| | | - Incl last chance £35 M&S vchs for spending 1p on credit card

- Get £100 switching to one of four top current accounts

- Plus more quick cash and vchs - many paid within three months

We always tell you about top deals but this week we're focusing on those that also pay you to grab them. We're not suggesting you get all of these but in total there's £300+ worth of free cash and vouchers, which shows the breadth out there. Most involve a credit check which puts a minor mark on your file. That's not usually a problem, but you might want to avoid if you're a month or two from a mortgage or other big credit application. So without further ado, here's what's on offer if you're accepted for these hotties... | 1. | Ends Wed. Free £35 in M&S vchs for spending a penny. Trigger to get: Spend 1p in M&S. Amount: £35 in vchs. How quick? 1-3mths.

We've flushed out a great deal. Accepted new M&S Bank card holders (eligibility calc / apply*) who apply by 11.59pm on Wed, via this link, and spend anything, anywhere on it (even 1p) by 31 Dec, get emailed a £30 M&S vch by 31 Jan. If needed, the card's also 25mths 0% on spending - used right, there's no cheaper way to borrow.

- Bag extra £5. You're sent another voucher to scan in store (or enter a code online) with a purchase within 6wks, on most things at M&S (incl food). You'll get 500 M&S points worth £5 with your first quarterly reward statement. So buy an M&S banana and you're £35 up. Buy a Tesco one and it's only £30. You can pay the card off to avoid interest and forget it, or use for 1pt per £1 spent in M&S, per £5 elsewhere.

- How good is the 25mths 0%? If you use it for this, never miss min monthly repayments and clear before the 0% ends to avoid 18.9% rep APR interest. It's close to the longest but it's possible to get up to 30mths 0%, see the Virgin card below. Full options in Top 0% Spending Cards (APR Examples). The M&S deal's come and gone before (you can't get it if you've had the card within the last 12mths) & there's no certainty it'll return. For full details see M&S £35 offer. | | | | | 2. |  Free £100+ to switch bank account. Trigger: Switch account. Amount: Four £100 bribe options. How quick? Some in 10 days. Free £100+ to switch bank account. Trigger: Switch account. Amount: Four £100 bribe options. How quick? Some in 10 days.

We've been yelling for years that numerous banks bribe you to switch to 'em. These zingers are top accounts too, and you may even get the cash in time for Xmas. All require you use their switching services and most require you switch 2+ direct debits.

- Free £100 in 1-2 mths, no.1 service, 5% linked savings & 0% overdraft. First Direct's* won every customer service poll we've done; 91% rate it 'great'. The free £100 should come within 28 working days of paying in £1k while switchers also get a £250 0% overdraft and can put up to £300/mth in its linked 5% regular saver. Min £1k/mth pay-in to avoid its £10/mth fee. Full info: First Direct.

- Free £100 M&S gift card in 40 days, plus £10/mth. M&S Bank* gives a £100 M&S gift card, plus pay in £1,000+ a month and you get £10/mth added for a year. And it has a £100 0% overdraft and a linked 5% regular saver. Full info in M&S.

- Free £100 in 1-2mths, 3% interest & up to £5/mth cashback. Via this link (not direct), TSB* pays £100 within 28 working days of your switch completing provided you've paid in £500+. Plus from Jan you can get 3% on up to £1.5k (5% on up to £2k till then), if you keep paying in £500/mth. It also gives 5% contactless cashback on an up-to-£100/mth spend till Sep. Cust service is a strong 72% 'great'. Full info: TSB.

- Free £100 in 10 days, plus £5/mth (£3/mth from Feb). Halifax pays £100 by the time the switch's complete, and also pays £5 for each month you're in credit (£3/mth from Feb) & pay in a min £750/mth. Its service is 63% 'great', but beware its costly £1+/day overdraft. Full info: Halifax Rewards.

Switching's little hassle. It takes seven working days and they move all payments. It's so easy, some of us at MSE have made £800+ as bank tarts. Though some of you have made much more with serial bank account switching, such as David: "My wife and I collected £2,145 from opening new accounts in the last 2 years. Many thanks." | | | | 3. | Free £100 Amazon/M&S voucher for 3mths' normal spending. Trigger: Spend £2k. Amount: £100 vch. How quick? 1-4 mths.

Spend £2k+ in the first 3mths and the Amex Rewards Gold charge card (eligibility calc / apply*) gives 20,000 bonus Membership Rewards pts, usually credited when you hit the £2k spend, but can take 1mth.

