| | | Martin's Weekly Briefing: For more tips, alerts & puns, follow Martin on Twitter From 25% off gift cards to decoding price tags, haggling online, free Amazon delivery tricks & more...

For some shopping is a hobby, others a chore, for me it's a challenge. If you're going to buy, how can you get exactly what you want and pay less for doing it? For some shopping is a hobby, others a chore, for me it's a challenge. If you're going to buy, how can you get exactly what you want and pay less for doing it?

Once you understand how shops try to sell and target us - you can turn it on its head and start to take advantage. So here I've compiled some of my favourite hidden shopping tricks, to give you an advantage. | 1. | Buy yourself 25% off gift cards. A new gift card marketplace lets people flog unwanted cards and e-vouchers, usually with 5%-25% off, eg, a £100 card for £75. So if you're due to spend in a store, buy one just before then use it, especially as it can usually be combined with sales & codes.

It's a new concept so feedback's limited, but what we have is good. Some retailers' conditions say cards can't be sold, so check, though biggies Argos and John Lewis say it's fine.

Extra tip: If you're planning a big spend at one of 50+ retailers (eg, Homebase, PC World) buy its gift card in Morrisons and you get 1p/litre off fuel per £10 spent. So £100 gets 10p off, £1,100ish gets a free tank. Full info, incl pros & cons, in Petrol gift-voucher trick. | | | | | 2. | Free 'Amazon delivery trick' tool. You used to get free delivery if you spent £10. Now it's a minimum of £20, but a handy tool provides a way round this; try the Free Amazon delivery tool. | | | | | 3. | Abandon online shopping baskets to tease 'em into giving you a code. Fail to finish a web order and shops often send codes to tempt you back, as Sarah found: "Something went wrong paying on Boohoo so I left it in the basket, next day I got a 15% voucher, so bought it for less". So try doing this deliberately to grab extra discounts. For the best chances see How to get abandoned basket discounts, incl 25 stores we hear do it.

| | | | | 4. | Set the price you want to pay. Use a price drop service which searches 100s of stores and you can either ask it to email you when a price drops or when it drops to a price you're willing to pay. Last week we found a £99 Garmin sat-nav, and asked to be emailed when it dropped. Within days it came in at £79. | | | | | 5. | Revealed. The top-10 high street stores for haggling in. Don't think haggling is something only to try when buying used cars or in foreign bazaars. With chutzpah and charm it can work in big UK high street chains too.

Our latest poll on the best places to try has just closed, the Top 10 places to haggle on the high st reveals the winners plus full info on how to do it. Our own MSE Guy tried it: "I got £150 extra off a TV at Currys just by asking nicely, as it had a clearance sticker. Easy."

And I love a bit of haggling too, I even once used it to impress a date. It worked: she's now Mrs MoneySavingExpert. | | | | | 6. | Always check if there are codes before you buy, eg, right now Body Shop 35%, Urban Outfitters 20%. Use our Discount codes page to see if you can get a reduction. This is especially true of stores such as Body Shop that seem to have a code every week (eg, Body Shop 35% off now). Other big current codes include Urban Outfitters 20% extra off TODAY and River Island 20% off £50. | | | | | 7. | Check store price-tags for hidden codes to reveal if items will be on sale. Store-tag scribbles can be a bargain hunter's treasure trove for hidden info, eg, B14 means it'll drop to £14. See Decipher store tags. | | | | | 8. | There is a way to haggle ONLINE. Shopping on the web is generally cheaper but the one frustration I always had was you can't haggle. That's changing and it's all about retailers offering live chat help. We tried and got 10% off Nike and £55 off a £779 Dell laptop. See How to haggle with online chats. | | | | | 9. | Check if that Amazon discount's really a bargain. Amazon prices move like a yo-yo, but the CamelCamelCamel tool tracks changes, eg, we found Kraken rum '25% off' at £24.65, but the tool showed it was £23 two months ago, so the deal ain't all that. | | | | | 10. | No code for the store you want? Get clever. Department stores or multi-brand shops may provide a workaround. For example, previously we found Clarks Orinoco boots, £60 at Clarks, no code, yet a 40%-off-everything Brantano code meant you got the boots for £36. | | | | | 11. | Bag hidden local eBay bargains. eBay sellers often specify items - from designer sofas to PS3s - as 'collection-only', which often results in fewer bids, so prices are lower. You can't search for 'em on eBay, so we built the Local eBay Deals Mapper (also iPhone & Android apps) to help you out. Chris tweeted: "Great local eBay pickup tool. Large Pets at Home rabbit hutch - RRP £180, got it for £40, like new." It doesn't currently always show 100% of results. We're working to fix it, but it mostly works well. | | | | | 12. | Find hidden Amazon 75%+ bargain basements. It's possible to manipulate URLs (web address) to build your own pages and search criteria, so we built the Amazon Discount Finder which does it focusing on Amazon's level of discount (though see point 9) to build you special pages, eg, beauty 70%+ off* and TV 25%+ off*. | | | | | 13. | Bag 5% off ALL shopping for three months. Cashback credit cards pay you when you spend on them. The Amex Everyday* (eligibility calc) is the top payer, giving a huge 5% for the first three mths (max £100) and up to 1.25% after. So if you've a big one-off purchase planned it's perfect.

