| | | Incl £5 off £20 Amazon, free delivery trick & 5% cashback

Bagging an online bargain should be a core MoneySaving skill. New stats suggest we've spent £80bn on web purchases this year already. So before you buy, browse our top 19 hacks, codes and tricks - then shop till the price drops with our 44 Online Shopping Tips and 15 Tricks Shops Don't Want You To Know. (Of course, you should never overspend but if there are things you'd buy anyway, this is how to get 'em cheap.) | 1. |  'I haggled £300 off my laptop.' You don't have to sweet-talk your way to a better deal in person - you can do it online via chat windows. Last week Brian tweeted this massive success: "@MoneySavingExp Have tried online haggling a few times and always get a discount. Best was £300 off a £1,200 Dell laptop via online chat." 'I haggled £300 off my laptop.' You don't have to sweet-talk your way to a better deal in person - you can do it online via chat windows. Last week Brian tweeted this massive success: "@MoneySavingExp Have tried online haggling a few times and always get a discount. Best was £300 off a £1,200 Dell laptop via online chat."

See how to haggle online - and tell us how you've done. | | | | 2. | £5 off £20 Amazon trick for much of Eng & Scot... Via Amazon Prime Now app. Do you qualify? See Amazon £5 off. | | | | 3. | ... plus check your Amazon account for a 'free' £7. Selected customers get a £7 code, provided you haven't bought a gift card from it in the last 2yrs. 'Free' Amazon £7 | | | | | 4. | No code or sale for the brand you're after? Get clever. Even if a brand isn't offering a discount on its own site, you can sometimes slash the price via a department store or multi-brand shop. Eg, a Yumi dress was £38 at Yumi, yet this week's 'big brand' sale at House of Fraser has it for £27. See a full list of dept stores which offer multi-brand discounts. | | | | 5. | Buy from China - but with caution. Rock-bottom prices are possible on sites such as AliExpress. Our guide covers how to buy safely. Forumite Tazdev said: "I've just received my first order using AliExpress - a men's analogue quartz watch for £2.58 incl shipping - and I cannot fault the quality." | | | | | 6. | Bag 5% off ALL shopping for three months. Cashback credit cards pay you when you spend on them. The Amex Plat Everyday (eligibility calc / apply*) is the top payer, giving a huge 5% for the first three months (max £100) and up to 1% after (though you need to spend £3k/yr to get any cashback). Of course, always repay it IN FULL each month to avoid the 22.9% rep APR interest.

Now's the perfect time as the 5% covers the high-spend Xmas & Jan sales period. Full help in Top Cashback Cards. PS: To get rewarded by THIS CHRISTMAS see Amex Gold below. | | | | 7. | Set the price YOU want to pay. Got your eye on something? Ask price-drop sites to email you when the cost falls, or when it hits what you're happy to pay. We found £55 Kurt Geiger loafers and got emailed when they dropped to £29. | | | | | 8. | CODES: Body Shop, H&M, Gap. If you're going to buy, always check first if there's a discount code. This week, biggies incl Body Shop £25 off £50, 25% off H&M and Gap 25% off (till 11.59pm on Weds). See ALL codes. | | | | | 9. | Don't bother going out of town - hit the web outlets. Lots of big names such as Argos, Mothercare and Tesco offer up to 70-80%+ off via special online outlets. See Outlet Store Discount List. | | | | | 10. | Buy MORE, pay LESS - the simple trick to get free delivery. Always check what you need to spend. It can be cheaper to add an extra item than pay for delivery. Eg, we found a £49 John Lewis clutch bag, delivery £3.50, but add a £1 Christmas decoration and it's over the £50 free delivery threshold. Even better, with Amazon there's a 'free delivery trick' tool to help. | | | | 11. | Instantly compare prices across scores of stores. A shopbot, or shopping robot, scours a range of e-tailers in seconds to find the cheapest price. As different bots deliver different results, our MegaShopBot finds the best overall. | | | | | 12. | Free £100 gift card in time for Xmas by shifting your spending. The Amex Rewards Gold charge card (eligibility calc / apply*) gives accepted newbies who spend £2,000+ on it in the first 3mths a 20,000 membership rewards points bonus. This can be converted into a £100 M&S/Boots/Amazon etc gift card (exact stores can change). While £2k sounds a lot we're saying shift ALL your daily and Xmas spending to it, replacing cash, other cards etc.