- What are points worth? You can swap them for a £100 Amazon/M&S/Boots etc gift card (shops can change) or BA/Virgin etc points. You earn 1pt per £1 spent on the card too.

- Warning. There's a £140 annual fee after 1yr. Diarise to cancel if you don't want to pay it. Also as it's a charge card it must be repaid IN FULL each month. There's no interest but missed repayments cost £12 & a credit file black mark. Just do normal spending (it's not an excuse to spend more). Full help in Cashback Cards (APR Examples).

Won't spend that much? The Amex Rewards credit card (eligibility calc / apply*), via this link, gives 10k bonus pts for a lower £1k+ spend in three months, so you can get a £50 vch. If you don't repay IN FULL every month, it's 22.9% rep APR. | | | | 4. | Bank with Nationwide? Share £200 with a friend if they switch to it. Trigger: Your friend's switch. Amount: £100. How quick? 1-2 mths.

While not quite the same concept as the rest, we like this as Nationwide accounts tend to be decent. If you've a Nationwide FlexAccount, FlexDirect or FlexPlus account, and you rate it, if you refer a friend who switches to one, you both get £100. Full info: Nationwide refer-a-friend. | | | | 5. | £20 Amazon to shift debt to 41mths 0%. STOP paying credit card interest. Trigger: Transfer £1k+. Amount: £20 vch. How quick? 2-3mths.

A balance transfer is where a new card pays off existing credit & store cards, so you owe it instead, but at 0% interest (for a small fee). Repayments just clear the debt rather than interest too, so you're debt-free quicker. And a card with the joint-longest 0% has a hot freebie.

- With MBNA-owned Nuba (eligibility calc incl pre-approval / apply*), if you get its up-to-41mth 0% card and transfer £1k+ within 60 days, you're emailed a £20 Amazon gift card within another 60 days. The fee is 3.29% of the amount moved.

- Who's it best for? It's right up there among the top picks but isn't necessarily best for all. Our eligibility calc shows which of the top ones you've best odds of getting. For Nuba and some others it can also tell if you've been pre-approved, subject to an ID check. If you can pay it off quicker, a 25mth 0% NO-FEE card may win. Full options and info in Best Balance Transfers (APR Examples).

- Balance transfer golden rules. Repay by the end of the 0% period or you'll pay the rep APR (20.9% on Nuba). Plus never miss the min payment and avoid spending or cash withdrawals, which aren't at 0%. | | | | 6. | Free £25 cashback or £20 Amazon to (re)build your credit history. Trigger: Use card responsibly. Amount: £25 cashback/£20 vch. How quick? 2-3mths.

If you've a patchy or limited credit history, you'll struggle to get the deals above. Yet some cards accept those with past CCJs & defaults. Do normal spending, never bust your limit and pay off IN FULL each month to avoid horrid interest (the below are 24.7% & 34.9% rep APR respectively) and (re)build your credit score by proving you can handle credit. Two have hot freebies:

- New. Vanquis Chrome (eligibility calc / apply*). We've blagged you £25 cashback after two months if you make at least £50 of purchases, pay on time and stay within your credit limit. Do this and the £25's credited to your account.

- Aqua Advance (eligibility calc incl pre-approval / apply*). You're emailed a £20 Amazon voucher after two months, as long as you use the card at least once, pay on time and don't bust your limit. Keep up this 'good behaviour' and your APR can drop from 34.9% to 19.9% over 3yrs.

Loads more help in Credit Rebuild Cards (APR Examples). | | | | 7. | Members of cashback sites could get cashback on lots of things. Just make sure it's the same product. For full info, pros and cons, see Top Cashback Sites. | |

The Martin Lewis Money Show, 8pm MON 5 Dec, on ITV

Are you married, got (grand)kids or get tax credits? If so, you can't afford to miss it Over to Martin... "I'm gobsmacked that 4.2 million of you chose to watch this week's Savings in Crisis show, thank you. Next Monday it's all about how to boost the family finance coffers, with tips if you're married, have kids or get tax credits. Do watch or set the Betamax." | | | | | | | | | | | | | | | | | | Not only does this card give the longest 0% on purchases, it offers lengthy balance transfers & money transfers too

STOP PRESS: We weren't planning to do another note on cards, but this one is so short-lived we felt we had to. There's nothing out there quite like this Virgin Money card (eligibility calc incl pre-approval / apply*). At 30 mths you get the longest 0% interest on purchases, and decent balance and money transfers too. Plus you'll definitely get the full length if accepted, and as it's 3in1 you only need one application for three perks, protecting your credit file. It has... -

30mths 0% on spending. The longest available. If you NEED to borrow, doing it at 0% interest is best. Full help & options: 0% Cards. Which'll you get? Use our 0% Spending Eligibility Calc. Here's how it compares... 30mths 0% on spending. The longest available. If you NEED to borrow, doing it at 0% interest is best. Full help & options: 0% Cards. Which'll you get? Use our 0% Spending Eligibility Calc. Here's how it compares...

