| Plus... Green Homes Grant ending?, free wills & happy birthday MSE  THE TOP TIPS IN THIS EMAIL

| | Brit Gas, EDF, E.on, Npower, Scot Power & SSE announce £100 price hikes, so time for...

MSE's Big Energy Switch 17

Two CHEAPER than the cheapest deals, lock in prices for 1 year, save £200+/yr Martin: "It's predictable, but depressing. The big six energy firms have just announced new prices for standard tariffs (those most people are on) from 1 April. All are hiking them by about 9%, to within £1 of the max under the new price cap - a jump of £96/yr on avg for those with typical usage. "Yet YOU NEEDN'T ACCEPT THE PRICE HIKE, as there are tariffs £100s cheaper to switch to, many of which are fixes meaning the rate is locked in. Our MSE Cheap Energy Club now includes the big firms' new rates (not Scot Power - as we await its data), so take 5mins to do a comparison to see your exact saving, or use our Pick Me A Tariff tools where we do it all for you this year (including all the deals below) and, if you want, in future too.  "To help, on the site's 18th birthday (more below) we've utilised the huge reach of this email to negotiate two 1yr fixed tariffs that undercut even the cheapest deals available on the open market. There's top service provider So Energy and top green provider Pure Planet , which has a good service rating too (sadly, they're not available on prepay or in N Ireland). "To help, on the site's 18th birthday (more below) we've utilised the huge reach of this email to negotiate two 1yr fixed tariffs that undercut even the cheapest deals available on the open market. There's top service provider So Energy and top green provider Pure Planet , which has a good service rating too (sadly, they're not available on prepay or in N Ireland). "And this is really worth doing, as Sarah tweeted me: '@MartinSLewis just gone on to MSE energy saving and switched, saving over £400 on my energy bill, £500 with the price increase in April. Thank you.' Now over to the team for full details..." The tariff prices below are averages; yet real prices depend on region and usage. All links go via our Cheap Energy Club comparison, so you can see your exact winner, price and more tariff details. Find choosing confusing? Most people actually prefer to let us help them through it. The MSE Pick Me A Tariff tools are perfect for those unsure or nervous about switching or choosing. And don't worry, they are whole-of-market, including all the top deals we list here. Savings below are based on someone with typical direct debit use paying the new Apr-onward £1,138/yr price cap. - Joint-cheapest deal. So Energy. A top service 1yr fix with 100% renewable elec. Avg price: £920/yr on typical use. Service rating: 4.5/5 (top). Save: £218/yr. 12,000+ avail until Fri 12 Mar at the latest.

The So Energy So Carrot Essential v2 - Green tariff is a version of its standard 12mth fix, but we've got it to add £57 bill credit on top of our usual £25 MSE cashback. Include these in the price, and it's the joint-cheapest deal (tying with our other winner below).

So Energy is a decent-sized firm, with about 240,000 customers. It also finished top in our latest customer service rankings.

Who can get it? New dual-fuel (ie, gas & elec) custs

Smart meters? Not required

Renewable? 100% renewable elec, not gas

Early exit fees? £10 (unless within 49 days of the fix ending)

Payment? Monthly direct debit only

Comparison link above: Filtered to include all but lower service firms or those with no feedback

- Joint-cheapest deal. Pure Planet. A good (+ MSE enhanced) service 1yr fix with 100% renewable elec and offset gas. Avg price: £920/yr on typical use. Service rating: 3.8/5 (good). Save: £218/yr. 10,000+ avail until Fri 12 Mar at the latest.

The Pure Planet 100% Green 12m Fixed Feb 21 v1 tariff is a version of its standard 12mth fix, but we've got it to add £26 bill credit (£13 for elec-only) on top of our usual £25 MSE cashback (£12.50 elec-only). Include these in the price, and it's the joint-cheapest deal (tying with our other winner above).

Many tariffs these days are 100% renewable electricity, but this is also 100% carbon-offset gas (it pays to offset the environmental impact of the gas). See more on how green is green?.

Pure Planet has over 200,000 customers and its service rating is a decent 3.8/5 - plus it has agreed to 'MSE enhanced service', meaning if it isn't helping you, contact us so we can escalate issues (pls talk to it first though).