The bonus is usually added soon after you hit the trigger £2,000 spend (though T&Cs say it could take 1mth), then you can choose your reward. Those who hit £2k quickly may make it for Xmas - if not, hopefully January.

Important:

- This is a charge not credit card, ie, you must fully repay each month. No interest's charged, but don't miss repayments or it's a £12 charge & credit file black mark. Only spend if you can afford to repay.

- There's no annual fee in year one - after it's £140/yr. If you don't want to pay, get the reward & CANCEL.

- You will be credit-scored; use our eligibility calc to see your chances of getting the card before applying. Full details & help: Amex Gold. | | | | | 13. | Abandon your online basket to score a discount. See Shopping Secrets for how, incl 26 stores we hear give discounts. | | | | 14. | Check Amazon Europe. It can massively undercut the UK, even with the weak pound. Eg, Sennheiser headphones for £153 on Amazon UK cost £115 delivered from Amazon Italy. Use a cheeky Amazon EU tool. | | | | 15. | Pay just 1p on a credit card to protect £100s. Buy goods costing £100+ and even if you pay just 1p of it on a credit card (and the rest of it any other way), the card company is jointly liable with the retailer for the WHOLE amount. See full Section 75 protection info. | | | | 16. | Check if that Amazon discount's really a bargain. Prices move like a yo-yo, but a nifty price-checker tool tracks the changes. Eg, we found a Fisher-Price Jumperoo at £66 with "45% off" - but when we checked, it was actually £56 the month before. | | | | 17. | Get an eBay alert when the item you want is listed. After something specific? eBay will let you know when your heart's desire is available. MSE Jenny said: "Saw a pair of ankle boots I liked for £110. Set up an eBay alert, someone listed them & I got them virtually new for £20." Set up eBay alerts. | | | | 18. | You've a right to change your mind online - you DON'T in store. You may be surprised to learn you've got more rights when you shop online than on the high street. Here are the rules:

- Online purchases: You've 14 days after delivery to change your mind, and then a further 14 days to send the items back. See web rights.

- In-store purchases: You can only return items if they're faulty (although many store policies go above and beyond this). | | | | 19. | Can you get cashback on your shopping? Don't let cashback sites dictate where you shop - only once you've found where what you want is cheapest should you see if there's cashback for that store available. See full pros and cons in Top Cashback Sites. | | | | | | | | | | | | | | | | | | | | | New deals mean you can save £100s or even £1,000s in credit card interest & get cashback or vouchers on top

A balance transfer means you get a new card that pays off your existing credit & store cards, so you owe it instead, but at 0%. This means your repayments go to clear the debt rather than just interest, so you're debt-free quicker. Now MBNA has launched a new brand, Nuba, offering a £20 Amazon gift card, or you can get £30 cashback with HSBC. Think of the cashback/voucher as money off the transfer fee, then go for the lowest fee in the time you're sure you can repay.

Will you be accepted? Use our Balance Transfer quick eligibility calc (or our FULL Credit Club Balance Transfer eligibility calc, where you also get a free Credit & Affordability Score) to see which cards you've best odds of getting. Plus for some cards the calc can 'pre-approve', meaning you've a 100% chance of getting 'em (you must pass the ID check).