Always repay it IN FULL each month or the cashback gain is dwarfed by the 22.9% rep APR interest. Stephen tweeted me: "Made £140 in 10 wks with cashback on my usual purchases with Amex card you mentioned, thanks". Full help: Cashback Cards. | | | | | 14. | Check if the price ends in 7, 8 or 1. If so it's often likely to be clearance stock, and that's a very valuable piece of knowledge in your haggling arsenal. As if it is in the clearance you can ask and see if they'll discount it further. See Crack clearance codes. | | | | | 15. | Play the John Lewis price promise to bag a free warranty. Buy electricals from John Lewis and you'll get a free 2-5-yr warranty; couple this with its 'never knowingly undersold' policy and get cunning.

It promises to match the price of an identical item you find cheaper at any retailer that has physical stores (not web-only). So find the cheapest price for what you want, then show proof (pic on yr phone) to John Lewis, get it to match the price and get the warranty too. | | | | | 16. | Can you get cashback on your web purchases? Cashback websites give you a cut of the money they make from referring traffic to e-tailers. So once you know where what you want is cheapest, see if a cashback site can give you extra money back. See our Top Cashback Sites guide for the right sites + pros & cons. | | | | | 17. | The 'Is Amazon Europe Cheaper?' tool. Oui, non, nein, ja. A cheeky tool compares prices across Amazon EU sites. Forumite deanos used it: "I bought a Philips sound system for £230 delivered from Amazon Germany. Was selling for £450 over here." | | | | | 18. | You've a right to change your mind online but NOT in store. Buy in store and legally you've only a right to return faulty goods (defined by the SAD FART rules). So buy the wrong colour, size, or just change your mind, and you've no rights (eg, if they offer a credit note, and say you need a receipt, actually that's generous).

However, buy online and for most goods you DO have a right to change your mind, as long as you let them know within 14 days and send it back within the next 14. See Online return rights. | | | | | 19. | Instantly compare prices across scores of stores. A shopbot, or shopping robot, compares a range of e-tailers in seconds to find the cheapest price. Our MegaShopBot instantly finds the right one for your item, be it games, tech or owt else. | | |

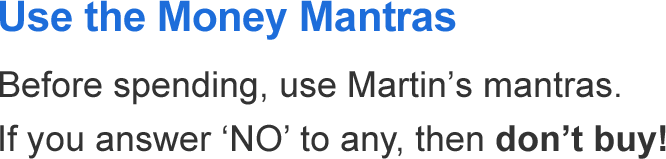

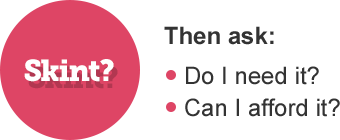

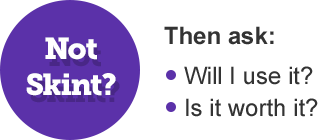

These are just the start - also check out 15 Shopping Secrets and 43 Online Shopping Tips. PS: And do remember my money mantras below... | | | | | | | | | | | | | | | | | | New. Longest-ever no-fee balance transfer credit card. Done right it means you can cut debt costs to nowt

If you've existing debt on credit/store cards, a balance transfer card pays them off for you, so you owe it instead, but at 0%. A new 24mth 0%'s launched with NO FEE for balance transferring, so done right there's no cost. Huge savings are possible, such as Victoria's: "Thanks to you I got my fiancé to balance transfer to a 0%, saved £1,500". Yet don't just apply in hope, that hits your credit file, first use our eligibility calcs to find which top cards you've best odds of getting.

-

Tip 1: Go for the lowest fee in the time you're sure you can repay. Most 0% cards charge a fee to transfer your balance, eg, 2.5% is £25 per £1,000 shifted. So calculate how long it'll take to clear the debt, add a bit for safety, then pick the lowest fee within that time. Unsure? Play safe and go long, even with a bigger fee. -

Tip 2: Some are 'up to' 0%s, so you may get a shorter deal. So we include the best non 'up-to' options above. Use the eligibility calc and if you've good odds of getting a non 'up-to' card, you get more certainty. -

Follow the Balance Transfer Golden Rules. Full help & ALL best buys: Balance Transfers (APR Examples).

a) Never miss the min monthly repayment, or you can lose the 0% deal and it'll cost far more.

b) Clear the card or balance transfer again before the 0% ends, or the rate rockets to the higher APR.