Who can get it? New dual-fuel (ie, gas & elec) and elec-only custs

Smart meters? Not required

Renewable? 100% renewable elec, 100% carbon-offset gas

Early exit fees? £30/fuel (unless within 49 days of the fix ending)

Payment? Monthly direct debit only

Comparison link above: Filtered to include all but lower service firms or those with no feedback | To get those two tariffs, use the email this MSE weekly newsletter is sent to. As these are 'collective' tariffs, the rules require 'membership' to get them. We define that as wide as we can, by being a 'member' of either Cheap Energy Club or this weekly email by 4pm on Tue 23 Feb. So if you're new to Cheap Energy Club, but you get this newsletter by email, use that same email when logging in. | - Cheapest big-name deal. E.on (newbies only). A big name 1yr fix with 100% renewable elec. Avg price: £923/yr on typical use. Service rating: 3.0/5 (lower). Save: £215/yr. Ends: Wed, 3 Mar.

While not technically part of our Big Switch, we'd already blagged this E.on Fix 1 Year Exclusive February 2021 tariff that's the cheapest from a big name (something many of you tell us you like), including the £25 dual-fuel cashback (£12.50 for elec-only).

Again, the fixed rate (not the price, which varies by use) lasts for 12mths, so you're protected against hikes until spring 2022.

E.on has a lower service rating than the Big Switch winners, but for this specific deal, it has agreed to 'MSE enhanced service', meaning if it doesn't sort it for you, we can escalate issues directly.

Who can get it? New dual-fuel (ie, gas & elec) and elec-only custs

Smart meters? Required if you don't have them (unless they can't be fitted), but they're free

Renewable? 100% renewable elec, but gas isn't green

Early exit fees? £25/fuel (unless within 49 days of the fix ending)

Payment? Monthly direct debit

Comparison link above: Filtered to exclude all but big-name deals PS: There is a British Gas 14mth fix incl 1yr's FREE heating insurance tariff, priced at an avg £937/yr on typical usage (including MSE cashback). Its big advantage is the insurance, which it'd normally charge £138/yr for. If you don't pay by monthly direct debit, you either can't get the deals above or you'll pay a higher rate. However, that doesn't mean you shouldn't act: - Billed (not prepay) meter but not on monthly direct debit? The cheapest thing to do is to switch to monthly direct debit, as the top deals are only via this payment method. If you're not happy to do so, you can still do a comparison based on your payment method.

- Are you a prepay customer? Those on prepay sadly have a less competitive market to choose from, and usually pay more. The prepay cap is also increasing, so try our prepay comparison - savings are smaller, but still possible. If you're willing to, it is likely you would make far bigger savings in the long run by switching to a credit meter. For help on that, see Cut prepay energy costs.

- In Northern Ireland? Sadly our Cheap Energy Club - like all main comparisons - doesn't include NI as it has a separate energy market. But you can get more info in Cheap NI Electricity or do a comparison via the Consumer Council for Northern Ireland's tool.

Here's a quick Q&A - for more, see the full Cheap Energy Club FAQs.

Q. Is switching risky? Could I be cut off? No, as no one visits your home (unless you want/need a smart meter), and it's the same gas, same electricity and same safety. The only things that change are price and service. See our How switching works FAQs. Q. Does MSE make money from this? Yes, provided it's a tariff we can switch you to. Like all energy comparison sites we're paid (though unlike others, we don't hide tariffs that don't pay), and we give you roughly half as cashback (£25 dual fuel, £12.50 single fuel). You wouldn't get this going direct (not that the deals above are available directly anyway), so it's a win-win. The rest helps cover our costs and hopefully makes us some profit. More switching and energy help in the links below... Switching with smart meters | Why's my bill risen when I've fixed? | Reclaim credit | Switching-in-debt help | Switching if I've solar panels | How direct debits are set | Can I pick a switch date? | How do you compare my rates? ____________________________

Ask Martin anything to celebrate the 100th show 8.30pm Thu, ITV: Martin's Money Show Live

Back to Martin: "It's not just MSE's 18th birthday this week. It's also the 100th episode of my half-hour show. Back to Martin: "It's not just MSE's 18th birthday this week. It's also the 100th episode of my half-hour show. "To celebrate, as well as a brief look back and all the latest money need-to-knows to save you cash, we're leaving space for an 'Ask Me Anything' - you can tweet suggested questions to me via @MartinSLewis, and if possible, please use the show's hashtag #MartinLewis. Do tune in or set the Betamax. It pays to watch." PS: Did you miss last week's Pension Special? This ITV Hub link lets you watch it now. | | DON'T believe the fake 'Martin Lewis' or 'MSE' ads