-

Tip 1: Go for the lowest fee in the time you're sure you can repay. Most 0% cards charge a fee to transfer your balance, eg, 3.44% is £34.40 per £1,000 shifted. So calculate how long you'll take to clear the debt, add a bit for safety, then pick the lowest fee within that time. Unsure? Play safe and go long, even with a bigger fee. -

Tip 2: Some are 'up to' 0%, so you may get a shorter deal. That's why we include the best non 'up-to' options. If our eligibility calc suggests you've good odds of getting these, unlike the 'up-tos', you know what you'll get. -

Balance Transfer Golden Rules. Full help, get cashback & ALL best buys: Balance Transfers (APR Examples).

a) Never miss the min monthly repayment, or you could lose the 0% deal and it'll cost far more.

b) Clear the card or balance-transfer again before the 0% ends, or the rate rockets to the higher APR.

c) Don't spend/withdraw cash on these. It usually isn't at the cheap rate and cash withdrawals hit your credit file.

d) You must usually do the balance transfer within 60/90 days to get the 0% & the cashback/gift card. | | | | | 35,000 FREE £14+ Ideal Home Show at Christmas tickets (London & Manchester). We've bagged 19,000 for London (23-27 Nov) and 16,000 for Manchester (10-13 Nov). Free Ideal Home

This Thursday: Millions of Easyjet seats released - cheapest time to book? Covers Easter & May half-term, only happens five times a year. Easyjet tricks

Plus: Bag cheap Xmas train tickets now. Some tix, up to Xmas Eve & beyond, already on sale. Xmas trains

HOT Sim: Unlimited mins & texts, 16GB data, £20/mth + £70 Amazon vch. MSE Blagged. From 9am Wed, EE* newbies can get a 12mth contract + 6mths' free BT Sport via app + 6mths' free Apple Music. The vch should be auto-added - if not, enter code AWOCTMSE70 & it should come within 3mths. A corking deal if you're a high-data user. Need less data? Three offers unltd mins & texts, 4GB 4G data, for £9/mth. Full info & options: Top Sims.

Clarks shoes extra 25% off code on already discounted items, eg, £42 delivered (norm £66). MSE Blagged. Also works on Dr. Martens. Rubbersole

Help to Buy mortgage guarantee scheme to close. Many first-time buyers have contacted us in panic - find out what it really means, incl a video explanation from Martin. H2B scheme closing | | | | | | | | | | | A new card has near-perfect exchange rates AND no fees or interest for taking cash out of overseas ATMs

Regular MoneySavers already know the easiest way to spend cheaply overseas is via specialist credit cards. While most plastic adds a 3% exchange fee when used abroad - so spending £100 of euros costs £103 - these specialist cards don't add that fee, so you get the same near-perfect rates that banks get. So set up a direct debit to repay the card IN FULL to minimise interest & these are an easy way to spend cheaply abroad. This week there's a new kid on the block with a special feature... -

New. 'No ATM charges' overseas card. The new Barclaycard Platinum Visa (eligibility calc / apply*) has no exchange fee till 31 Aug 2018 and unusually it doesn't charge a cash withdrawal fee or interest on overseas (not UK) withdrawals if you pay your bill IN FULL. So it's one of the cheapest ways to withdraw cash abroad (for the first couple of years anyway). New. 'No ATM charges' overseas card. The new Barclaycard Platinum Visa (eligibility calc / apply*) has no exchange fee till 31 Aug 2018 and unusually it doesn't charge a cash withdrawal fee or interest on overseas (not UK) withdrawals if you pay your bill IN FULL. So it's one of the cheapest ways to withdraw cash abroad (for the first couple of years anyway).

Now, you're probably wondering "why the question mark in the title?" Well, it's a Visa card, and they, in our research, tend to have slightly worse underlying exchange rates than Mastercard.

So if you mostly spend on your card abroad, it's probably best to use the best of those - the Creation Everyday Mastercard (apply*) or Halifax Clarity Mastercard (eligibility calc / apply*). But if you take a lot of cash out, Barclaycard's the likely winner (individual ATMs may still charge though).