- Virgin 3in1 (eligibility calc incl pre-approval / apply*): 30mths 0% on spending (18.9% rep APR after).

- Sainsbury's (eligibility calc / apply*): 28mths' 0% spending only (18.9% rep APR).

-

30mths 0% on balance transfers. You can shift debt from other credit cards to this one, so you owe it instead, but at 0%. Here's how it compares against the top 0% balance-transfer-ONLY deals (aim for the lowest-fee card, provided you can repay in that time). Full help & options: 0% Balance Transfers. Which'll you get? Balance Transfer Eligibility Calc.

- Virgin 3in1 (eligibility calc incl pre-approval / apply*): 30mths 0% on balance transfers for 2.5% fee, min £3 (20.9% rep APR after).

- Halifax (eligibility calc / apply*): Up to 41mths 0% on balance transfers for 3.18% fee (18.9% rep APR after).

- Halifax (eligibility calc / apply*): Up to 25mths 0% NO FEE on balance transfers (18.9% rep APR after).

-

30mths' 0% money transfer 'loans'. An additional feature of a few balance transfer cards: you can transfer 'cash' at 0% to your bank account - great for clearing overdrafts or if you need a small cash loan. Here's how the 3in1 stacks up. Full help & options: 0% Money Transfers. Which'll you get? Money Transfer Eligibility Calc.

- Virgin 3in1 (eligibility calc incl pre-approval / apply*): 30mths 0% on money transfers for 4% fee, min £3 (22.9% rep APR after).

- Virgin (eligibility calc incl pre-approval / apply*): 32mths 0% on money & balance transfers for 1.69% fee, min £3. After, its rep APR is 19.9% on money and balance transfers.

- MBNA (eligibility calc incl pre-approval / apply*): Up to 24mths 0% on money transfers for 1.99% fee, and up to 32mths 0% on balance transfers (1.14% fee). After, its rep APR is 22.9% on money transfers and 20.9% on balance transfers. If you can repay quicker, there's an all-in-one with a lower fee. Virgin (eligibility calc incl pre-approval / apply*) also has a 25mth all-in-one card, with a lower 1.5% fee on balance transfers (2% money transfers, both min £3). After, the rep APR is 18.9% spending, 20.9% balance transfers and 22.9% money transfers. The Golden Rules. It's not just about picking the right card, it's about using it the right way...

a) Don't do new borrowing unless you must. If so, always budget & plan to repay before the 0% ends.

b) Don't just apply in hope, as that marks your credit file. Use our quick eligibility calcs to find your best chances or join our FULL Credit Club, where you get that and also free Credit & Affordability Scores.

c) Never miss min monthly repayments, or you can lose your 0% deal and pay far more.

d) Clear debt or balance-transfer before the 0% ends, or it rockets to the standard APR (APR examples).

e) Never withdraw cash. It's often far more than 0%, and just doing it can hurt your credit file. | | | | | | | | | | | | | | | EVERY DAY'S DELAY COSTS. We warned you cheap fixes were disappearing - sadly we were right. Do it now.

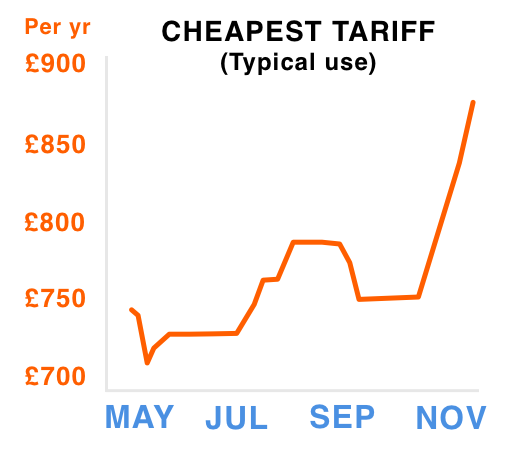

This is the reason we keep nagging. Last week we warned that the cheapest energy deals had gone up from £724 to £822 since May (for someone on typical usage) - now, as more of them have been pulled, it's £863/yr. And with wholesale prices (what energy firms pay for gas and elec) skyrocketing, we don't see any reason why it won't be even higher by next week. So do a 5-min energy comparison ASAP, lock in to a cheap fixed rate and save yourself hundreds - before savings are eroded further. -