Lots of scam ads litter social media and even newspaper websites - some of these lie that we or Martin promote Bitcoin, binary trading etc. See Fake ads warning. | New. We reveal the top broadband for SERVICE... or to slash costs, hot deals to get b'band and line for just '£14/mth', saving many £200+/yr We're MSE, so our usual price-focused broadband help is about pouncing on short-lived promos. Yet for some, broadband frustrations result in lost hair or gnashed teeth, so this week we're looking at service too. As broadband availability is postcode dependent, links go via our Broadband Unbundled comparison, which shows if you can get the top deals. They include customer service ratings, but you can't currently sort by service, though we're working to add it. -

New. Zen broadband wins on service (plus £20 off sign-up fee). Zen's topped every customer service poll we've done since 2015, and is often raved about by tech websites. Our latest poll closed yesterday and it won again, with 200+ of its customers voting to rate it 9.4/10 overall. That's extremely high when you consider broadband service ratings are normally low, and most major providers' scores are usually between 4/10 and 7/10. Price-wise, Zen's a little cheaper than most standard deals, but more than the cheap promos. To help, till Thu 4 Mar we've got it to waive the usual £20 set-up fee, so you can get... New. Zen broadband wins on service (plus £20 off sign-up fee). Zen's topped every customer service poll we've done since 2015, and is often raved about by tech websites. Our latest poll closed yesterday and it won again, with 200+ of its customers voting to rate it 9.4/10 overall. That's extremely high when you consider broadband service ratings are normally low, and most major providers' scores are usually between 4/10 and 7/10. Price-wise, Zen's a little cheaper than most standard deals, but more than the cheap promos. To help, till Thu 4 Mar we've got it to waive the usual £20 set-up fee, so you can get...

- Zen 35Mb fibre b'band & line: £29.99/mth on a 12mth contract.

- Zen 66Mb fast fibre b'band & line: £34.99/mth on a 12mth contract.

Whether you go for service or price is, of course, personal preference, but if you've had problems and need a reliable, always-on connection (tech reviews say its router's extra settings help with reliability) with a firm that anecdotally fixes problems speedily, then it's worth considering.

- Or halve your broadband cost with the market's cheapest deals. Many who are out of contract are paying over double these rates, often for slower speeds.

TOP NEWBIES' HOME BROADBAND & LINE DEALS

Eligibility depends on postcode, all links go via our broadband comparison, which shows what's available | | DEAL + EQUIV COST (1) | HOW GOOD IS IT? | Shell Energy 12mth contract

MSE Blagged

- 11Mb standard speed £13.83/mth

- 35Mb fibre £17.83/mth

Customer service: 4.1/10 | Cheapest standard and fibre b'band & line. Apply via this Shell 11Mb deal link and you pay £17.99/mth, but you automatically get £50 bill credit within 3mths. In total, that's a £165.88 outlay over the year's contract, equiv to £13.83/mth. For faster speeds, Shell's 35Mb deal is £21.99/mth, also with £50 auto bill credit, equiv to £17.83/mth over the year.

| Ends Sun. Virgin 18mth contract

MSE Blagged

- 108Mb mega-fast fibre £18.40/mth

Customer service: 4.2/10 | TOP PICK: Cheapest MEGA-FAST fibre broadband & line. For serious speeds, apply via our Virgin Media link and it's £23.95/mth, but you automatically get £100 credit applied to your first bill, so pay nothing for 4mths. In total, that's £331.10 over the 18mth contract, equiv to £18.40/mth. However, it's only avail to 52% of households (you're told when applying if you can get it) and cust service is on the mid to low side compared to others. | New. Vodafone 24mth contract

- 63Mb fast fibre £19.62/mth

Customer service: 5.5/10 | Cheapest FAST fibre b'band & line. Apply via this Vodafone link and it's £22.95/mth, but you can claim (it's not automatic - so put a note in your diary) either an £80 Amazon, Tesco or M&S vch. If you'd spend that anyway, factor it in and the cost is equiv to £19.62/mth over the 2yr contract (there will be a price rise in Apr that will add around £1/mth). | Ends 11.59pm today (Wed). Plusnet 18mth contract

