your money back or get help if it happens when you're abroad. For more information, see how to create your own protected holiday. Also, it's always safest to book by credit card as in most cases you get the added protection of the card firm being jointly liable if something goes wrong. See our Section 75 guide for more. Please suggest a question of the week (we can't reply to individual emails). | | | | | | | That's it for this week, but before we go, do you always make your workmates tea but never get any in return? Or are you happy to sip away and never head to the kettle yourself? Check out the forum thread on the Tea Round App - which randomly picks the next maker - and see whether it'll solve your office (or home) ills, plus have your say. We hope you save some money,

The MSE team | | | | | | |

No comments:

Post a Comment