A cheap fix typically saves you £200/year and prevents any price hikes. If like 66% of the population you're on a standard tariff, you're massively overpaying. And DON'T think "I switched about a year ago, I'm fine," as your cheap deal may now be over and you'll have reverted to the standard tariff. A cheap fix typically saves you £200/year and prevents any price hikes. If like 66% of the population you're on a standard tariff, you're massively overpaying. And DON'T think "I switched about a year ago, I'm fine," as your cheap deal may now be over and you'll have reverted to the standard tariff.

If you're with British Gas, E.on, SSE, Npower, Scot Power or EDF on a standard tariff, you pay an average £1,063/yr on typical use. And Martin's predicting these firms will announce price hikes of 5-10% in or before January (except SSE which is freezing prices until April and will very likely increase them then, unless things change).

Yet right now do a full market comparison and for the same usage the cheapest fix is £863/yr, and the rate is certain not to rise for a year or more (what you pay of course depends on usage too). The reason for doing a comparison is your exact cheapest depends on your use and region. Plus if we can switch you, we split what we make so you get £30 dual-fuel cashback (£15 single), money you wouldn't get going direct to the energy firm.

-

Save by sticking with the same firm. Comparing is by far the best route, but if you want to stick where you are, you can switch without switching, just by asking your own energy firm for a cheaper tariff. Eg, EDF's cheapest fix is £136/yr less than its standard rate for someone on typical usage. -

Is it safe to switch to a smaller provider? Many are asking if they should stick with the Big 6 following GB Energy's collapse. Here's Martin's answer: "I suspect we'll see some other smaller firms go bust. However don't just go to the Big 6; mid-sized players Ovo, First Utility, Co-op etc have decent backing. Plus even if you go to a small firm, and it goes bust, Ofgem rules now mean there's little risk. Your credit is protected and your energy stays on as you're transferred to another supplier - you may just need to find a new cheap tariff. Don't let it put you off." -

More energy-switching tips.

- It's easy. It's the same electricity, gas & safety - only service, billing and price change. For most, it takes just 5-10 mins to fill out their details on our Cheap Energy Club.

- Paying by monthly direct debit is about 6% cheaper. And if you think your DD's too high, you can challenge it.

- If you've switched before, you may be owed by your old firm. Many have claimed £100s; see Reclaim Credit.

- On prepay? Check if you can switch to a standard meter. Many suppliers do it for free - you could save up to £275/yr. See Cheap Prepaid Gas & Elec.

- Use heating oil? Haggle for the best deals - see our Cheap Heating Oil guide. PS: Give us your energy questions. We're planning a special energy feature next week to answer concerns you have. | | | | | | | | | They can get this email free every week | | | | | | | | | Avoid winter car trouble with cheap breakdown cover - and now our top pick AutoAid has got better

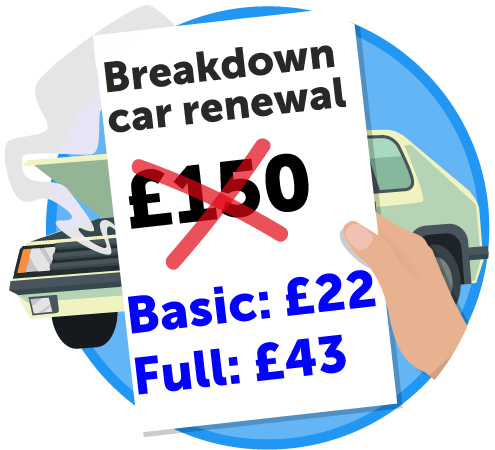

We've been driving you towards AutoAid for years as our top pick for cheap breakdown cover. Its only real issue was it used to be a pay and reclaim service, where you paid first and sent in receipts after the rescue. Now it works like the others and takes care of costs up front, meaning less hassle for you. Here's what you need to know... -