- 36Mb fibre £19.66/mth

Customer service: 6.5/10 | Cheap fibre b'band & line and good service rating. Apply via this Plusnet link and it's £22.99/mth, but you can claim (it's not automatic - so put a note in your diary) a £60 prepaid Mastercard - almost as good as cash. Factor that in and the cost is equiv to £19.66/mth over the 18mth contract (there will be a price rise in Apr that will add about £1/mth). It also has clearly the strongest cust service rating of the sub £20/mth fibre deals.

| | Customer service grades are from our Feb 2021 poll. (1) To compare, we use 'equivalent costs' - adding all costs, deducting promo credits and averaging over the contract. | - Broadband need-to-knows:

- Firms can only advertise speeds if 50%+ of customers get that at peak times. Plus all providers above tell you the estimated max you're likely to get before applying. Do check your current speed and see our speed boosting tips.

- Switching usually means about two hours of downtime. You're told the switch time in advance.

- Engineers won't usually need to visit, though they may do with some switches involving Virgin. If you're switching from Virgin, you may need a new line installed if you don't have an Openreach one (as it supplies most other firms). Engineers can visit your home during lockdown (with social distancing in place), but if they need to, there may be a delay as Openreach is prioritising urgent issues. If switching to Virgin, about 60% won't need a visit (if in this group, you're told BEFORE signing up). Of the remaining 40%, an engineer may need to visit your home or may just need to visit the local exchange, though you won't know which at sign-up. | FREE 50p - £10 to spend at Sainsbury's for virtually ALL Nectar users. See Free Nectar points. New. 'I paid £94 extra on a £265 order' - how new post-Brexit delivery charges work. Many shoppers have been caught out by couriers demanding import VAT, customs duty and handling fees, when some are unaware their Amazon/eBay etc order was even from abroad. So we've a new EU parcel charges rights guide. FREE £100 switching to top service bank First Direct or FREE £125 HSBC switch. A reminder that First Direct* newbies can now get a FREE £100 to switch to it, and if needed most get a £250 0% overdraft. It's consistently been first or second in our bank service polls for years - it was 91% 'great' in the most recent. FREE £125: Alternatively you can get more, via a FREE £125 switching to HSBC Advance*. Or a FREE £130 of wine + £50 to charity + 2% interest on up to £1,000 with Virgin Money*. Full details, including crucial ELIGIBILITY info, in Best Bank Accounts. Watch Martin's pensions tax trap warning - it could save you £10,000s. Plus how to get totally free 1-on-1 pensions help and guidance from the official pensions help service. See Martin's pension warning. Get a FREE solicitor-drafted will if you're 55+ (norm £150+). Free Wills Month happens every Mar and Oct. It allows those aged 55+ across much of the UK to get a solicitor-drafted (or updated) will for free, in the hope you'll leave a bequest (something in your will) to one of their partner charities. Bookings open next Mon at 9am, but go quick as they tend to fill up fast. Full details, incl which areas and charities are taking part this time, in Cheap Wills. Rumours the £5,000 Green Homes Grant vchs could be pulled - if you want it, hurry. The Govt's overcomplex, cumbersome but lucrative Green Homes Grant gives up to a free £5,000 towards some home improvements for homeowners in England. We've already warned there'd be less in funding next tax year (from Apr), but now newspaper reports say it may be pulled altogether at the end of this tax year. Whether you can still do it in time if that happens is questionable, but it's still worth investigating if it may be right for you. Full info in Green Homes Grant. | Happy birthday to us. Happy birthday to us.

Happy 18th birthday MSE.