If you fail to repay these cards in full you'll be charged 11.9%, 12.9% and 18.9% rep APR on spending (more on cash) - see Top Travel Credit Cards (APR Examples). -

Find out which top overseas card you're most likely to be accepted for. The differences between the specialist cards are small, so what really counts is which you'll get. Best practice is to use our free Overseas card quick eligibility calc (or our FULL Credit Club overseas eligibility calc, where you also get a free Experian Credit Score & Affordability Score) to find which, of most top cards, you've best chance of getting - without hitting your credit file. -

How much will it save you? Earlier this week, spending €1,000 (in a mix of ATM and card spending) on the top specialist cards would’ve cost you roughly £867; cash via M&S bureaux (for non-M&S cardholders) £904; a debit card from hell £934; and changing at the airport £990. -

Top prepaid cards. Prepaid cards are available to all. The best ones' rates compete with and can even undercut the cheapest credit cards, but you load cash on them in advance, so you usually get the rate when you load it, not spend on it. This means for good or bad you're at the mercy of currency moves. Top picks are WeSwap and Revolut. Or, if you're buying £600+ of euros or dollars, FairFX adds £20 credit. Full info & more options in Cheap Prepaid Cards. Related info: 17 Overseas Spending Tips | Travel Cash Comparison (iPhone or Android app) | Cheap Flights | Cheap Hotels | | | | | | | | | They can get this email free every week | | | | | | | | | Vodafone and TalkTalk launch new tariffs with 'clearer' monthly costs. But we've found better deals elsewhere

For years broadband pricing's been as clear as mud - but from 31 Oct all providers must clearly show all costs in their headline figures, so no more 'free broadband' offers with line rental costs in the small print. Vodafone and TalkTalk are first to launch 'all-in' deals - but although they may be more transparent, DON'T assume that makes them cheapest. Full info and top picks in Cheap Broadband - in brief... -

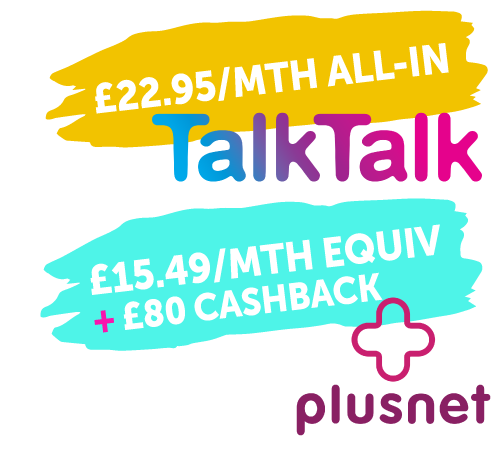

Up to 17Mb standard broadband. TalkTalk's launched a fixed-price deal, but it's smashed by Plusnet's old-style 'free' broadband deal. Here's how they compare: Up to 17Mb standard broadband. TalkTalk's launched a fixed-price deal, but it's smashed by Plusnet's old-style 'free' broadband deal. Here's how they compare:

- TalkTalk: £22.95/mth all-in includes line rental & free router (incl p&p), but not calls. 18mth contract. Plus bear in mind customer service is a factor with TalkTalk - it suffered brand damage after last year's high-profile hack, and 47% scored it 'poor' in our Jan poll, though latest Ofcom stats suggest it may be improving.

- Plusnet: equiv £15.49/mth if line rental paid upfront, £17.99/mth otherwise. Plus you get £80 cashback. Factor this in and it's equiv £8.82/mth or £11.32/mth if you can't pay line rental upfront (no calls incl). 12mth contract. See full Plusnet details. -

Up to 38Mb (faster) fibre broadband. Vodafone offers '£0 line rental'. But the freebies with BT's old-style deal means it beats Vodafone and TalkTalk, and at up-to-52Mb, it's faster too. - Vodafone: equiv £27.72/mth, this is £25/mth all-in cost (£22/mth for existing Vodafone custs), plus a £49 connection fee. 18mth contract, no calls incl.

- TalkTalk: equiv £28.39/mth, this is £27/mth all-in cost, plus a £25 connection fee. 18mth contract, no calls incl. Again, consider customer service.