c) Don't spend/withdraw cash. It usually isn't at the cheap rate and cash withdrawals hit your credit score. PS: Got a credit card question? Tweet @MoneySavingExp Fri, 1pm - 1.30pm and MSE Helen & Rosie will answer. | | | | | | | | | | | | | | | So £10 of points gets you £20, but don't stop there - 4 tricks that boost your points stash and max the gain

Tesco is making big changes to its loyalty scheme. But we only know what it's scrapping, not what it may launch. It says this is the last time it'll run a 'double-up' promotion. So with the latest batch of Clubcard vouchers dropping through letterboxes, now's the moment to ensure you use Tesco points boost tricks. Here's key info... -

Find £100s of lost Tesco vouchers. First, speedily check if you can reclaim lost/unused Tesco vouchers (you can go back two years), like AnnaV, who said: "WOW - I've got £413 of unspent vouchers. Ridiculously excited." Find £100s of lost Tesco vouchers. First, speedily check if you can reclaim lost/unused Tesco vouchers (you can go back two years), like AnnaV, who said: "WOW - I've got £413 of unspent vouchers. Ridiculously excited."

-

Last-ever double-up. Halve toy, BBQ, home & other costs. From now until Sun 26 Jun you can swap every £5 of Clubcard vouchers for £10 in eleven categories incl toys, entertainment, garden, home, cosmetics, sport and travel. It works both in store and online at Tesco Direct. Eg, a £160 kids' mountain bike reduced to £70 is just £35 in vouchers. Full info and hot suggestions in Tesco double-up. -

Before doubling up check if you can quadruple up. The Clubcard Boost scheme allows you to swap vouchers for up to 4x their value. So £10 becomes £40 at Café Rouge, Pizza Express or London Zoo, £30 at Goldsmiths or £20 on train tickets. For what's best value, see our Tesco Clubcard Boost top 10 rewards. Tesco's confirmed to us Boost will stay and in fact "plans to add to it". -

Max your points collecting. You can add to your future Clubcard stash by answering surveys and giving insurance renewal dates. See Earn Tesco pts without spending.

| | | | | FLASH Habitat 25% off almost everything code. 1 day only, starts Wed 7pm. Online & in stores. Habitat

15% off Ebookers UK & world hotel code. MSE Blagged. Ends Sun. Travel by 31 Oct. Ebookers

Can you reclaim £1,000s of past charges for busting your overdraft? Yesterday the competition authority proposed a cap on these charges, but some can still reclaim £100s or £1,000s. See Reclaim Bank Charges For Free.

75 photo prints £2 (or 200 for £3.75) code. MSE Blagged. We can't see negatives in these deals. Cheap prints

Hot home-insurance deals including 'free' £70 Nutribullet, £80 M&S or £60 Vax. MSE Blagged. We've blagged freebies if you get combined buildings & contents policies till 31 May. a) Together Mutual*, £80 M&S vch; b) Direct Line*, £70 Nutribullet; c) Churchill*, £60 Vax steamer - they arrive 60-120 days after start date. Important: We're not saying they're cheapest; always compare with results after combining comparison sites. Yet they can be a winner, as Steve emailed: "Insurance was £110 but with £80 M&S vch, real cost £30 - happy days." Full info: Cheap Home Insurance.

Beauty-ful Deals Free £12ish L'Occitane minis & £10 off £25 voucher. Plus we've blagged a Crabtree & Evelyn 30% off code. | | | | | They can get this email free every week | | | | | | | | | If so and like most people you're on their standard tariffs, UNTIL FRI you can typically save £340/yr

It's warm and the last thing on your mind is energy, yet 5mins' effort now can protect your pocket over winter. What we believe is the cheapest big tariff since 2011 (though it's a minefield, so can't say 100%) ends on Friday. It's for EDF newbies only via our Cheap Energy Club, it's easy to do & potential savings are HUGE, as Tom tweeted: "@EnergyClubHelp Just switched to EDF & will save nearly £500/yr. Hurrah." -

Ends 4pm Fri. Super-cheap EDF fix. This new MSE Blagged EDF tariff (not NI or prepay) is a 1-year fix, so the cheap rate (not what you pay, that changes with usage) is locked in over next winter. For many it's the cheapest tariff for years. If, like 70% of the UK, you're on a standard Big 6 tariff (the firms in the headline + EDF), with typical usage on average you pay £1,060/yr - switch to this and it's £725/yr, plus you get £30 cashback. Ends 4pm Fri. Super-cheap EDF fix. This new MSE Blagged EDF tariff (not NI or prepay) is a 1-year fix, so the cheap rate (not what you pay, that changes with usage) is locked in over next winter. For many it's the cheapest tariff for years. If, like 70% of the UK, you're on a standard Big 6 tariff (the firms in the headline + EDF), with typical usage on average you pay £1,060/yr - switch to this and it's £725/yr, plus you get £30 cashback.