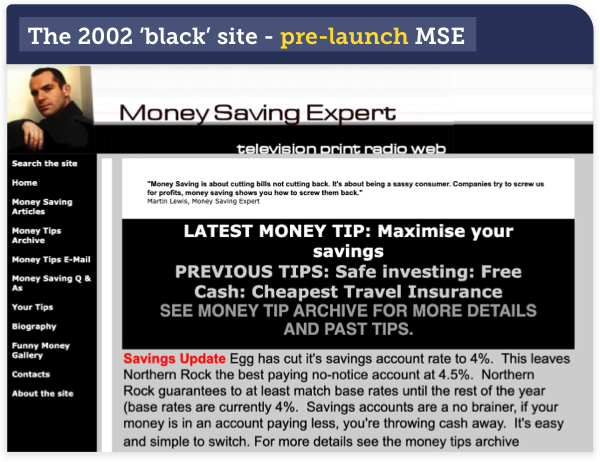

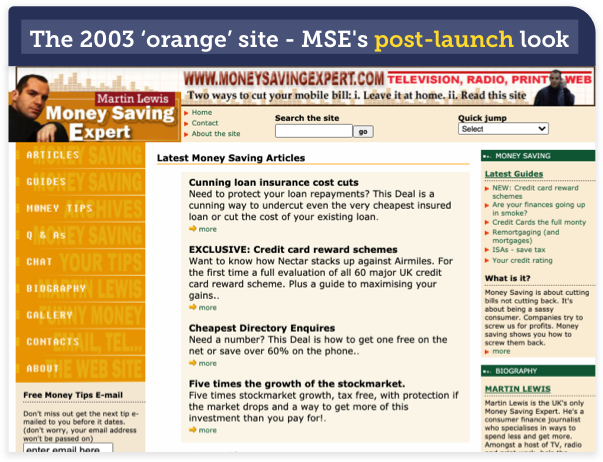

We hope you've saved billions, you see. This week, 18 years ago, Martin officially launched MoneySavingExpert, meaning we're now truly grown up (sadly the pubs are closed so we can't have a drink there). In truth, there'd been a homepage-type version - the 'black' MSE site - since summer 2002 (see MSE's early history), but the point things got serious was Feb 2003, which we count as its real birth.  Martin had put the build work out to tender, and paid a web designer in Uzbekistan the princely sum of £80 to build the 'orange' site that included a forum. Rather scarily, that's the only capital outlay he ever put in. We'll let you decide if it was a good return. Martin had put the build work out to tender, and paid a web designer in Uzbekistan the princely sum of £80 to build the 'orange' site that included a forum. Rather scarily, that's the only capital outlay he ever put in. We'll let you decide if it was a good return. It started as a one-man band, with a stated aim "to cut your bills without cutting back", with nerdily-detailed, unbiased guides on all areas of consumer finance, so you could give yourself a money makeover and save £1,000s. Yet it was also about finding and exploiting product loopholes, leading to the aggressive motto: "A company's job is to screw you for cash, our job is to screw 'em back". As the site, and Martin (as he says himself), matured, these thoughts merged into our long-standing mission: "Cutting your costs, fighting your corner".  Things took off at speed, helped as its launch coincided with the growth of Martin's own profile on Radio 2, This Morning and elsewhere. By the end of Feb 2003, some 5,300 people had signed up for the weekly Martin's Money Tips email. By Apr it was 10,000, and little more than a year later, it was 100,000. Things took off at speed, helped as its launch coincided with the growth of Martin's own profile on Radio 2, This Morning and elsewhere. By the end of Feb 2003, some 5,300 people had signed up for the weekly Martin's Money Tips email. By Apr it was 10,000, and little more than a year later, it was 100,000. In late 2003, the first MSE team member, Brendan, a part-time webmaster, came on board. By 2005, with a team of eight, our first big campaign - reclaiming bank charges - started, including the now-famous template letters. That campaign resulted in more than £1 billion reclaimed from the banks, before a legal quirk kiboshed it. By 2007, there were a million people on the email list. Do take a look at the Internet Archive to see what the site looked like when you joined. Not long after, in 2008, the MSE Charity was set up. And soon we even got big enough to do our own MSE leaders' debates at general elections, something we now do each time. There've been many other campaigns, bigger even than bank charges. It's estimated MSE and Martin together helped people get £12 billion back in PPI alone (while that's now closed, you can still reclaim tax on PPI payouts), and possibly 100,000s have rebanded their council tax thanks to us. In 2012, MSE joined MoneySupermarket Group. Part of the deal was a binding ethical editorial code ensuring users' interests remained the priority ahead of making money. That back-end change substantially boosted our tech abilities, letting us build things such as Pick Me A Tariff on energy, eligibility calcs and more. These days, we even have our own MSE Open University course. Today, more than 15 million emails have been added to our email list (though we now instead talk about sending to 7m+ active accounts). And even though Martin's baby is fully grown, he's still here, in his role as exec chair, one of about 100 people who work on the site - a good few who've been here more than a decade. Together we hope MSE is still fulfilling what it was born to do - cutting your bills, fighting your corner. To celebrate our birthday, we don't want gifts, but we would love to hear your stories of how MSE has impacted your life. | HMRC waiving £100 late self-assessment fee if you file by SUN, and delaying 5% fine too. H MRC's already waived £100 fines for people who file returns after the 31 Jan deadline, so long as you do it by 11.59pm this Sun. Now it's said it'll also waive the usual 5% late payment fee it charges in Mar, so long as you pay by 1 Apr. Remember though that's on top of the 2.6% interest it's already charging on outstanding tax, so if you've not paid, at least estimate and pay what you can ASAP. Self-assessment help Cheap school uniform, incl Morrisons, Asda & M&S - items from £2.50 each. With some schools in Scot & Wal going back this week and those in Eng & NI from 8 Mar, we've a school uniform deals round-up. Three and Vodafone to hike prices by up to 4.5% - your rights. Millions of mobile and broadband custs hit. Price hike help 30+ FREEBIES for your birthday, incl Krispy Kreme and Greggs doughnuts, free Body Shop £5. With MSE turning 18 this week, we thought we'd tell you which goodies you can claim on your birthday (and some have extended validity if yours is during lockdown). Birthday freebies Tesco says it's FIXED the double-charging problem we revealed last week - but check your account. After our story that 1,000s may have been affected, Tesco says it's now sorted (but banks may take a few days to process refunds). Tesco overcharging help | Tell your friends about us They can get this email free every week | | AT A GLANCE BEST BUYS | | Free £125 for switching + 1% regular saver: HSBC