£43/yr for full UK breakdown cover for you + spouse + IMPROVED claims process. AutoAid* covers any car you drive, & spouses/civil partners driving any car, for £42.54/yr. Unlike basic policies, it includes cover if broken down at home, plus onward travel if stuck elsewhere. Equiv AA cover is £100+. Feedback on its service & call-out times has been positive for years & remains good after the change. £43/yr for full UK breakdown cover for you + spouse + IMPROVED claims process. AutoAid* covers any car you drive, & spouses/civil partners driving any car, for £42.54/yr. Unlike basic policies, it includes cover if broken down at home, plus onward travel if stuck elsewhere. Equiv AA cover is £100+. Feedback on its service & call-out times has been positive for years & remains good after the change.

-

£22/yr for basic RAC/AA cover. Use cashback sites to slash costs. Full info in £22 RAC and £25 AA deals. -

NEVER just auto-renew. It's easy to haggle with the RAC, AA & Green Flag. Get on the phone using the deals above as a benchmark and tell 'em you'll leave unless you get a better deal. Some 88% of AA customers (86% RAC, 73% Green Flag) bagged better deals by haggling, according to our latest poll on the subject. If it doesn't work, just switch. Full 'how-to' in our Breakdown Cover Haggling guide. Robert emailed: "My RAC annual renewal was £497 for two cars but I called and was immediately given a £193 discount. Thank you so much MSE." | | | | | 20,000 'free' Megabus tickets (50p booking fee). Tix released daily for Jan and Feb trips in Eng, Scot & Wales. Coach deals

SUCCESS OF THE WEEK: (Send us yours on this or any topic)

"After seeing your article on marriage tax allowance I got online, filled in a few details and got last year's allowance of £209 paid direct to my account. So simple, thanks to your information."

Is new Govt-backed savings bond any good? Read our assessment of the new NS&I Investment Bond announced by the Chancellor in last week's Autumn Statement. NS&I Investment Bond | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | Thu 1 Dec - Good Morning Britain, ITV, Deals of the Week, 7.40am. View previous

Fri 2 Dec - This Morning, ITV, Martin's Quick Deals, from 10.30am. View previous

Mon 5 Dec - This Morning, ITV, from 10.30am

Mon 5 Dec - BBC Radio 5 Live, Lunch Money Martin, noon. Subscribe to podcast

Mon 5 Dec - The Martin Lewis Money Show, ITV, 8pm | | | | Wed 30 Nov - Share Radio, 11.20am

Wed 30 Nov - BBC Radio Cumbria, 'Money Talks', from 6pm

Thu 1 Dec - BBC Radio Tees, 10.35am

Fri 2 Dec - BBC South West stations, breakfast

Tue 6 Dec - BBC Radio Cambridgeshire, 2.20pm

| | | | | | | Q: You can pay via PayPal on some websites, which avoids credit card fees, but still means the payment is taken from your credit card registered with PayPal. Does this method give you the protection of paying with a credit card? Beccy, via email.  MSE Sam D's A: Not normally. As a rule of thumb, you only get Section 75 protection (where the card firm is jointly liable by law with the retailer for anything costing £100-£30,000) if you pay for something directly with a credit card. Use PayPal and you're deemed to be using a third party (ie, you pay it, it pays the retailer), so the protection doesn't apply. MSE Sam D's A: Not normally. As a rule of thumb, you only get Section 75 protection (where the card firm is jointly liable by law with the retailer for anything costing £100-£30,000) if you pay for something directly with a credit card. Use PayPal and you're deemed to be using a third party (ie, you pay it, it pays the retailer), so the protection doesn't apply.

However, there could be a few circumstances where PayPal can work for Section 75. For example, larger retailers may use it as a 'merchant acquiring service', which simply means it acts as a traditional payment processor. Yet it's very difficult to tell if this is the case - so to be on the safe side, assume not. Remember, you still have standard consumer rights protection, and PayPal has its own buyer protection scheme. But it's inferior to Section 75 as it's just the company's internal code, not law. For more info, see Warning: Don't use PayPal to pay on a credit card and Your Consumer Rights. Please suggest a question of the week (we can't reply to individual emails). | | | | | | | That's it for this week, but before we go, with Xmas ad saturation of commercial breaks at this time of year (to little effect, as the poll results above show), our forumites are asking which are most annoying. From bouncing dogs to humming families, let us know which Christmas ads you love and hate. We hope you save some money,

The MSE team | | | | | | |

No comments:

Post a Comment