It's available until 4pm Fri (unless we hit the 25,000 cap first). But you can't get it direct from EDF, you must go via our Cheap Energy Club comparison, which also means you can double-check it's your cheapest, as rates vary with use & region. -

Key need-to-knows. Worth quickly reading this info about it first:

- Existing EDF customers sadly can't get it. Though still do a comparison - big savings are possible elsewhere.

- Switch to it and we give £30 dual-fuel/£15 single-fuel cashback. That's roughly half what we're paid. Plus you also set a Cheap Energy Club alert, so if it's no longer cheap (eg, after a year), we alert you to switch again.

- It's avail for dual fuel or elec-only. But you must pay by direct debit or (more costly) quarterly cash or cheque.

- If you leave early there are £25/fuel exit fees. Though if you move home, it can move with you, for free.

- EDF's customer service rating is 55% 'great', 33% 'OK'. Good for the Big Six, some smaller players are better.

- It's also on MoneySupermarket. We're in the same group; it's nowhere else. Yet there you don't get cashback. -

Worried about switching? Don't be. Here are 5 easy need-to-knows. Full info in Cheap Gas & Elec, in brief:

1) There's no downtime when you switch. Your electricity and gas stay on.

2) It's the same gas, same electricity, same safety. Only customer service and price change.

3) To get the lowest price, pay by monthly direct debit. Just ensure you give regular meter readings.

4) If you're in credit when you switch, the provider should give you money back. If not, see Get Credit Back.

5) If your existing tariff has exit fees, factor these in. Note, though, they can't charge 'em in a fix's last 49 days. | | | | | Free Mental Health & Debt Help booklet 2016. It's Mental Health Awareness Week. If you're struggling with debts too, see our free 44-page Mental Health & Debt Help 2016 PDF and read Martin's new The Money and Mental Health Policy Institute - what'll it really do? blog.

SUCCESS OF THE WEEK: (Send us yours on this or any topic)

"Thanks MSE, my husband and I have overhauled our banking and made £420. We switched joint account to First Direct earning £100 and sole accounts to M&S Bank and Halifax earning £320. And thanks to the Balance Transfer Eligibility Calc we moved both our credit card balances to MBNA at 0% for 36 months."

Hot Diamonds 35% off EVERYTHING incl up to 50% sale code, eg, £60 earrings £19. MSE Blagged. Hefty discounts on women's jewellery site, incl £80 necklace £26, £250 bangle £49. Limited stock. Free delivery. Hot Diamonds

5,000 FREE £13 Spin - The Cycling Festival tickets. In London this weekend (20-22 May). Cycling festival | | | | | | Should parents be allowed to take kids out of school for a holiday?

Shop small and you'll be rewarded. In our latest annual haggling on the high street poll, last week a whopping 97% of those who had tried to haggle in a small, independent shop had had some success. Remain a regular and you may well be rewarded every time. Your next best odds are with charity shops and Carphone Warehouse - where 77% of those who tried had gleaned a discount. See the full range of haggling success results. | | | | | | | | | | | | | | | | | | | | | | | | | | | Thu 19 May - Good Morning Britain, ITV, Deals of the Week, 7.40am. View previous

Fri 20 May - This Morning, ITV, Martin's Quick Deals, from 10.30am. View previous

Mon 23 May - This Morning, ITV, from 10.30am

Mon 23 May - BBC Radio 5 Live, Lunch Money Martin, noon. Subscribe to podcast | | | | Wed 18 May - Share Radio, 11.20am

Thu 19 May - BBC Radio Manchester, 4.20pm

Tue 24 May - BBC Radio Cambridgeshire, 2.20pm | | | | | | | Q: Will having a company credit card affect my credit score? Glenn, via Twitter. MSE Maeve's A: As long as it's not your business, it shouldn't have an impact because corporate cards tend to be registered to your employer, not you, even though it may have your name on it. Bills and correspondence will most probably go directly to your firm's accounts department. It's their responsibility to pay them. It's a bit like being a second cardholder on a credit card where the primary cardholder is responsible for the debt. While this is normal practice, do double-check with your employer. When you've got the card, check your credit file to ensure you can't see it. Find out how to do that using our Check your credit score for free guide. Please suggest a question of the week (we can't reply to individual emails). | | | | | | | That's it for this week, but before we go, check out this thread from the forum: Dunkable biscuits. Tea and biscuits are a British institution. But some biscuits are better for dunking than others. Are you with Peter Kay who thinks 'unbreakable' Hobnobs are the SAS of biscuits for dunking? Join the discussion and share your biscuit(s) of choice. We hope you save some money,

Martin & the MSE team | | | | | | |

No comments:

Post a Comment