- BT: equiv £31.84/mth if line rental paid upfront (£33.74/mth otherwise) - this is £10/mth broadband, plus £49 connection fee and £7.95 router p&p (no calls incl). But factor in the £100 prepaid Mastercard & £40 M&S voucher freebies and it's equiv £20.17/mth (or equiv £22.07/mth if you can't pay line rental upfront). 12mth contract. See full BT fibre details. MSE analysis. 'All-in' pricing should make choosing a package easier. Right now though, the top deals are two old-style offers, once you factor in the extra cashback or vouchers. Expect to see more changes before the end of the month, as other providers make their moves to 'all-in'. For an overview of the best deals, see Cheap Broadband (checked daily). | | | | | 30 tulip bulbs bundle £8 all-in (next cheapest £15). MSE Blagged. Or 60 bulbs for £11. Pink, black & red flowers. Park Promotions

Over 55? Get a free will. This month, solicitors offer will-drafting for nowt in 54 English, Welsh & Scottish locations incl Leeds, Swansea and Glasgow. Free wills

SUCCESS OF THE WEEK: (Send us yours on this or any topic)

"I've just saved £430 on my dual-fuel energy bill thanks to the Big Switch. Thanks Martin and team."

MSE's Big Switch Event 5 is now over, but you can still slash bills with our Cheap Energy Club.

FREE £4-£10 Lancôme beauty sample. Get free 5ml serum & moisturiser to suit your skin. Lancôme

Half-term activity week for 16-17-year-olds £50 (free for some). Govt-backed Eng & NI scheme includes 3 nights away & gets 'em abseiling, canoeing & learning life skills during Oct half term. National Citizen Service | | | | | | | | | | How does the prospect of Brexit make you feel about your finances? Three months ago we asked how you felt after the UK voted to leave the European Union. This week Theresa May confirmed we'll start the process by the end of March 2017. So we're asking the same question again to see if anything's changed.

It wasn't a close call... Last week's poll asked what the most appropriate age is for kids to be given their first mobile phone. An overwhelming 71% of you told us somewhere between 10 and 12 is best - 3% thought it a privilege not earned until kids turn 17, while 1% would let them have a mobile before they're six. See the full kids' mobiles poll results. | | | | | | | | | | | | | | | | | | | | | | | | | | | Mon 10 Oct - This Morning, ITV, Martin's Quick Deals, from 10.30am. View previous

Mon 10 Oct - BBC Radio 5 Live, Lunch Money Martin, noon. Subscribe to podcast | | | | Wed 5 Oct - Share Radio, 11.20am

Thu 6 Oct - BBC Radio Manchester, 4.50pm

Tue 11 Oct - BBC Radio Cambridgeshire, 2.20pm | | | | | | | Q: I bought a tablet which developed a fault a few months later. The company offered to replace it, but with a reconditioned one instead - is this right? Judy, via email. MSE Megan's A: No, it's very unlikely this is right, as you should be offered an identical replacement. Under the Consumer Rights Act 2015 you have a right to have goods which develop faults after several months repaired or replaced. Although it's not explicitly set out in the act itself, Government guidance says with mass-produced items such as your tablet, the replacement should be the same make and model. In general it should be identical - and it's hard to see how the company can argue a reconditioned model is identical to one you bought new. If the company isn't able to offer you the exact same tablet, it is allowed to offer an alternative - however, it can't force you to accept it. If you can't reach an agreement, or if the company could have offered you the same tablet and chose not to (eg, if you know the tablet's still being sold), your next step would be to reject the original and insist on a full refund, or keep the faulty tablet and ask for some money back. See our Consumer Rights guide for more on your rights with faulty goods. Please suggest a question of the week (we can't reply to individual emails). | | | | | | | That's it for this week, but before we go, check out this thread from the forum: How popular do you think your own birthday is? Last week included the most popular birthday of the year (there's clearly something in those Christmas drinks - think nine months earlier). Check out just how popular your birthday is across the UK. We hope you save some money,

The MSE team | | | | | | |

No comments:

Post a Comment