New. Free £100 for switchers + top service: First Direct | | £18 Nails Inc face mask and feet pamper set (norm £39). MSE Blagged. Incl five different face masks, a foot peel and an under-eye mask. 2,000 avail HAGGLING SUCCESS OF THE WEEK:

"Thank you for the heads-up regarding Sky's price increase . My bills were increasing to £81/mth - however, after a 30-minute call with it, I've reduced my bill to £51/mth [a £360/yr saving]."

(Send us yours on this or any topic.) Heads up: we use tracking pixels in this email - but not to track you. Recent news reports have warned of 'spy pixels' in emails. So we wanted to be transparent about what we do. The firms we use to send the email use two tracking pixels that let us know if the email's been opened, reading time & device type used. This helps us spot if email clients are blocking us, so we can try to ensure you get your email, and it helps tell us if email addresses are no longer valid, so we stop sending to them. None of this is about finding out more about you. As with all data, our binding editorial code ensures it will NEVER be shared with third parties, or even other parts of the group that we're in (eg, MoneySupermarket). | THIS WEEK'S POLL Should the contactless spending limit be increased? The financial regulator's consulting on plans to raise the maximum amount you can spend using contactless from £45 to £100 per transaction (there'd still be a separate cap on the amount you're liable for if someone takes your card). But where do you think the limit should be set? Zen takes the crown for broadband customer service. In last week's poll, small firm Zen came top among providers with 75+ votes, with 91% of its customers rating it 'great'. BT was best of the biggies, with 52% saying it's 'great'. Shell Energy took the wooden spoon - just 28% said it was 'great', while 46% said it was 'poor'. See full broadband poll results. | MARTIN'S APPEARANCES (WED 24 FEB ONWARDS) Wed 24 Feb - Ask Martin Lewis, BBC Radio 5 Live, 1pm. Listen again

Thu 25 Feb - This Morning, phone-in, ITV, 10.55am

Thu 25 Feb - The Martin Lewis Money Show Live, ITV, 8.30pm MSE TEAM APPEARANCES (SUBJECTS TBC) Sun 28 Feb - BBC Radio Leicester, Mid-morning with Summaya Mughal, from 10am

Mon 1 Mar - BBC Radio Manchester, Drive with Phil Trow, from 2.20pm

Tue 2 Mar - BBC Radio Cambridgeshire, Mid-morning with Jeremy Sallis, from 12.40pm | 'WHEN I WAS A KID, I DREAMED OF EARNING MONEY SO I COULD BUY A VACUUM CLEANER' That's all for this week, but before we go... last week MSE Becca revealed that as a kid she couldn't wait to have an income so she had the cash to buy a vacuum cleaner. So we wanted to ask, when you were little what things did you dream of owning as a grown-up, or that you started saving for as a child. One MoneySaver wanted a Mr Frosty drinks machine, others saved up for the next Beatles record, a pony and even a hostess trolley. Though serious MoneySaving kudos goes to the people who put their pocket money away to save for their own home. Share your stories in our childhood dreams Facebook post. We hope you save some money, stay safe,

The MSE team | |